The most common type of term life insurance among physicians is level term. Often, it’s purchased and forgotten about. But is this the best strategy?

In this post, we will compare several different strategies physicians might for owning term life insurance. We will then use a case study to show how the numbers shake out over time.

We will assume everyone reading already knows how much life insurance they should own and has determined term life insurance is the best solution. What we will be looking at is the most efficient method for owning term life insurance as you become financially independent.

Physician Specific Considerations

- Above average earning capacity often requires purchasing large amounts of individual life insurance

- Income increases 3 to 10x overnight when transitioning into practice

- Some have another big income jump several years after being in practice

- Student loan repayment takes a big chunk of income. Once paid off, this is essentially another big pay raise

- Job changes are common – especially early in careers

- Delayed entry into the workforce requires higher than normal savings rate and aggressive wealth building

What does all this amount to in regard to owning term life insurance? Tons of changes! Lifestyle and existing wealth are the biggest drivers for determining your life insurance death benefit. Death benefit needs tend to change over time, and change more quickly for the young physician.

There are two main types of term life insurance to choose from…

1) Level Term

2) Annually Renewable Term “ART”

Level Term

The cost of owning life insurance naturally increases as people age. This is primarily due to the fact that more people die as they get older. Insurance companies would call this “increasing mortality costs.” They create all sorts of life insurance products ultimately all based on the underlying mortality cost.

Level term products take an otherwise increasing cost (risk) and flatten or “level” it out over the period or “term” of the policy. The most common term periods are 10, 20 and 30 year, and are often guaranteed to remain level for the term. Often, when the term is up, your policy ends. You are paying additional costs to lock in or guarantee your rates. You are also paying future mortality costs in advance. The risk with level term is: what if you need it less than expected? Then you overpaid for the period. Or, what if you need it longer than the term and have health issues when you must reapply?

It works best when you need the exact amount of death benefit for the specific term period and then none thereafter. It also works well for people that want the guarantees and predictability associated with a level premium (premium = what the consumer pays the insurance company each year to maintain coverage).

Annually Renewable Term (ART)

Like level term, mortality costs drive pricing with ART. The main difference with ART is that the pricing is not artificially leveled out over the “term”. The premium increases as you age because with age, chances of death increase. Some ART requires that you qualify your health every year, however, in this article we will only consider ART that locks in your health class for the duration of the policy.

ART has very weak guarantees – so pricing could go up higher than scheduled. Keep in mind that the biggest driver in pricing is mortality (or paying for the people that pass away). Mortality has been improving for the best health classes consistently over time. Therefore, historically, the companies we talked to that sell ART have been able to keep pricing very close to scheduled premiums.

For example, one company has historically charged lower prices (below scheduled premiums) on ART over time in the form of dividends. And another has increased rates above scheduled premiums one time in the past 20 – 30 years – and that increase was around 3%.

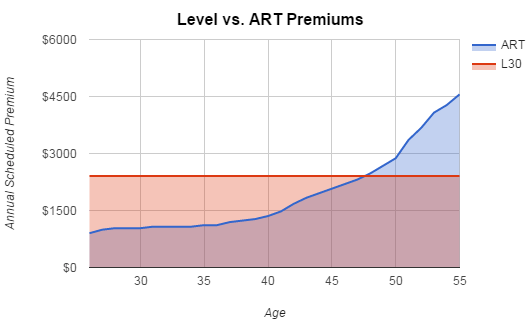

See below example cost comparison using the lowest reasonably rated company we could find for L30 and ART (locked into the health class for at least 30 years). We assume that both males are in the best health class available, beginning age is 26, and both continue for 30 years. Legal & General was the lowest premium for L30 and AXA was the lowest ART.

Comparing Long Term Ownership Strategy

The Lazy Approach (Buy And Hold)

The most common strategy for young physicians is to purchase term life insurance two times: once during residency and once again after transitioning into practice – and then most leave as is.

