“I can’t afford to pay for one.”

“My net worth isn’t high enough.”

“I don’t have any extra money to save.”

“I’ll do it next year.”

We hear all kinds of reasons NOT to engage in financial planning – some are legitimate, but many are just misinformed views about what financial planning really entails. Here, our ultimate objective is to put you in the best overall financial position to achieve your goals. We review all aspects of your financial life, from basic budgets and insurance, to more complicated investment and estate planning analysis. Our review of all of these areas frequently allows us to find money-saving opportunities for our clients along the way. Here are some examples of the more common ways we’ve been able to accomplish this:

1) Tax Planning & Review

To say that taxes are complicated would be an understatement. Fortunately, we see tax returns every day. We are familiar with what we should and should not see on a tax return, and spotting those errors and omissions have literally saved our clients thousands:

- Did you miss a deduction?

- Did you know there’s a credit for that?

- Are you withholding too much from your paycheck instead of putting that extra cash to work for you throughout the year?

- Would you be better off making pre-tax or roth contributions?

- Are you tax-loss harvesting in your taxable accounts?

- Should you file jointly or separately? (especially when considering your student loan repayment plan)

These are all things that can have a large & direct impact on your bottom line. Are you sure that you haven’t missed something? A second or third set of eyes can help make sure you don’t!

2) Insurance Analysis

Very rarely do we find that people have the right amount or type of insurance… whether it be life insurance, homeowners insurance, auto insurance, etc., it’s often in need of improvement. To be clear, we do not sell these products, but we do run an analysis on what amounts of coverage you should have and what kinds of coverage you should have.

For example, it’s very common for people to get their home & auto insurance early on and never revisit it. And you’d probably be very surprised to learn how many people are over-paying for their insurance (some significantly – $1k/yr+). We have helped clients cut back on monthly premiums just by assisting them in comparing coverage with different companies.

We also see many clients paying for insurance they DON’T need. Some are over-insured, some are paying for permanent life insurance they don’t need, some are paying for extra benefits & riders on their policies that they’ll never use, and many can save hundreds a year by paying premiums at a different frequency (semi-annually or annually vs. monthly) and just don’t realize it.

3) Employee Benefits Review

Similarly, we see a lot of people paying for benefits they don’t need, and some who are not utilizing benefits that could help them. $10/paycheck for that unneeded insurance may not sound like much now, but when you pay it for 10 years.. there’s ~$2,500 you’ll never see again.

Are you using your HSA? Most people aren’t. Do you understand the benefits of an HSA? You might be interested to know that you are potentially better off saving here than you are your IRA from a tax-standpoint. Further, did you know that many companies make HSA contributions on your behalf? We’ve seen company contributions up to $2,400/yr! That’s a lot of free money & you could be missing out! Not to mention the potential savings in health insurance premiums.

And then there’s the retirement plan – are you using this in the most efficient manner possible? Are you using the right plan? Does it make more financial sense to use your 401k, 403b, or 457? Are you getting your full employer match? Does your plan have a “true-up” option? If not, you could be missing out on part of your employer match and not even realize it.

4) Student Loan Analysis

This is a biggie – I’m talking 5-figures in potential savings big. Student loans are a bear of a topic and it’s very difficult to find a planner who truly understands the ins and outs. Fortunately, we make it a point to keep up with the changes & stay informed because it drastically affects such a large percentage of our client base. If you can’t answer these questions, you may stand to benefit from a discussion:

- Do you know your options for loan forgiveness? Are you eligible for PSLF?

- Should you consolidate your loans? Do you know how this affects your forgiveness status?

- Should you refinance to save on interest? If so, which company should you use? Do they offer a welcome bonus?

- Do you understand how costly is is to defer payment on your loans?

- Should you file jointly or separately for tax planning/savings?

- Which repayment plan makes the most financial sense for you? IBR? PAYE? RePAYE?

Especially for someone with a high student loan balance, getting help with this is CRITICAL and can have a MAJOR impact on your future.

