This is our ninth article in a series covering student loans. Our goal in this series is to equip you with the knowledge necessary to make efficient and informed decisions regarding your student loans. This post will cover student loan tax considerations and how student loans and income taxes work together. If you missed any of the prior posts, go back and check them out before reading on so that you have the necessary foundation built (Part 1, Part 2, Part 3, Part 4, Part 5, Part 6, Part 7, Part 8).

If you are still not convinced that student loans have become extremely complicated, then this should seal the deal for you. In many cases, student loan planning will become very much intertwined with your tax planning. Unfortunately, just keeping up with student loans alone isn’t enough. In order to get the best deal, you must also regularly analyze various tax scenarios and keep up with applicable income tax laws.

You might think this trouble is not worth your time – but not so fast! It can easily result in thousands of dollars being saved each year. I suggest either making time to keep up with all of this yourself OR hiring an expert to help – like us :-).

But for now, we will go over the basics to help get you started.

In this post, we will cover the following tax considerations of student loan planning:

- Public Service Loan Forgiveness “PSLF” Maximization

- Student Loan Interest Deduction

- Taxation of Loan Forgiveness

Public Service Loan Forgiveness Maximization

Tax Deductions – PSLF Booster #1

Certain types of tax deductions are like boosters for maximizing PSLF. When going for PSLF, the goal is to repay the least amount possible on each of your 120 qualifying payments. Your income-driven payments are normally established based on your Adjusted Gross Income or “AGI”. AGI is your gross income minus above the line deductions. The more above the line deductions you have, the lower your AGI. The lower your AGI, the lower your income-driven payments (assuming you qualify to use AGI). The lower your income-driven payments, the more future forgiveness you receive. Catching my drift?

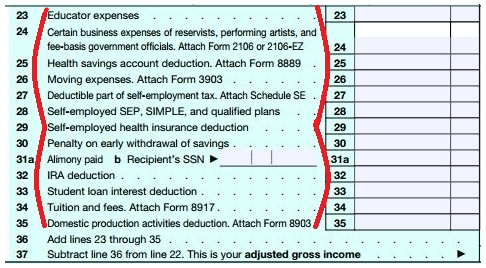

See below screenshot of the 1040 IRS form listing above the line deductions (bracketed in red – lines 23 – 35).

You may recognize some of these deductions. Health savings account (HSA) contributions, for example, are great because contributions are pre-tax, the balance grows tax-free, and qualified withdrawals are tax free. A solid deal can turn into a home run when going for PSLF because of the reduced income-driven payments resulting from a lowered AGI. You receive the normal tax benefits AND you get the additional PSLF value resulting from your reduced AGI. Typically, each dollar of reduced AGI reduces your income-driven payments by 9-15% under PAYE and IBR.

For example, during lower income years such as those in medical residency, the Roth IRA would normally be your best bet. You would compare your current marginal tax rate to your expected future marginal tax rate to make this decision. If your tax rate is lower now that you expect it to be in retirement, the Roth IRA is the easy choice. However, if you are going for PSLF and therefore working to minimize your income-driven payments, your calculation of the Roth vs. the Traditional IRA decision must also include PSLF additional value. For some, this can totally swing the pendulum in favor of the Traditional IRA.

Married Filing Separately – PSLF Booster #2

Another easy way to potentially boost PSLF benefits for married, dual-income households is by analyzing the tax and student loan implications of filing separately vs. jointly. Filing separately often brings negative tax implications and positive PSLF benefits. The key is the NET benefit of this decision. For example: a couple might pay $1,000 in additional income taxes by filing separately, however, by doing this, they reduce income-driven payments by $6,000 in the following year. This reduced payment results in pure savings when going for PSLF. Therefore, their net benefit from filing separately is $5,000. You must perform this analysis every year before filing taxes to determine how it shakes out.

It’s surprisingly common to see that filing separately provides much more net value when considering both taxes and PSLF. You can play with the numbers using the Federal Student Aid’s repayment estimator – it allows you to input filing separately or filing jointly. At a minimum, it’s well worth your time or the cost of paying for help to run these numbers each year!

Managing Income-Driven Repayments – PSLF Booster #3

Lastly, you must be very proactive about managing your income-driven repayment planning to maximize PSLF.

