This is our fifth article in a series covering student loans. Our goal in this series is to equip you with the knowledge necessary to make efficient and informed decisions regarding your student loans. In this post, we will cover student loan forgiveness options. If you missed any of the prior posts (Part 1, Part 2, Part 3, Part 4), go back and check them out before reading on so that you have the necessary foundation built.

Public Service Loan Forgiveness “PSLF”

The PSLF program is available for certain Direct Loan borrowers (including Consolidated Direct Loans) employed by not-for-profit or government organizations. To qualify for forgiveness of the remaining balance on your Direct Loans, you must have made 120 qualifying payments under a qualifying repayment plan while working full-time for a qualified employer.

If you meet all of the qualifications for PSLF and your income-based monthly payment is less than the 10-year standard repayment, you will have some amount forgiven at the end of 10 years. The amount of total forgiveness depends on your income (lower = more forgiveness) and total debt (higher = more forgiveness).

Alternatively, if your income-based repayment is equal to or greater than the 10-year standard repayment amount for the entire 10-year qualifying period, you will not realize any loan forgiveness under PSLF.

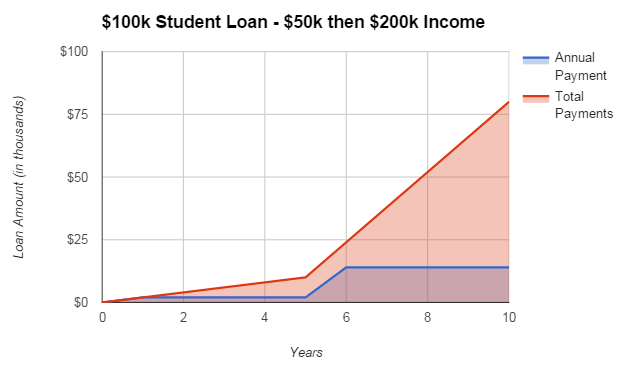

The classic example shown in the graph below is the medical resident working in an academic not-for-profit hospital that plans to continue working at a not-for-profit hospital in practice. This example shows a hypothetical borrower who is eligible for PSLF and has income that allows for income-based payments far below the 10-year standard payments. This low income period lasts for 5 years. In year 6 their income jumps up and, as a result, they must then begin to pay the maximum payment under PSLF (10-year standard payments) for the remaining 5 years.

Although this borrower ends up with a very high income, they still realize plenty of value because half of the PSLF qualifying years are at a very low income level (as a ratio of the total debt). This person ends up paying back only 80% of what they originally borrowed over the 10 years! The forgiveness occurs at a point when their income is 2x greater than the original loan balance. And under current tax law the forgiveness under PSLF is tax free.

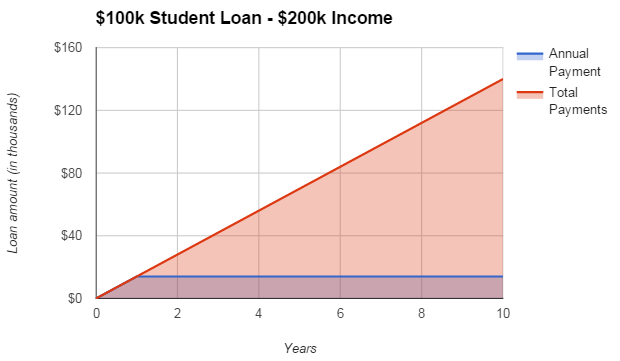

To put the value of this into perspective, let’s consider another example illustrated below. This person is PSLF qualified based on their employment, however, their income and total debt requires that they must pay the 10-year standard payments over the entire duration of the 10-year repayment period.

Although they are technically PSLF qualified, by paying at the 10 year repayment rate for 10 straight years they end up paying off the entire loan themselves. There is nothing left to forgive. In the example below, the borrower ends up paying back 140% of the original loan balance. This is more consistent with a normal loan repayment.

