Ultimately depending on a lot of variables, roth conversions can hurt or help your financial position. Is the strategy right for you? Maybe. Here’s what you need to know in order to identify whether or not this strategy should be on your radar.

Back to the Basics: Roth vs. Traditional IRA

Traditional IRA contributions are eligible for a tax-deduction (aka. pre-tax). The balance grows tax-deferred over time, and then qualified withdrawals in retirement are taxed as income. The big tax benefit is on the front end when you contribute. You avoid tax today and opt to pay in the future.

Roth IRA contributions are after-tax (you receive no tax-deduction today), the balance grows tax-deferred over time, and then qualified withdrawals in retirement are tax-free. The big tax benefit is on the back end when you take withdrawals. You pay tax today in order to avoid paying tax in the future.

Roth Conversions

A roth conversion allows you to “convert” your existing Traditional IRA (or other pre-tax assets like a 401k or 403b) into a Roth IRA (or Roth 401k, 403b, etc). Check out this IRS publication for more info. Under the current tax law, there are no income limitations on Roth conversions. However, it does trigger a taxable event on any previously untaxed portion of the Traditional IRA (often 100% of the value unless it was non-deductible). With the Roth conversion, you’re effectively opting to pay the tax now instead of later. Always proceed with caution and consult with your tax advisor before initiating.

Astute investors know that complexity favors the informed. The Roth conversion is just another example of additional complexity. The informed investor has a choice to consider each year: should they leave their Traditional IRA as-is or should they convert to a Roth IRA? Tax me now (convert to Roth) or tax me later (leave as-is).

When To Convert

If your tax rate is higher now than it will be when you take withdrawals from the IRA, don’t convert to Roth. If, instead, your tax rate is lower now than it will be when you take withdrawals from the IRA, Roth conversion likely makes sense. The bigger the difference in rates now vs at withdrawal, the greater the impact of the decision to convert (or not to convert). Simple, right? Not quite!

The first hurdle is determining your effective marginal tax rate “EMTR” now. EMTR is the true percentage of tax paid on an extra unit of income. It’s not the same as your tax bracket or your effective tax rate. EMRT takes into consideration income taxes, payroll taxes and any decline in tax credits or deductions as a result of income based phaseouts. Your EMTR will help you determine the true dollar cost of the potential Roth conversion.

It’s best to seek the advice of a tax professional or financial planner when calculating your EMTR. We use tax software to help clients figure their EMTR when considering the Roth conversion.

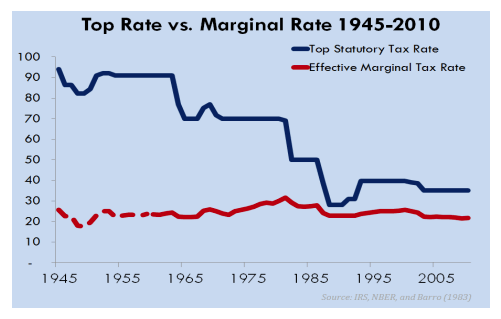

The second hurdle involves estimating EMTR at the point you expect to take withdrawals from the IRA. This is an educated guess. However, historical data, tax knowledge, and long term planning can improve the guesstimate. For instance, most people think taxes today are higher than ever and will continue to increase. But historical data considering EMTR shows otherwise, at least for those in the top tax bracket. Although top tax brackets have been all over the place, EMTR for taxpayers in the top bracket has stayed surprisingly consistent.

The difference between your EMTR now and your estimated EMTR at withdrawal is the biggest factor in determining the impact of a Roth conversion.

Scenarios To Consider Roth Conversion

Starting A Practice

You worked for a hospital as an employee for several years and recently decided to start your own practice. During your time at the hospital, you built up a considerable amount of pre-tax dollars in your 403b. Now, you’re starting a new business and have significant startup costs and tax deductions. This temporarily causes your EMTR to drop considerably for one or two years.

Back To Fellowship

You’ve been in practice for a year and decide to go back to fellowship to specialize further. As a result, you’ll have several calendar years where household income is under $100,000. After this, when you’re back in practice, it’s going to jump way back up.

Medicine As A Second Career

You’ve already worked in a non-medical career for several years and decide to go to medical school. As a result, your income stops. You have a pre-tax IRA that was originally your 401k from your old job.

Moving To Higher Income Tax State

You’re a medical resident in Texas and plan to start in practice in California where you’ll finish out your career. State income tax in Texas is 0% while California is 10-12%. Additionally, you’re in the 25% federal income tax bracket. In practice, you expect to be in the 33% bracket. That’s 25% vs. 45%.

States With Income Tax IRA Income Exclusion

Some states allow for a portion of IRA income to be excluded from state income tax. For example, Kentucky allows $31,000 of IRA income (in 2019) to be excluded from state income tax. This means a Roth Conversion in Kentucky under this amount is state income tax free (saving you 5% in tax).

Non-Deductible IRAs

Unlike most Traditional IRA’s, non-deductible IRA’s have basis (or a portion that’s already been taxed). They’re also eligible for Roth conversion. Conversions on non-deductible IRA’s can work really well no matter what current and future rates look like when basis is very high as a percentage of the total balance. However, the lower the percentage basis is of the total balance, the more current and future EMTR will come into play.

Side note – because we’ve run into some confusion in the past – don’t confuse a Roth Conversion with a Backdoor Roth IRA, because they are not quite the same thing. One USUALLY generates a tax bill, while the other USUALLY does not. With a Roth Conversion, you’re typically intentionally triggering a taxable event by turning pre-tax dollars into after-tax dollars. With a Backdoor Roth IRA, you’re typically making a non-deductible contribution to an IRA (after-tax) and converting it to roth (after-tax), which does NOT trigger a taxable event when done properly.

Have you come across another good scenario for a Roth conversion? Let us know in the comments…