The growing popularity in private real estate investing is becoming increasingly hard to ignore. With interest rates being held near all-time lows, money is cheap; and for many physicians looking to put their extra cash to work, real estate seems a viable option. This is understandable, as the rental income a good investment can generate may prove to be a valuable income stream to grow wealth or help facilitate an early retirement.

Far too often, however, we sit down with clients who have not taken the necessary steps to ensure their money is being put to good use. This invariably leads to a conversation regarding the client’s reason for owning a property, followed by a fundamental analysis to determine whether or not the property serves such function. Although not always clear cut, proper analysis is useful for guiding clients towards a more efficient allocation of their hard earned money. If you are considering investing in real estate, or are interested in evaluating a property you currently own, I would urge you to consider going through the following exercise as well.

1. Know the Market

This is critical in evaluating any property. Look to invest in areas with positive economic trends — population growth, rising household income, etc. Know how similar properties in the area are performing — or, better yet, know how the property in question has performed! Collect as much relevant information as possible for helping you set a sensible expectation of what kind of income a property will produce.

2 Understand Your Costs — Don’t Underestimate!

Be conservative with expected costs for maintenance and repairs — this is the one expense we consistently see underestimated. Anticipating 1% of appraised value per year going towards maintenance is a good starting point — adjustments should be made for age of the property, general condition, etc.

3. Know your Required Rate of Return

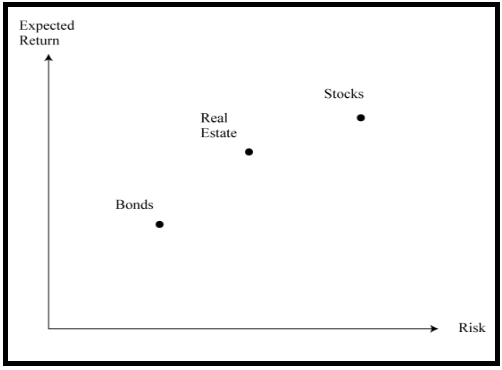

Each investor is different, and so is the rate of return they require to take on an investment. Know yours. Look at the returns you are getting on your other investments. Identify the goals you are trying to achieve. Understand your need for liquidity. Without knowing your required rate of return, you have no basis for evaluating whether or not an investment is satisfactory. For reference, consider the following diagram for how real estate typically compares to stocks and bonds.

4. Don’t Speculate

Be careful in assuming that property values will go up. Rather, consider what your return would be if there is no appreciation at all — or even depreciation. Trying to guess the future is a losing proposition – don’t even try.

5. Be Patient

Don’t rush. Find a property that meets your criteria, and never compromise your rules for investment. Uncertainty is your enemy — if you don’t have enough information, it is usually best to walk away. There will always be more opportunities.

6. Consider Alternatives

If you are simply looking for exposure to real estate, consider publicly traded securities such as REITs. This allows you to further diversify your real estate portfolio by participating in ownership of multi-family developments, hotels, malls, hospitals, and more. It allows you to maintain liquidity, and doesn’t require such a large capital investment.

7. Seek Advice

As with any investment, consider it in the context of your entire financial situation. Mistakes can be costly, especially with investments that require a large initial cash outlay — as with real estate. If you need help, consult with a professional.

After considering the points above, take what you’ve learned and calculate the Net Operating Income on your prospective investment — Feel free to make a copy of this simple calculator. Take special note of the Cap Rate. This number allows us to better compare properties solely by the income that they are expected to generate. A general rule of thumb, is to target a Cap Rate close to 10%, and accept no less than 6%. If you have any questions, or would like to request a consultation, we would love to hear from you!