Understanding how they verify income is KEY. You are required to verify income annually under income-driven repayment. However, you can also choose to re-certify income whenever you’d like (typically if your income decreases). Let’s say, for instance, that your income decreases one year by a considerable amount. Most people would wait until their annual request to re-certify income, but if you want to maximize PSLF, you should be proactively requesting that income be re-certified ASAP. In most cases, you can use AGI to verify income. Examples of exceptions would be if your income changed “significantly” from the prior year OR if you haven’t filed taxes for the prior two years. When you are unable to use AGI, you must verify current income another way.

Timing is also KEY as you can control (to some extent) when you apply for income-driven payments. Typically, for the medical professional, filing for repayment ASAP is a good strategy because your income stair-steps upward. For example, the medical school graduate may want to file for income-driven repayment before they officially start earning their residency income so they can claim no income (this strategy is becoming harder than it used to be). Waiting too long to file could force you into higher monthly payments if your income increases and/or you file a new tax return. Maybe you are getting married to someone with a much higher income in August – it’s probably a good idea to file for income-driven repayment in July before you are officially married.

Avoid forbearance and missed payments like the plague. Knocking out your 120 payments to qualify for PSLF asap is key. You can only qualify for 1 payment per month – if you miss a month you can never get it back. The lower your payment each month, the more impactful PSLF will ultimately be for you. People usually file for Forbearance during one of the best possible times for maximizing PSLF (when income is really low). Often, they don’t realize they can re-certify their new lower income or that payments would be lower under PAYE.

Let’s say someone is paying $400/mo during medical residency under IBR. They cannot handle the payments and choose forbearance for 6 months. Fast-forward 7 years and they are in practice finishing up the last year of PSLF qualification. Their income is much higher so they are paying the maximum payments at $3,000/mo. Because of their decision to forbear a total of $2,400 in payments, they now must pay an additional $18,000 in payments to qualify for PSLF.

To further make a point, let’s say instead that this person used a credit card to pay the IBR payments for those 6 months. (DON’T EVER DO THIS – I AM SIMPLY MAKING A POINT OF HOW IMPACTFUL THIS IS). This credit card charges 30% interest – this may be over the legal limit but I’ll assume it isn’t. This unpaid credit card balance with interest over the 7 year period ultimately ends up being $17,972 at the beginning of the 84th month.

Student Loan Interest Deduction

The current tax law allows certain taxpayers to deduct student loan interest paid during the year on qualified student loans. You can find much more detailed information here. Some of the high points to consider are as follows:

- Most private student loans would be considered qualified student loans

- You cannot deduct interest if no payments were made (Ex. forbearance)

- Voluntarily paid interest would qualify as student loan interest payments

- You cannot deduct student loan interest when filing taxes separately

- You cannot deduct student loan interest on a loan from a related person

- In most cases, student loan interest on a refinanced loan would qualify

- The maximum deduction for 2014 is $2,500

- The student loan interest deduction is phased out in 2014 if your modified adjusted gross income (MAGI) is between $65,000 and $80,000 ($130,000 and $160,000 for joint return)

Several takeaways to consider…

- Once again… avoid forbearance like the plague. Often people chose forbearance at a point when student loan interest is actually deductible. Don’t miss the opportunity to deduct interest if at all possible. Medical residency is the classic example when it’s likely the only point in your life where you will actually qualify for this deduction – use it when you can!

- If you are using income-driven repayment and are not going for PSLF, you should consider making enough additional voluntary payments to maximize the interest deduction each year if you qualify.

- If you are going for PSLF, when you calculate the value of filing separately make sure to consider the fact student loan interest cannot be deducted.

Taxation of Loan Forgiveness

Under current tax law, the amount forgiven under Public Service Loan Forgiveness is NOT considered taxable income and the amount forgiven if you still have a remaining balance at the end of your income-driven repayment plan is considered taxable income.

Nothing in this post should be considered tax advice. For more information or specific recommendations, seek advice your tax advisor or check with the IRS.

Check out our other posts in the series below: Part 1: Student Loans & Your Situation Part 2: Student Loan Interest Part 3: Student Loan Consolidation Part 4: Student Loan Repayment Plans Part 5: Student Loan Forgiveness Part 6: Qualifying for Public Service Loan Forgiveness Part 7: Student Loan Refinance Part 8: Student Loan Refinance Reviews Part 9: Student Loan Tax Considerations Part 10: Student Loan Resources