This is the second article in our series covering student loans. Our goal in this series is to equip you with the knowledge necessary to make efficient and informed decisions regarding your student loans. In this post, we will explore what you need to know about your student loan interest.

If you missed part one of our series now before reading further. It’s an important and foundational step that will allow you to save time building and executing your student loan plan.

Student Loan Interest: Making Sense Of The Ridiculousness

Student loan interest is crazy. There are so many variations and nuances and they’re always changing. Unfortunately, there is no real “rule of thumb.”

But don’t let the complexity freak you out – understanding the basics of how student loan interest works will allow you to take on your debt like a champ. Complacency, on the other hand, will increase your chances of throwing dollars away.

Federal vs. Private

You have two categories of student loans – Federal and Private. Many students take out both types of loans, and it’s not always easy to figure out which is which.

Federal Student Loan Interest Rates

Federal student loan interest rates are set by the government and do NOT take into consideration your individual situation. Every borrower receives the same deal. It makes no difference whether you are a millionaire or flat out broke.

If the government is using proper economics and not subsidizing the program (aka picking up some of the tab), the available interest rate should be higher than the best market rates available, but lower than the worst. This is because it’s a random pool of borrowers (some good and some bad), and this is why your Federal student loan interest rate is likely higher than your mortgage rate (or your parents).

The government does offer certain student loans that take your situation into consideration (such as financial need or area of study). Typically, you either qualify or you don’t. And aside from that, it’s not customized based on your specific situation. Everyone that qualifies receives the same deal.

These rates are often lower than other Federal loans because the government picks up some of the tab. The interest rates on these loans, in theory, would also be higher than the best market rates – but, in reality, they depend on how much of the tab the government is willing to pick up.

Private Student Loan Interest Rates

Private student loans originate from non-government lenders and work differently than Federal loans. The interest rates are set by the lender based on your specific situation and the products they have available. If you have fantastic credit, no debt and high income, you should receive the lender’s best interest rate option.

On the other end of the spectrum, if you recently went through a bankruptcy, you will likely be declined. The interest rates on private loans are all over the place. We have seen loans with interest rates from as low as 2% all the way up to more than 20%!

Variable vs. Fixed Rates

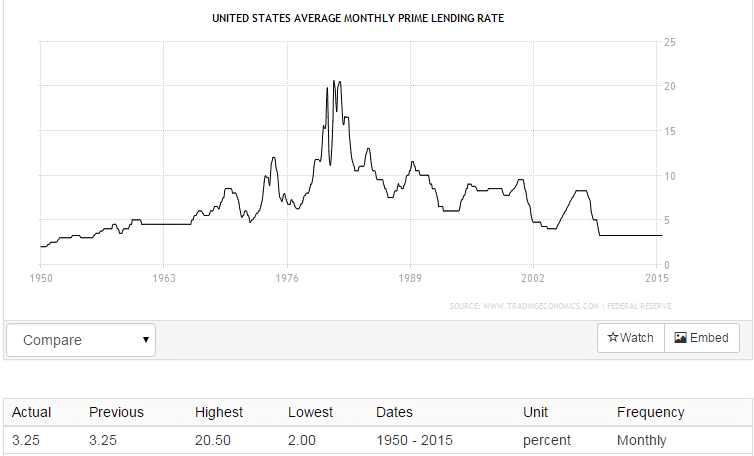

This is a big deal because market rates go up and down over time. It’s easy to feel comfortable right now because the market rates have been very low for some time. Historically, though, they always go up and down over longer periods of time.

Federal and private student loans can be fixed or variable. Federal loans that were originated before 2006 were variable rate only. From 2006 until now, the rates on new federal student loans are fixed.

Sometimes it’s difficult to determine whether your rates are fixed or variable, especially since rates have been relatively consistent. Never assume that your rate is fixed – always verify with the source.

Fixed Rates

Fixed rates are pretty simple. The interest rates are fixed for the life of the loan and are independent of the repayment method and economic conditions. At origination, the fixed rate is normally higher than the comparative variable rate loan. However, if (or when) market rates increase, it does not affect the fixed rate loan’s interest rate.

Variable Rates

Variable rates are a little more complex. The interest rate can go up and down and is typically tied to some sort of market rate (like the prime rate). Economic conditions go up and down, which will cause your rate to go up and down with it. Many loans have a cap on interest rates which tell you the maximum rate you would ever pay. You should be aware of your current rate, what index it’s tied to, and the rate cap.