The problem with the lazy strategy is that it almost always results in being over-insured as you become financially independent (and although this is better than being under-insured, it will cost you).

ART works well when you have a lot of unknowns but hope to achieve financial independence quickly. However, it can become the worst approach if you do nothing and keep coverage as is for longer than 20 years and/or into your 50’s.

Lazily buying level 30 (or any single level term policy for that matter) and holding it works best in circumstances when your death benefits needs rigidly end at a predictable year. It can also work well if you literally will do nothing once you buy term life because it will automatically go away once the term is up.

So let’s consider an example. Frugal Freddy is 25 and in residency. He’s done his calculations and knows he will need $1.5 million during residency and $3.5 million once he transitions into practice. He expects to need life insurance coverage until around age 60 at the latest. He is considering either purchasing one Level 30 policy at $1.5 million and one more for $2 million 3 years later OR purchasing the same exact death benefit but using ART.

If you compare the cost of Level 30 guaranteed premiums vs. ART scheduled premiums, the cost over the 30 years is very comparable – it ends up being around $65K for both.

Therefore, if you want to be really lazy, level 30 seems appealing. If pricing is similar, you might as well take the guaranteed route. However, BOTH strategies are far more expensive than the not-so-lazy approach. The cost savings might be motivation enough.

The Semi-Lazy Approach (Layer Level Term And Hold)

The semi-lazy strategy involves a little bit more strategic planning and proactive thinking on the front end, however, it’s still pretty lazy over time. Instead of simply buying two Level 30 policies and holding onto them, you buy different types of Level Term (they typically come in 5 year increments) based on your circumstances.

With this strategy, you structure in a couple automatic future reductions that are more in line with the fact that your death benefit needs will decrease incrementally as you become financially independent. Unlike the Lazy Strategy, this strategy requires that you project out your expected death benefit needs over time and use that to decide how to layer your term.

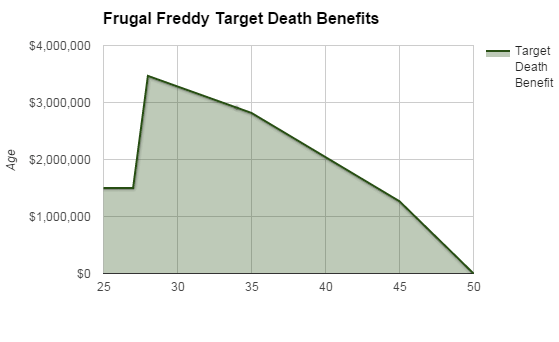

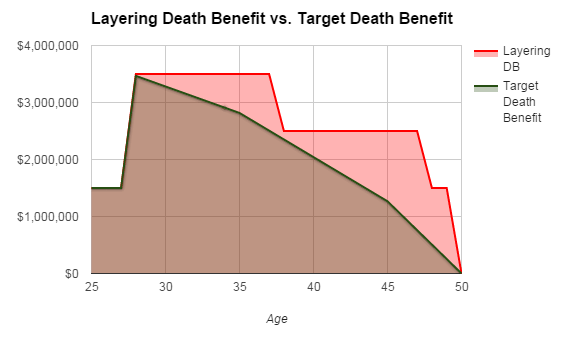

Let’s consider Frugal Freddy again. He decided he wants to be a little more proactive and is considering the semi-lazy approach. After going through his financial planning, he is able to project his future death benefit needs and comes up with the following…  This projection takes into consideration Freddy’s current and projected lifestyle and savings habits. As you can see, Freddy’s frugality allows for financial independence by age 50 – 10 years faster than he had originally estimated. Based on this projection, he decides to purchase Level 25 in residency (age 25) for 1.5 million. He wants the first policy he buys to last the longest because he is locking it in at a younger age. He knows this will provide the lowest rates and it will be the best chunk to hang onto for the long haul. He is also confident he will be totally financially independent by age 50 at which point it will end. When he transitions into practice, he purchases two additional Level Term policies. One is Level 10 for $1 million and the other is Level 20 for $1 million.