Keep in mind, these examples are hypothetical, rough estimations of varying scenarios and will not be reflective of your exact situation. You must calculate the numbers based on your specific circumstances in order to get an accurate projection. These scenarios will vary considerably for each borrower’s situation.

Income-Driven Repayment Forgiveness

If you are repaying loans using one of the income-driven repayment plans (IBR, PAYE, or ICR), loan forgiveness may be available on any remaining balance(s) at the end of the repayment period (if you make it that far). Essentially, for this forgiveness option to be of any benefit, you must have a loan balance at the end of full repayment period (20 or 25 years depending on your loans). Keep in mind this is totally different than PSLF. Most notably, it does NOT require “qualified employment” and the qualifying period is the full duration of the respective income-driven repayment plan.

How could you still owe money at the end of full repayment? Because it’s INCOME based. Results will depend on several factors, such as your income over the repayment period and the size of your total debt. We cover how repayment plans work more in this post. Higher income and resulting higher payments will lower the likelihood of forgiveness. There is a point where your payments are high enough to pay off the entire loan on or before the full repayment period. This eliminates any benefit associated with income-driven forgiveness.

The forgiveness option is typically something to consider when your total student debt value exceeds total income. However, there are many factors to consider over a long period of time. Ultimately, it will depend on your specific circumstances. Also, under current tax law, the amount forgiven is taxable whereas the PSLF is tax free.

Total and Permanent Disability or Death

Borrowers of Direct, FFEL and Perkins loans who become totally and permanently disabled or die during repayment may be eligible for loan discharge. If you would like more information on qualifying for discharge, you should check out this outline from The Federal Student Aid Office.

Teacher Loan Forgiveness (5 year forgiveness)

Full-time teachers that work five consecutive years for a designated employer serving students from low-income families may be eligible for up to $5,000 (or up to $17,500 for certain special education, math and science teachers) of loan forgiveness at the completion of the fifth year. This program is available for certain Direct and Stafford Loan borrowers.

Perkins Loan Forgiveness Options

Several additional forgiveness options are available specifically for Perkins Loan borrowers. You should check out more information at the student aid website. Here are several of the cancellation conditions that may exist for borrowers that are unique to Perkins Loans:

- Service in the US armed forces in a hostile fire or imminent danger area

- Full-time firefighters

- Full-time law enforcement or corrections officer

- Full-time nurse or medical technician

- VISTA or Peace Corps volunteer

- Certain librarians

- Full-time attorney employed in a federal public or community defender organization

- Certain full-time employees of public or nonprofit child or family agencies working in low-income communities

- Various other education and social service related jobs

Other Loan Forgiveness Programs

There are many other loan forgiveness and repayment options available. Here are a few to consider:

- The US Military offers several loan forgiveness programs that vary by the specific military branch and occupation.

- Many states offer medical and other health professionals loan repayment assistance or scholarships. This website will help you to search these programs and find out more info.

- The National Health Service Corps offers loan repayment for qualified health care providers who choose to work in certain need areas. This website will provide more information on this program.

- The National Institute of Health provides loan repayment to certain qualified health professionals focused on research careers.

- Many employers offer loan repayment programs. Some are very rigid programs whereas others can be negotiated and directly relate to your specific compensation package.

Don’t let yourself get overwhelmed by your options. Don’t miss out on saving potentially thousands of dollars. Read up and seek help! And feel free to ask questions in the comments section.

Don’t forget to check out our other posts in the series below:

Part 1: Student Loans & Your Situation

Part 2: Student Loan Interest

Part 3: Student Loan Consolidation

Part 4: Student Loan Repayment Plans

Part 5: Student Loan Forgiveness

Part 6: Qualifying for Public Service Loan Forgiveness

Part 7: Student Loan Refinance

Part 8: Student Loan Refinance Reviews

Part 9: Student Loan Tax Considerations

Part 10: Student Loan Resources