Subsidized vs Unsubsidized

The government picks up the interest tab on any subsidized loans while you are in school or deferment and sometimes during grace but never during forbearance.

With unsubsidized loans, you are responsible for the interest that accrues during all periods. All private loans are unsubsidized.

Under Income Based Repayment “IBR” and Pay As You Earn “PAYE”, if you have a subsidized loan, the government picks up the tab on interest above your normal monthly payment for the first three years of repayment. Therefore, your outstanding balance will not increase for the first three years if your payments aren’t keeping up with interest.

Interest Capitalization

Capitalization occurs when any unpaid interest is added to the outstanding loan balance.

This is a big deal with student loans because many people’s payments are not large enough to cover interest. You need to know what happens with this unpaid interest each month.

If interest has not yet capitalized, you’re paying interest based on your original outstanding loan balance only and not any unpaid interest. Upon capitalization, your unpaid interest is added to your balance owed – and then you’ll pay more interest because of the higher outstanding loan balance.

Capitalization essentially allows your loan to begin incurring interest on your interest. This is on top of the interest you were already being charged based on your original loan. The sooner capitalization occurs, the more expensive your loan will be.

Capitalization Example

This can be confusing and hard to describe on paper, so let’s look at an example:

In your first year of medical school you borrow $100 at a 10% interest rate. The interest does not capitalize while you are in school. After one year of having the loan, you have made no payments – so your principal balance is still $100 and your interest for the year is $10. The new interest does not get added back to your principal because it’s not capitalized. After 4 years you enter repayment and your outstanding balance still at $100. Plus you have $40 of interest. At that point the $40 is added to the $100 (aka capitalized) and you now owe $140.

Alternatively, many loans capitalize interest daily, monthly or annually. Let’s use the annual capitalization example to make the math simple:

You borrow $100 from a private student loan lender at a 10% interest rate. After one year, you build up $10 in interest and it’s added to the original balance of $100 (capitalized) – which means you now owe $110. At the end of year two, your interest is $11 (10% of $110). This is capitalized and you owe $121. Year three interest is $12.10 and at the end of the year you owe $133.10. Year four interest is $13.31 and at the end of the year you owe $146.41. The $6.41 difference is the cost of having interest capitalized annually vs. at the end of four years. It’s interest charged on the interest.

Federal Loans Capitalization

Generally, federal loans “capitalize” when at least one of the following triggers occur:

- Repayment begins

- Deferment ends

- Forbearance ends

- Upon default

- Change of repayment plan

- Loan consolidation

Capitalization During Income Based Repayment

Under IBR, if your payments don’t cover all of the interest, it will be capitalized (added to the outstanding balance) IF you leave the IBR plan OR you no longer qualify to make payments based on income.

The same is true with PAYE, except there is an interest capitalization cap if you no longer qualify to make payments based on income. The maximum interest that will be capitalized if this occurs is 10% of the initial loan balance at the time you entered PAYE.

Private Student Loans Capitalization

Similar to Federal student loans, many private student loans offer delayed capitalization on unpaid interest in certain situations. However, there are many variations and you should never assume your private loan works this way. Private student loans are all are over the place – as we mentioned before, there is really no rule of thumb. You must understand how your specific loan works to make the best decisions.

Loan Fees

Some federal and private student loans charge loan fees above and beyond interest. The most common fee is the origination fee charged when you take the loan out. It’s best to include any fees and interest when considering the entire lifetime cost of your student loan.

Consolidation Loan Interest Rates

Consolidation loans allow you to wrap all your loans into one. They set your new interest rate by taking the weighted average of your underlying rates and rounding up to the nearest 1/8th percent. Student loan consolidation is NOT a way to get lower interest rates, but it can be a way to switch from variable to fixed interest rates. There are several other pros and cons which we will cover in more depth in part 3 of our series.

In our next post we will get into the ins and outs of student loan consolidation.

Check out our other posts in the series below:

Don’t forget to check out our other posts in the series below:

Part 1: Student Loans & Your Situation

Part 2: Student Loan Interest

Part 3: Student Loan Consolidation

Part 4: Student Loan Repayment Plans

Part 5: Student Loan Forgiveness

Part 6: Qualifying for Public Service Loan Forgiveness

Part 7: Student Loan Refinance

Part 8: Student Loan Refinance Reviews

Part 9: Student Loan Tax Considerations

Part 10: Student Loan Resources