This projection takes into consideration Freddy’s current and projected lifestyle and savings habits. As you can see, Freddy’s frugality allows for financial independence by age 50 – 10 years faster than he had originally estimated. Based on this projection, he decides to purchase Level 25 in residency (age 25) for 1.5 million. He wants the first policy he buys to last the longest because he is locking it in at a younger age. He knows this will provide the lowest rates and it will be the best chunk to hang onto for the long haul. He is also confident he will be totally financially independent by age 50 at which point it will end. When he transitions into practice, he purchases two additional Level Term policies. One is Level 10 for $1 million and the other is Level 20 for $1 million.

As you can see below, Freddy uses his projected death benefit values to structure (or layer) term policies that more closely follow what he expects his actual needs to be.  This provides a lot of cost savings for Freddy. The total cost over this period of time ends up being just over $24K (more than $40K less than the lazy approach!). This approach works much better than the lazy approach if you can confidently project your future needs. However, there are risks associated with this approach. If things don’t work out as planned or if the projection is wrong, flexibility is limited for longer and greater death benefit needs.

This provides a lot of cost savings for Freddy. The total cost over this period of time ends up being just over $24K (more than $40K less than the lazy approach!). This approach works much better than the lazy approach if you can confidently project your future needs. However, there are risks associated with this approach. If things don’t work out as planned or if the projection is wrong, flexibility is limited for longer and greater death benefit needs.

The Proactive Approach

The proactive approach involves annually revisiting your ideal death benefit and reducing it each year as you approach financial independence (we’re assuming the insurance company allows for incremental reduction of death benefit – most should but it’s a good idea to check first). This approach will provide maximum flexibility and the lowest costs but it also requires proactive behavior.

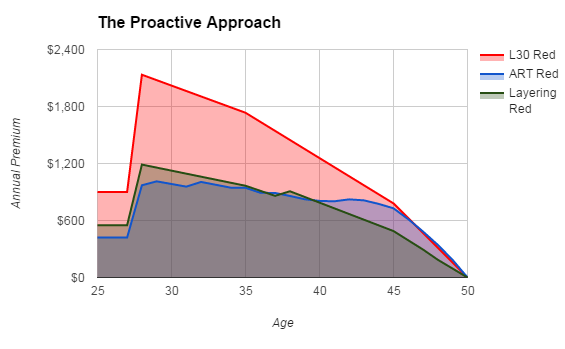

Is the cost worth the effort? And which specific proactive strategy provides the best possible value? Let’s look at the numbers using Frugal Freddy’s case. In this example, we will compare the Level 30 strategy, the ART strategy, and the Layering Term strategy but we will adjust the death benefit each year to match the projected death benefit needs. With the Level 30 strategy, his total cost is just under $32K. The ART and Layering strategies are very close in cost – both total around $19K over the full period (around $46K less than the lazy approach!).

Keep in mind, with all three of these strategies, the death benefit will be exactly what is needed (or projected to be needed) each year. Below graph shows the cost projections for each strategy using low cost term life insurance for each solution.  As you can see, the proactive approach is a very efficient method for owning term life insurance… particularly the ART and layering proactive approach. If you want to have guaranteed costs and you are very confident in your future projections, the layering proactive approach will work best.

As you can see, the proactive approach is a very efficient method for owning term life insurance… particularly the ART and layering proactive approach. If you want to have guaranteed costs and you are very confident in your future projections, the layering proactive approach will work best.

Comparing The Strategies

Generally, we discourage the lazy approach – no matter which type of life insurance you purchase. Life insurance death benefit needs are always changing – especially for the young physician. The semi-lazy approach can work well, but your initial projection must be fairly accurate or else you could get into trouble. The proactive approach – using ART or Layering Level Term – works best, however, you must be proactive or hire an advisor or planner to help you be proactive (I would not count on the average life insurance agent to be proactive about reducing your coverage). What strategy are you using for owning term life insurance? Have you used any other strategies we didn’t cover?