Starting in 2019, the University of Kentucky will begin offering the UK Saver plan (click to compare UK health insurance plans). This is a big deal because it finally gives University of Kentucky employees access to the Health Savings Account “HSA”. If you’re unsure whether or not you would benefit from this new plan, read on.

The UK Saver Plan Highlights

Although the premium is the same as the PPO and HMO options, the new UK Saver plan opens up access to an HSA plan which is by far the best tax shelter available today. If you participate in the UK Saver plan, the University of Kentucky will automatically add $1,000 (Employee only) or $2,000 (Employee + children, spouse or family) to your Health Savings Account (“HSA”). Plus, you can add more to your new HSA (up to the annual maximum). The downside is that you’re going to be paying for most of your health care expenses out of pocket. And, in general, University of Kentucky employees who expect to have high healthcare costs will likely benefit by going with one of the other options. But there are many factors that play into this and many exceptions to the general rule.

What is an HSA?

An HSA allows you to save money in a tax-favored manner that will ultimately be used to pay for healthcare costs during your lifetime. In fact, we believe that it’s the best tax-sheltered savings plan available today. Here are 10 reasons why. To qualify for an HSA, you must be enrolled in a high deductible health insurance plan (HDHP). Once qualified, in 2019 you and your employer combined can contribute up to $3,500 (individual) or $7,000 (family).

Up to this point, University of Kentucky employees couldn’t take advantage of the huge tax benefits associated with the HSA. However, that’s changing with the addition of the new UK Saver plan. With the UK Saver plan, in the 2019/2020 plan year, the University of Kentucky will actually help get you started saving into the HSA by adding $1,000 for individuals and $2,000 for families. That means that as an individual, you can contribute an additional $2,500 to reach the maximum. And as a family, you can contribute an additional $5,000 to reach the maximum.

Contributions to the HSA avoid state and federal income taxes. PLUS they also avoid social security and medicare taxes. The HSA balance is NOT required to be used in the plan year and can roll over indefinitely for your lifetime. Most HSA plans allow you to invest a portion of the balance, which makes good sense if you’re planning to accumulate funds for the long-term. As the HSA balance grows over time, the growth is tax-free. And when you take cash out of the HSA, if it’s used for qualified healthcare expenses, it’s tax-free. If you’re over 65, you’re also able to take withdrawals from the HSA for non-healthcare expenses, it just gets taxed as ordinary income (similar to how a 401k would work). However, it’s better to use it for healthcare in your lifetime so you can avoid taxation. Under the current tax laws, the HSA is the only wealth accumulation vehicle that exists that is triple-tax-free (no tax going in, no tax on the growth, and no tax coming out) if used for healthcare expenses during your lifetime.

How does it compare to the Flex Spending Account (“FSA”)?

The HSA and FSA have the same tax benefits associated with contributions and healthcare qualified spending. Both are tax-free going in and tax-free coming out. However, the Flex Spending Account is a “use it or lose it” account whereas with the Health Savings Account, you can accumulate wealth. Because the FSA balance is always being spent, there is no real tax benefit associated with growth. On the other hand, the HSA comes with much greater flexibility to save and even invest the money and grow the balance tax-free. The FSA is a very good way to pay for current year health-care expenses, but so is the HSA. Keep in mind, the FSA and HSA will have differences in what they deem “qualified” health care expenses. Essentially, the HSA has all the benefits of the FSA plus it’s a fantastic tax-sheltering tool for building wealth to be used for future health care needs. And on top of all that, UK is throwing in $1,000 or $2,000 per year for you to get your HSA started.

How does the UK Saver Plan compare to the UK-PPO plan?

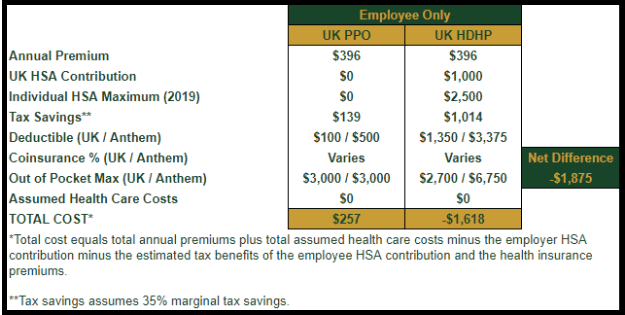

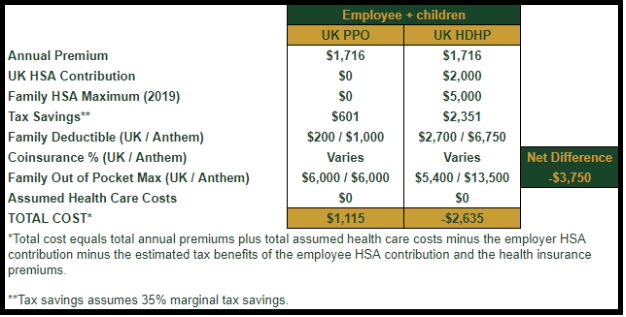

Let’s take a look at the numbers for the 2019/2020 plan year. In order to simply things a bit, we will start by looking at the all-in costs for the UK Saver plan (aka the UK HDHP) vs. the UK PPO plan and assume zero health care costs. We will also assume that you maximize the HSA account in the UK Saver plan/UK HDHP scenario. If you don’t have extra savings that would allow this, we will cover that more below.

