Rules of thumb can be dangerous when it comes to life insurance – it must be based on your specific preferences and circumstances! If you’re over-insured, you’re wasting money. If you’re under-insured and others rely on your income, your ignorance/procrastination can cause massive financial struggles for your family.

Although it may be tempting, unfortunately, this isn’t something you can just set and forget.

Below, we will cover:

1) Factors that determine appropriate coverage

2) Exceptions for the young physician

3) Examples of lifetime coverage targets

1) Factors

Lifestyle Replacement

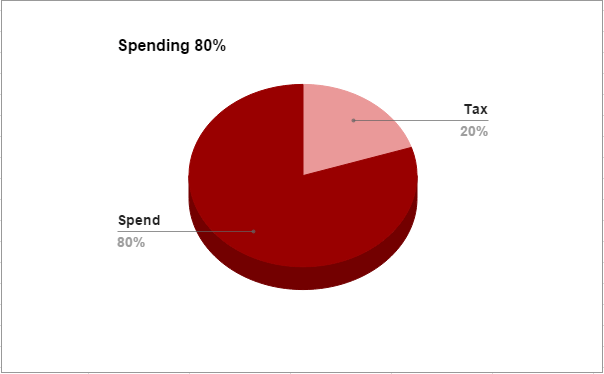

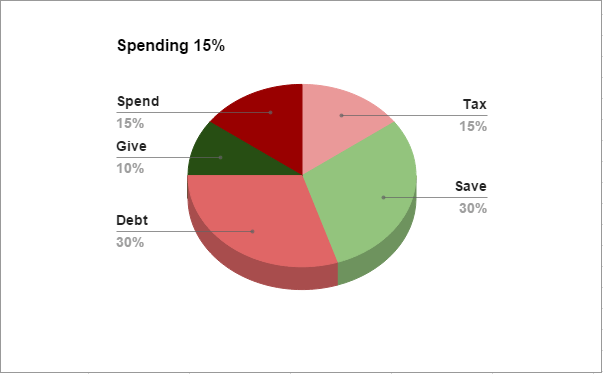

What does your lifestyle cost? What does it take to keep your household running? If you don’t know what your lifestyle is, start with analyzing your cash flow. Knowing where your money is going is key for accurate financial planning. Lifestyle spending will generally range between 10% and 80% of gross income.

For example if your taxes are 20%, you save 0%, have no debts, and give 0%, your lifestyle spending is 80% of gross income.

Or if you save 30%, pay 30% on student loans, pay 15% in taxes, and give 10%, your lifestyle spending is 15% of gross income.

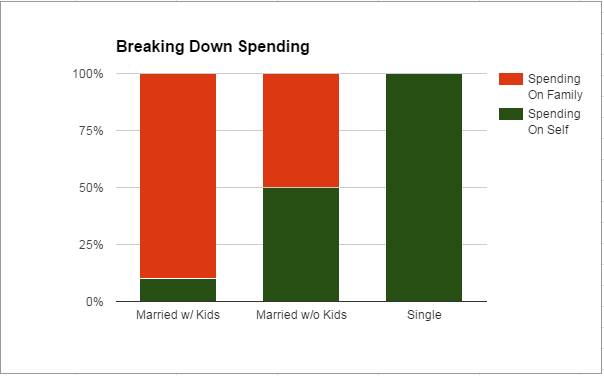

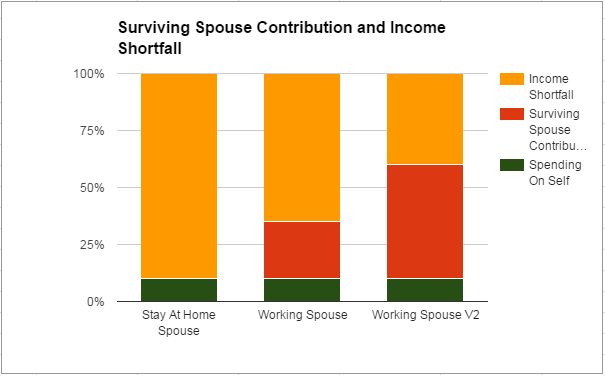

Now, how much of that lifestyle spending do you spend on yourself? This will help you determine how your current expenses might change in the event of your death. The percentage people tend to spend on themselves ranges from 10% to 100% of the total spending. The remainder – “spending on family” – would be the portion that would need to continue if you passed away so that your family could maintain it’s lifestyle.

If your spouse earns an income, figure out what contribution he or she will have to the household lifestyle and reduce the need accordingly. If we consider the prior 10% self-spending example, the spouse may or may not provide a contribution to the household spending. As you can see below, the spousal contribution percentage will reduce the “income shortfall” in the event of your death.

If you are the breadwinner and passed away today, how long should this lifestyle be provided for survivors (ex. forever, 20 yrs, etc)? When in doubt, we encourage people to consider providing lifestyle replacement for your spouse’s lifetime.

Let’s looks at an example based on the factors we’ve covered so far… You and your wife make $200K, spend 50% ($100K/yr), you spend 10% of that on yourself and your spouse covers 10% of spending through her income. Therefore, if you passed away, your income shortfall is 80% of spending, or $80K/yr.

