NO.

We get this question from clients quite often. It’s not always a direct question – sometimes we just pick up on the issue through comments made during meetings. But the topic comes up enough that we recognize there are some misconceptions about how our tax system actually works.

Progressive Taxes

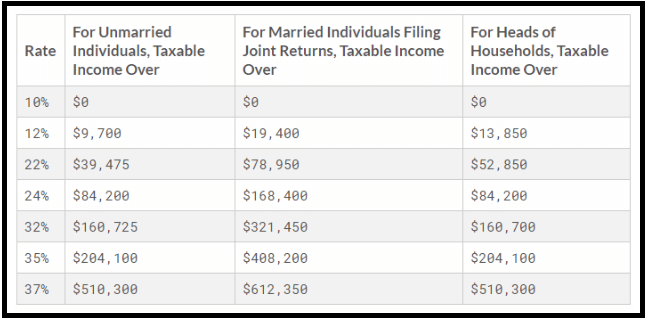

You may or may not be familiar with the phrase “progressive taxes,” but this is the system used to determine a taxpayer’s Federal tax due in the US. The intention is to structure tax due based on a person’s ability to pay… by way of assessing lower tax rates to lower income earners, and incrementally higher taxes to those with higher incomes. It breaks income levels up into “tax brackets” and associates each level with a tax percentage.

With a quick internet search, you can find all sorts of images showing these brackets. Most people look at these tables as if they’re a grid: they search for their income range.. then their corresponding tax rate.. multiply those numbers.. and assume that’s what they’re going to pay in tax. I.e. “If I make $100k and I’m in the 24% tax bracket I will pay $24,000 in tax.” But it’s actually not quite that simple. And the fact that tax tables can be misleading does not help.

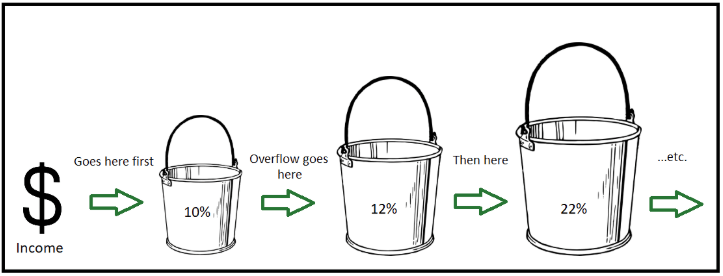

Instead of putting yourself in a single bracket, think about the individual income brackets as buckets. You’re going to fill up the lower tax buckets first and work your way up as you have more income. If you make enough to fill up the 10% bucket, then your income will overflow and start to fill up the 12% bucket. If you fill up the 12% bucket, then you’ll overflow to the 22% bucket… on and on. The increase is incremental.

Marginal Rate vs. Effective Rate

You may have heard the terms “marginal rate” and “effective rate” while discussing taxes. Usually, your tax bracket and the rate of tax you actually pay are different numbers. Your marginal rate corresponds to the “bracket” (10%, 12%, 22%, 24%, 32%, 35% or 37%) that is applied to the last $1 of income you earned. These are the rates people usually think of when they think about their taxes, but these figures can be misleading.

Being in the 24% marginal tax bracket does NOT mean you’re paying 24% tax on all of your income. It just means you’ve filled up all of the lower buckets and the additional dollars you’re earning are now being taxed in the 24% bucket. But before you even got to that 24% bucket, a lot of your dollars stayed in the 10%, 12% and 22% buckets. This is where the effective rate comes into play – this is the rate of tax that you’re ACTUALLY paying on all of your income on average – this number accounts for the taxes you paid at all rates. So even if you’re in the 24% marginal tax bracket, you still paid 10% on some of those dollars, 12% on some, and 22% for some – so your effective rate will be lower than 24%.

Susie’s Dilemma

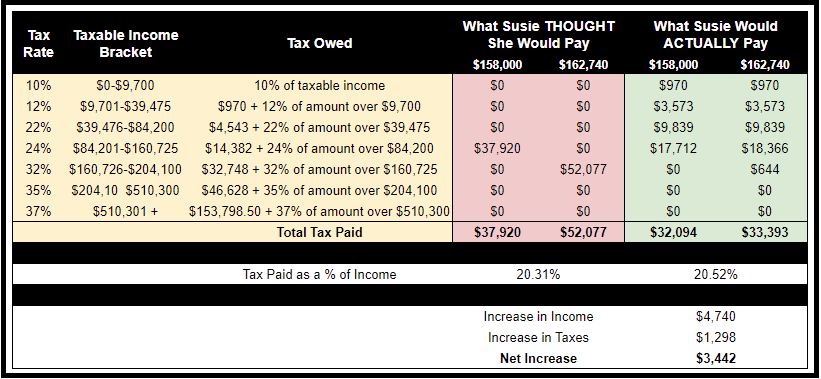

Now let’s look at an example. Susie is going to be our make-believe client. Susie is single and her salary is $158,000/yr (let’s assume salary and taxable income are the same). She is getting a 3% raise this year, which will bring her income up to $162,740. Susie wants to know if this will impact her taxes, so she does a quick Google search and a common tax table pops up. Looking at the table, Susie thinks she is currently in the 24% bracket (below $160,725), and she believes her raise is going to bump her up to the 32% tax bracket (above $160,725). She thinks she might be better off forgoing the raise because she’d rather pay 24% on $158,000 than 32% on $162,740. But, fortunately for Susie, that’s not how progressive taxes work.

In the table below, you can see how we break down Susie’s thinking (red area) versus what the reality would be (green area). If Susie had chosen to not take her raise, she would have ultimately missed out on an extra ~$3,500 of income. You can see her percentage of tax paid in the before vs. after is only slightly higher (20.3% vs. 20.5%). So while Susie’s marginal tax rate bracket goes from 24% to 32%, her effective rate doesn’t increase much at all.

Take the Raise!

Long story short, tax brackets are not a reason to turn down a raise. Raises are good! You might pay a higher percentage on each incremental dollar you earn as you flow over into the next bracket, but even still – taking home 60% of $1.00 is still better than no raise!