5) Investment Expense Reduction

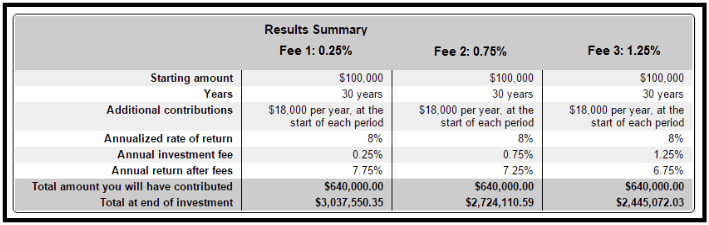

Most people don’t understand what they’re paying for with their investments, or the enormous effect these fees can have over the long-run. Check out the image below. This scenario assumes you have a 401k with $100k in it today. You max it out at $18k each year, and your average return before fees is 8%. Over 30 years, the difference between a portfolio with an expense ratio of .25% and .75% is over $300k! And then if you compare .25% and 1.25%, that jumps to over half a million dollars.

That is SERIOUS money, and most portfolios we review are closer to the 1.25% end than they are the .25%. Do you know how to determine what you’re paying? Are you literally missing out on hundreds of thousands of dollars without even realizing it?

6) Debt Refinance

Especially in today’s market, refinance opportunities are everywhere… auto loans, home mortgages, etc. Do you know if your rates are competitive? If not, do you know which lenders to go to? How do you keep those closing costs down? Recently, we helped a client refinance from a 30-year mortgage to a 20-year mortgage while keeping the monthly payments approximately the same. Not only did this save thousands of dollars in interest a year, they’re now going to pay off their home several years earlier than anticipated.

And then there are other questions to consider.. Should you get rid of your ARM? Are you paying PMI? What it would take to get out of PMI? What about physician mortgage loans?

7) Estate Planning Analysis

Some of the biggest potential issues we find are with beneficiary designations. Sure, you may have the right amount of life insurance coverage in place, but is it set to go to the correct person? Most of the time it is.. But sometimes that $2M death benefit is still set to go to your ex-spouse. Or your parents. We’ve seen this on a handful of occasions, and this small error could mean potential ruin for your loved ones. Make sure your hard earned money is going to fall into the right hands.

8) Salary Negotiation & Contract Review

We do a lot of pay stub and tax return analysis as a part of our services, so we likely have a pretty good idea of what people in your field can expect to be paid. We’ve encountered a few clients that were underpaid compared to what we typically observed in their field, and encouraged them to present their findings to their employers and discuss/negotiate opportunities. So far, outcomes have been positive!

Or for those going into a new job, do you know what to expect from your salary and benefits package? We are aware what the market dictates… especially for physicians. Are you getting a good (or at least fair) deal? Should you be negotiating for more? Are you missing out on anything?

9) Big Financial Decisions

Are you considering making a major purchase? Buying a new car or a new house? Have you sat down and thought about what you SHOULD afford, versus what the lenders tell you that you CAN afford? Because there is a major difference. Have you considered your financing options and how they can affect your interest rate and out of pocket costs?

Or if you have a rental property, have you taken the time to sit down and analyze its profitability? It’s not as simple adding up as the rent you collect. Have you calculated the return you actually realize after taxes, maintenance, etc? Many rental properties we analyze are not nearly as profitable as an alternative investment. Make sure you’re not missing out on earning more money somewhere else.

10) Time Savings

And for your most important asset – your time… it’s nearly impossible to put a dollar amount on this one. What is an extra hour of family time, relaxation time, time with friends, etc. worth to you? How do you quantify that? You really can’t, because time is invaluable. We allow clients to outsource tasks to professionals, which, in turn, allows them to spend more time with the people they love, doing what they love.

After running through those points, it becomes more clear that financial planning can be for everyone. It’s not just about investments, and it’s not just for the 1%. If you don’t work with an advisor yet, are you doing everything above for yourself? If not, you could be missing out on both time & money saving opportunities. Or if you do work with an advisor, is he/she doing everything above for you? If not, it might be time to consider a change – make sure you work with an advisor you trust, and who will work in your best interest 100% of the time.