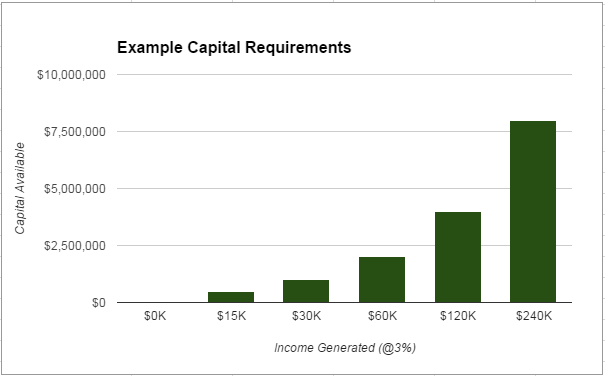

Then, figure the capital necessary today to provide this lifestyle. If you’re covering lifestyle expenses for your spouse’s lifetime, you might use a 3% withdrawal rate to calculate the capital necessary today to provide this. (There are many methods and assumptions to consider when calculating the capital necessary – this is just one version). Every $1 million of capital is assumed to safely produce 3% each year increased with inflation for your survivors without ever running out.

Using the above example, you would need $2.67 million to provide $80k/yr for your survivors lifetime.

If you pass away, how much wealth do you already have available for survivors? This might come from retirement accounts, investments or business assets. Your home does not count. This number should be subtracted from the total capital necessary to provide for lifestyle continuation.

Sticking with the same example… if you need $2.67 million to replace the lifestyle and have $670K available in retirement plans and investments, you are short $2 million.

Debts

This part is simple. Make sure to have enough life insurance coverage to pay off debts that are not forgiven at death. For example, if you owe $300k between your outstanding mortgage and auto loan, add this amount to your total coverage target.

Using the same example, our total is now up to $2.3 million.

Education Funding

Would you like to provide for your children’s post-secondary expenses if you pass away unexpectedly? If yes, what is your goal? (Pre-college expenses are typically included in lifestyle, but if not they should also be included here). An example of this goal might be: provide 4 years tuition, room & board for any in-state school.

College costs have been inflating at around the same rate as reasonable expected returns for college funds. Basically, if your education goal would cost $200k today, that’s what would need to be provided today if you passed away.

So add $200,000. Our example is now up to $2.5 million.

Final Expenses or Estate Taxes

This part includes anticipated estate and/or inheritance taxes expected and final expenses. Simply add this total to your number.

2) Exceptions for Young Physicians

Student loans

Keep in mind that student loans are often forgiven at death. We recommend you verify this with your loan provider. If this applies to you, this debt should not be considered in survivor lifestyle.

Income Potential

The training physician transitioning into practice will see a big income jump. If you are in residency or fellowship, this earning potential should definitely be a consideration. Your current lifestyle might only be $30k/yr, but do you want your family to continue living like a resident forever if you passed away during training? If yes, $1M would do the job on lifestyle replacement. If not, you should consider balancing cost of coverage with future earning potential. The closer you are to completing your training, the more you should consider your future lifestyle.

Forgivable loans

Many young physicians sign employment contracts early in training. In exchange, they might receive a larger payout or medical school assistance. These contracts often come in the form of a forgivable loan. Basically, it’s a loan until you satisfy the contract. This might require working for a set number of years in practice to allow the loan to be forgiven. Is this loan forgiven at death? If not, add it to your death benefit target until it’s forgiven.

3) Example Lifetime Coverage Targets

If done correctly, your target death benefit will always be changing. In some cases, there will be big changes. Common examples of big changes for young physicians are:

- transition into practice

- becoming partner

- buying a home

- paying off student loans

- having children

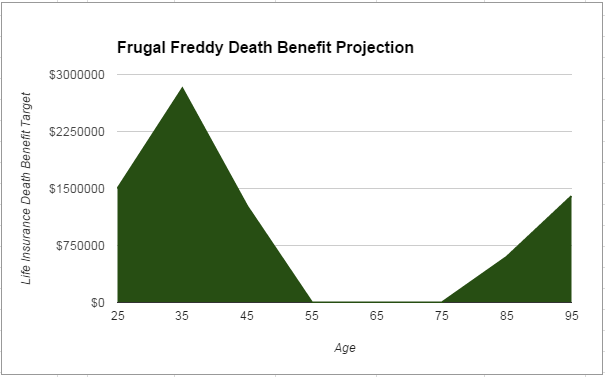

So let’s look at Dr. Frugal Freddy. During residency, his family would need 60% of his gross income to maintain their lifestyle. His wife stays at home. He has some debts and would like to fund college for his kids if something happened to him. Once in practice, he saves very aggressively at 30% of gross income and his family would need 40% of his gross income if he passed away. He also aggressively funds college and knocks out his debt. He becomes financially independent at age 50 and chooses to continue working until 70 because he wants to. As a result of his frugality, he ends up having a taxable estate based on his total wealth. His death benefit needs would look like this:

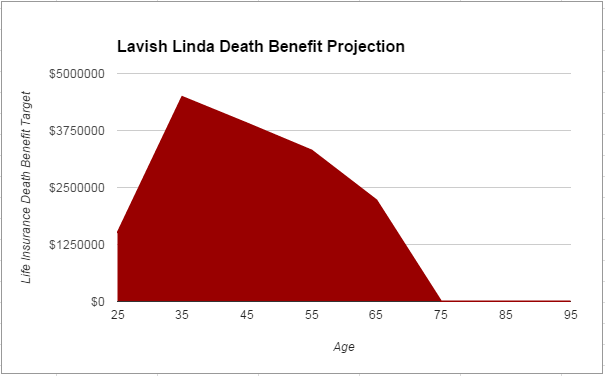

Now let’s check out Dr. Lavish Linda. She, on the other hand, spends more and saves less than Freddy, but has the exact same income. As a result, retirement is delayed, death benefits must be higher and for a longer period, and estate taxes never come into play.

Now What?

We’ve shown you how to calculate your ideal life insurance death benefit… now it’s up to you to make sure you get that amount in place to protect yourself and your loved ones. If you have questions, seek the advice of someone you trust and hire a good network of advisors to help you keep up with your changing needs!