I drive a 2003 Toyota Avalon. It’s got about 115k miles on it. Runs great. Definitely not the coolest car. But it’s extremely inexpensive and serves its purpose well.

The other day, my wife told me I should consider replacing my old car. We have three boys that are starting to get into sports and she thought it would make life easier if I had a newer and larger SUV. That got me going down this path of considering replacing my car. I began to think about how nice it would be to have a newer SUV and started to look at them online. As I began to do a little research on SUV’s I liked, everything I saw made me want a newer nicer version. Who wouldn’t want the back-up camera, extra safety features and fancy tech?

Eventually, though, reality set in. How was I going to make this work financially? Most people get to this point and financing is their answer. Everybody gets car loans, right? It’s easy. All you have to do is find the right car and make the monthly payments work. But “most people” are broke, too.

Buy first, pay later is not the way to build wealth. Especially when were talking about depreciating assets like cars. Do you think you will spend more on something if you pay for it in cash or if you finance it? The monthly payment pill is a lot easier to swallow, right. Apple figured that out. And it’s helped them sell over a billion $1,000 iPhones.

If you want to make the smartest financial decision, don’t finance cars. Unfortunately I’ve learned this the hard way. For a time in my life, I was like most people. I financed my second car in college. And it allowed me to spend way more than I should have. Lesson learned.

As I began to figure out how this would work financially, I thought about how much available cash we had to pay for it outright. And when I say available cash, I don’t mean our emergency fund. I mean cash reserves above and beyond the minimum necessary reserves. I call it “major purchase” savings. That plus the value of my car was the maximum I could afford for my replacement car.

I had my eye on 10+ yr old Toyota 4Runners. I’ve always liked the body style and fortunately they were within range of what I could stroke a check for. But then I started thinking about writing that check. It made me second guess why I was doing it in the first place.

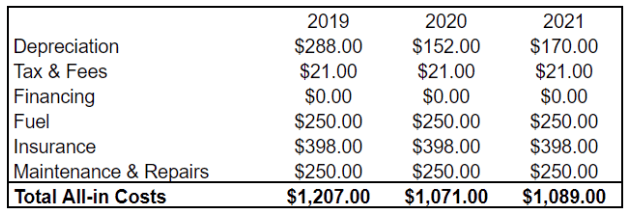

One of the biggest benefits of paying for things ahead of time is that it really makes you think about the decision. I started by looking at the true all-in cost of owning the SUV’s I liked. The one I liked the best was going to cost me at least three thousand per year even though I was buying an older vehicle in cash. That seemed high to me. So I decided to compare it to my car. Here are the numbers for my car.

If all you needed was a vehicle to get you from point A to point B, you could buy something comparable to my car for around $3,500. And then pay less than $100/mo for all the costs that come with it. That’s a heck of a deal, right?

It was never on my radar to buy a new 4Runner, but I thought it would be interesting to look at the all-in costs of it. Edmunds has an all in cost calculator that’s pretty handy for estimating all-in costs of newer cars. I ran it for a brand new 4Runner and the year one cost was $13,417. Total costs over five years were $45,421. Compare that to my car which will cost less than $5,000 over five years. That’s an added $40,000 expense over five years. If your household has two cars, multiple all those numbers by two. The numbers really start to get crazy if we assume that you invest the savings over a lifetime.

The more I looked at this, the more I started to not want to give up my car. It’s a good car. Runs well. It’s even got leather seats. And so far, my car has provided us with plenty of room. And the best part is it’s extremely inexpensive. After going through all this, I decided I was just going to keep my old Avalon.

And at the end of the day, a car is a pure lifestyle decision. If you’re looking at it from a financial perspective, it will almost always be better to keep your older paid-for car and drive it until the wheels fall off. I’m not against buying new cars if you have the money. I’m against people using irrational logic to justify buying their new fancy car on credit. Too many people buy cars they can’t afford with money they don’t have. Financing cars is super easy. But it tricks you into spending more. If you want to make better financial decisions, keep your old car and save your cash. And then when you have the money, go out and buy a fancy car if that’s what you really want.

Need help navigating decisions like these? We can help. Feel free to schedule a no cost consult with someone on our team to see if we might be a good fit.