How do I keep up with what’s most important in my personal finances without spending hours on it? I have a budget but I feel something is missing. I make a decent living, how am I running out of money each month?

Do you find yourself asking similar questions? Many of the people we come across in our business are busy professionals. They are very smart, but short on time, and often just don’t have a great handle on their personal finances. More importantly, they aren’t sure how to improve.

What’s the Problem?

We have noticed that the biggest issue lies in the systems (or lack of systems) being used. Some have overly complex methods that focus on every detail, rather than the big picture. Some have systems that are too simple and don’t provide valuable data. Some rely too much on technology, thinking it would become their automated system, only to find nothing changed. And then many others don’t have a system at all. In talking with hundreds of people about their systems, we began to notice some trends.

- Most people don’t really know where their money is going.

- The few that do have an idea spent WAY too much time on it.

- There is a LOT of unaccounted for spending that most don’t realize.

- It’s rare to have a good handle on how cash reserves are changing over time.

After learning this, it was no surprise that most did not feel in control of their money. So, we created a system to help accomplish three main things: 1) Provide insight into the most essential parts of your personal finances. 2) Accomplish #1 in the least amount of time possible. 3) Provide a tool that encourages improvement through visual aids. That’s what we’re really after, right? We want to improve. Everyone wants to improve. Our system consists of 2 worksheets: the Expense Worksheet and Monthly Cash Flow Tracker.

Expense Worksheet

Below is a snapshot of a portion of the Expense Worksheet. Take some time to fill out this worksheet, and your totals will populate at the bottom in the “Total Expenses” line. You want your estimates to be relatively accurate, but without spending hours crunching numbers. Here are a few quick tips: -Not every category will apply to you – it’s okay to leave $0 for some -If you have an expense that is not listed just replace one of the other items -Do NOT include any pre-tax payroll deductions (401k, health insurance etc). We want to base this on your net take-home pay.

Monthly Cash Flow Tracker

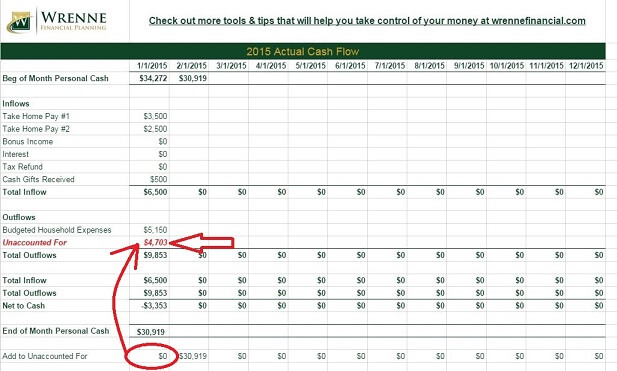

This spreadsheet looks scarier than it is – we promise. Really, you’re only going to input 5-10 figures each time you use it. Before you complete this part, make sure to: 1) Have the Expense Worksheet filled out 2) Have handy the values of any cash accounts you regularly use (checking, savings – anything that receives regular deposits or is used to pay for expenses) You will be completing this activity for the month PRIOR. So if it’s February when you’re doing this activity, you’re going to want to look at your January numbers.

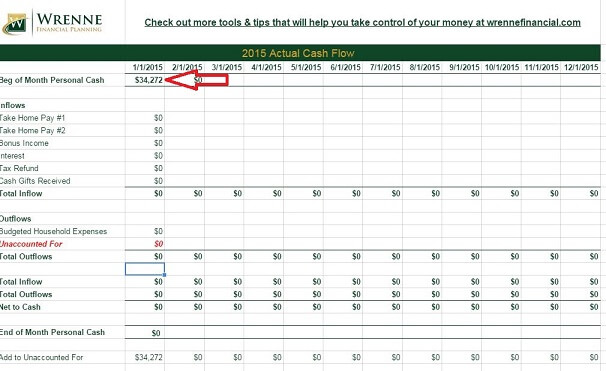

Step 1: Beginning of Month Personal Cash

(NOTE: if you’re more of an auditory learner, you can check out our video on how to use this spreadsheet instead)