Here is the employee only scenario…

And the employee + children scenario…

You might have noticed that we did not show the Employee + Spouse or the Employee + Family options. That is because they have the exact same net difference as the Employee + Children scenario shown above. Also, you might notice that we didn’t compare to the HMO. We did this because in this scenario, the all-in cost of the HMO plan is the same as the PPO plan.

As you can see, if you’re not expecting to use much healthcare, the UK Saver plan looks great compared to the PPO plan. That doesn’t even take into consideration the additional wealth building advantages that come with the HSA account.

However, it gets much more complicated when you take into consideration that everybody has a different tax bracket (we’ve assumed 35% marginal savings above for all tax benefits) and most people will have some health care expenses.

How do I fund the HSA?

If you’re in the UK Saver plan, there are two ways to fund the HSA. Through payroll and out-of-pocket. The preferred method is to fund through payroll. If you elect this method during open enrollment, UK will automatically fund your HSA through payroll on a pre-income tax and pre-FICA basis. This is the preferred method because it forces you to save evenly throughout the plan year and it’s pre-FICA. The alternative method would be to not fund anything through payroll and then fund an HSA yourself. The problem with this method is that you are responsible for making sure you qualify and successfully fund. Also, when you fund out-of-pocket, it’s not pre-FICA. Additionally, the income tax benefits are delayed because you have to file the deduction on your income tax return to realize the tax benefit. Plus — the tax form you get from the HSA provider (Form 5498) verifying the contribution amount doesn’t come until after the tax filing deadline so it’s ultimately your responsibility to report this number.

What if I’m doing the UK Saver plan and decide after open enrollment that I want to add more to my HSA?

Ideally, you meet one of the qualifications to adjust your HSA contributions during the plan year. However, the UK HSA has very strict limitations on being able to adjust during the plan year. So if you’re unable to qualify, the back-up option would be to set up and fund an HSA out-of-pocket. Taking this route does cost you FICA taxes, but if you qualify, you’re able to take the income-tax deduction on your tax return. It’s still a great tax benefit but not as good as running through payroll. If you’re considering this route, consider talking to a tax advisor before proceeding.

If I don’t have the cash to maximize the HSA, is the UK Saver plan still a good option?

The less you contribute to the HSA, the lower the all-in value associated with the UK Saver plan. This is because you don’t get any tax benefits associated with funding an HSA with pre-tax money. And if you don’t fund the HSA at all, there is no real tax benefit on your dollars — however, you still get the University of Kentucky employer funding amount. So if you’re expecting out-of-pocket health care costs under the UK Saver plan to be below this amount, it would still be a good option.

Before you skip the HSA because you don’t have the extra cash, think about the alternative savings vehicles that you’re already doing. It would be wise to compare those savings vehicles to the HSA. Maybe you redirect other savings, like a Roth IRA, into an HSA because the tax-benefits are better.

If I have an HSA balance, should I use it on current health care expenses?

Most people who start building up an HSA balance assume they will begin using it for health care bills as they come in. That can make sense for some people who don’t have alternatives. But for those with extra cash available in other accounts, it’s often much better to pass on using the HSA for today’s bills. Instead, let the HSA sit and begin to build wealth. The HSA is the best tax shelter you have going. Let it grow and instead use something extremely tax-inefficient, like a savings account, to pay for health care bills now. And if you’re onboard with this idea and plan to let it grow for long term goals, it’s wise to look at investing the balance.

I’m used to paying co-pays. How do I figure out how much my health care really costs?

Under the new UK Saver plan, instead of paying co-pays, you would be responsible for the negotiated costs until you hit your deductible. This negotiated cost is the medical provider’s costs after the insurance company discounts and negotiations. It’s basically the cost the insurance company pays the medical provider on your behalf. You can find all of your prior health care cost information by looking at your old explanation of benefit “EOB” statements. Take a look at the past claims and costs to get an idea of what typical costs would look like. This should help you understand better how costs would change under the new UK Saver plan.

How do I figure out the best plan for me?

As we mentioned, in general, those with lower health care costs will do better with the HSA plan. But there are a lot of health care exceptions and variables to consider. Income comes into play, too. Higher earning employees that maximize an HSA will see slightly higher tax benefits than lower income employees doing the same. Also, keep in mind, if you have student loans and are going for PSLF, there is an extra 10 to 15% kicker that comes with contributing to the pre-tax HSA.

For those expecting very low health care costs, it’s pretty simple. Go with the UK Saver Plan. You can see how much the all-in savings add up above. For everyone else, you ultimately have to run the numbers for your specific situation to decide on the best plan.

Do these types of decisions overwhelm you? If so, it might be a good time to reach out to a financial planner for help. We’re happy to chat and see if we might be a good fit. Or if you’re already working with a financial planner and they’re not helping with this stuff, we should talk too.