As I’m sure most are aware by now, 2018 is bringing with it some new, big tax changes. But what exactly does that mean for you? While some regulations are still “in the works,” we have highlighted ten changes that are most likely to affect you this year:

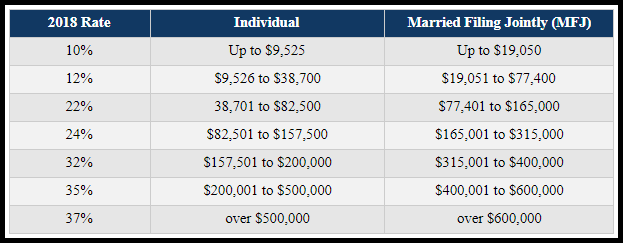

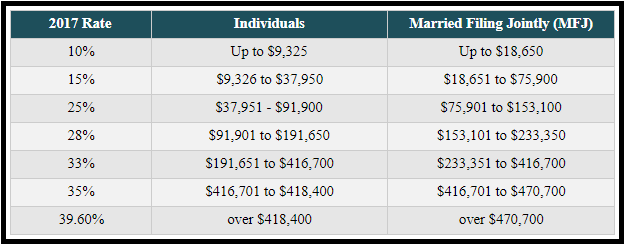

1) Individual Tax Rates:

Most people will see a decrease in their marginal tax rate in 2018. For example, if your taxable income was $315,000 in 2017 (MFJ), you were in the 33% bracket. In 2018, you would be in the 24% bracket. Big difference!

2) The Standard Deduction:

In an attempt to simplify filing for taxpayers, the standard deduction was increased ($12,000 for single, $24,000 for married filing joint), and personal exemptions repealed. These changes will result in fewer taxpayers being able to itemize deductions.. thereby “simplifying” their taxes.

3) The $10,000 “SALT” (State And Local Tax) Deduction:

Individual state, local, sales & property tax deductions will now be capped at a combined $10,000. You may have heard about taxpayers lining up to try and pre-pay property taxes for 2018 in 2017 – and this is why. If you pay more than $10,000 in combined state & local income taxes in 2018, you essentially receive no additional deduction/benefit for any property taxes paid.

4) Miscellaneous Itemized Deductions

Those subject to the 2% AGI limitation are being suspended. You may no longer itemize expenses such as unreimbursed employee business expenses (including the home office deduction), tax prep fees, investment advisor fees, etc.

5) Child Tax Credit:

This credit is being increased from $1,000 to $2,000 for each qualifying child under age 17. More importantly, however, the income phase out limits for the credit have been increased significantly: $200,000 for individuals (up from $75,000) and $400,000 for married filing joint (up from $110,000). There is also a new $500 credit for non-qualifying children such as those over age 17, elderly parents being cared for, etc. This credit is subject to the same income limitations (phased out at $200k indiv/$400k MFJ).

6) Mortgage Interest:

The mortgage interest deduction has been decreased for NEW debts (taken out after December 15, 2017). You may now only deduct interest on the first $750,000 of your mortgage debt instead of the previous $1M. Also, the deduction for home equity indebtedness has been eliminated. Previously, you were able to deduct interest for up to $100,000 in home equity debt – this will no longer be allowed. Unlike the mortgage debt interest, this also applies to existing home equity debt – no existing debts are grandfathered.

7) Business Taxation:

Corporations (and PSC’s) are being taxed at a new, flat rate of 21% – a huge decrease!

Pass through businesses (LLC, Sole Proprietorship, S Corp) are allowed a new below-the-line deduction: the Qualified Business Income (QBI) deduction. QBI is essentially the net income of the business (not including any investment income), and eligibility may be subject to income & other limitations depending on the type of business. Generally, they may deduct 20% of their QBI. This introduces some new planning issues/items for consideration. Specifically:

-

-

- – Employees will be incentivized to shift toward an independent contractor set-up to take advantage of the QBI deduction

-

- – Those in service businesses who are above the income limits for the QBI deduction might consider filing as a C Corp (QBI deduction fully phased out at $207,500 for individual and $415,000 for married filing joint)

-

8) 529 College Accounts:

Previously, 529s could not be used for pre-college expenses. The new law allows for a tax-free, qualified distribution of up to $10,000/year for elementary & secondary school expenses.

9) AMT (Alternative Minimum Tax):

AMT was retained but the exemption amount has been increased to $70,300 for single/HOH and $109,400. Further, the phase-out of exemption increased to $500,000 for single/HOH and $1M for MFJ. The combination of the increased AMT exemption and phaseouts plus the limited itemized deductions will make it less likely for individuals to trigger the AMT tax.

10) Alimony:

For agreements dated December 31, 2018 or later, alimony is no longer included as income for the recipient, and no longer allowable as a deduction for the individual paying.

These changes will affect taxpayers differently – there is not a “one size fits all” strategy. If you’re curious about learning more or finding out how this might affect you, please reach out to us! We’re happy to review your individual situation and help you navigate 2018.

You can see the full text of the new legislation here and the summary notes here)