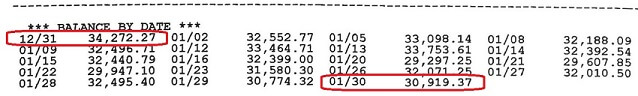

You should have something similar to the image above on your account statements. If we’re doing this activity for January numbers, you will total the first circled values from 12/31 for all cash accounts. Record the total value in the “Beginning of Month Personal Cash” box, as displayed in the image below:

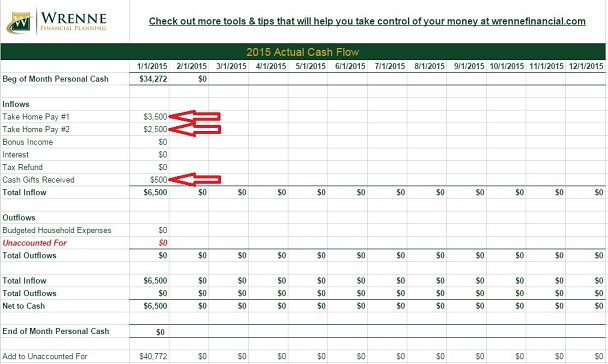

Step 2: “Inflows”

Input all incoming funds and deposits such as salary, bonuses, tax refunds, cash gifts, etc. Do not include transfers between accounts. You may not have values for all of these items, and that’s okay. Just fill in what applies to you. The goal is to account for every incoming dollar – this number should be exact.

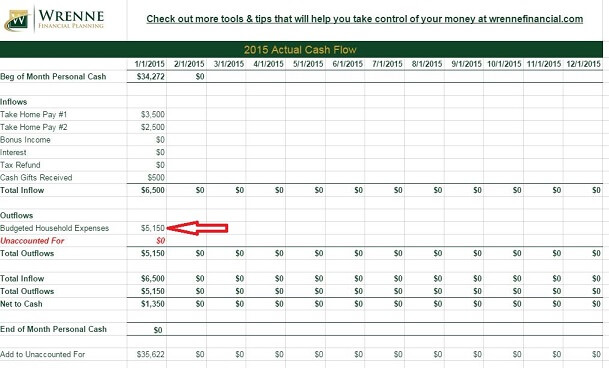

Step 3: Budgeted Household Expenses

This is the estimated value that was calculated for you in the Expense Worksheet you already filled out. Take your “Total Expenses” number from the bottom of the Expense Worksheet and plug them in here:

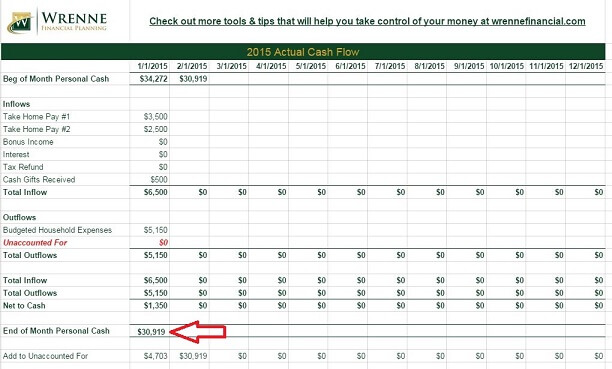

Step 4: End of Month Personal Cash

This is just like what you did in step 1, but instead you’re going to be using the END of month value. In this example, total the 1/30 value for all cash accounts. Plug this into the spreadsheet toward the bottom of the page:

Step 5: Add to Unaccounted For

All you are doing here is taking the value that has populated in the “Add to Unaccounted For” cell at the bottom of the page, and plugging that exact number into the red “Unaccounted For” line in “Outflows” – and that’s it!

So What Does This Tell Me?

If the RED number is positive, you spent more than you accounted for in your Expense Worksheet.

If the RED number is negative, you spent less than you accounted for in your Expense Worksheet

The ultimate purpose of this activity is to help you determine if you have monthly expenses that are “unaccounted for” – which means they’re not being planned for in your budget. And odds are that you do – most people will. The idea is just to make you aware that there is money going somewhere that you are not tracking/planning for.

Use this newly gained information to decide whether you need to evaluate your spending priorities, crack down on certain expense categories, save more of your surplus if you have it, etc.

You can get the spreadsheets free on our website – just head to the top of the main page, input your email, and they’ll be sent to you to download. We would love to get your feedback! Please let us know how the system worked for you – if it inspired you to make any changes, etc. Good luck!