Get More Value and Stop Leaving Money on the Table

At some point, most physicians will need to consider his or her best option for student loan repayment. One thing that everyone should look into is Public Service Loan Forgiveness, or PSLF. Many physicians qualify for PSLF, sometimes unknowingly. PSLF is a federal program which forgives the remaining balance on qualified Direct Loans after 120 qualified payments (like those made under IBR, PAYE and RePAYE) while working full-time for a qualifying employer, usually a nonprofit or government employer.

Let’s talk about some scenarios of how this might play out.

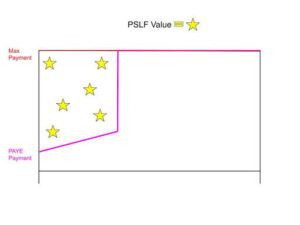

Say you’re in training now and have federal student loans. Most training programs are PSLF qualified. Plus income is typically lower (relative to student loan balances) and therefore income based payments are lower. As long as you’re entered into one of the qualified repayment plans, each monthly payment qualifies for 1 of the 120 required PSLF payments. Now you’re about to transition into practice, and you know the payment is going to jump way up with your income. At this point, maybe you’re thinking why not just pay off those wretched student loans as fast as possible. Is this the right move?

Not necessarily. First thing is you should verify whether or not your in-practice employer qualifies (you’d be surprised how many hospitals are qualified). If your employer qualifies for PSLF, your balance will be forgiven after 10 years or 120 payments, no matter how low or high those payments are, even if they are $0. COVID forbearance counts too! If you’re enrolled in IBR or PAYE repayment plans, your payment will be capped no matter how high it goes. The “cap” is the monthly payment you would have paid if you started on a ten year repayment plan at the very beginning (even though you didn’t). So in other words, maybe you’re five years into repayment with very low in-training payments. And then you transition into practice, and the max required qualifying payment is that original 10 year payment. You only have to pay it for five more years. In this situation, where you had low qualified payments in training, and payments are capped in practice, you can often see substantial PSLF value no matter how high your income goes. You could be making $2 mil per year in-practice and still realize substantial PSLF value. The key point is understanding how much PSLF value is created with those low in-training payments. Here is a visual to help.

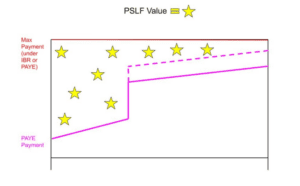

Let’s look at the same scenario and say you’re in practice but payments have not yet capped out. In other words, income still drives your payment (and you’re not in RePAYE). There are several ways to reduce your Adjusted Gross Income, therefore lowering your payments (and increasing the balance that will be forgiven). These include paying into pre-tax retirement plans, an HSA, or paying health insurance premiums. All of these are pre-tax and come out of payroll. Taking these out can lower your AGI and PSLF payments. Here is what this might look like.

Exceptions

Now, there are also several scenarios where PSLF will be of no benefit. These include:

- Making no payments during training because of forbearance or deferment paired with a very high income in-practice (relative to student loan balance). Basically, once your income reaches a point where you reach the IBR/PAYE cap, you’re not going to realize additional PSLF value. PSLF can still be a win here, but for that to happen, you would have had to already rack up valuable low PSLF past payments. However you still could take advantage of COVID forbearance because you’re technically making $0 payments that count toward forgiveness.

- REPAYE paired with a very high income in-practice (relative to the student loan balance). REPAYE will exceed the PAYE/IBR cap if your income is high enough. This occurs because there’s no max payment cap. However, you can switch out of REPAYE into PAYE or IBR as long as your income is low enough. But you need to make that switch before your income goes above a certain level.

- Loans Don’t Qualify. This is less common nowadays, but there are some loans that don’t qualify for PSLF. Look for the word “direct.” If your loan type includes that word, and it’s not in your parents name, they will qualify. FFEL loans, for example, don’t qualify. There are steps to get loans qualified if they’re not, but that’s a whole other article.

Things to do today:

1. Make sure your employer is qualified for PSLF, and think about this when choosing future employment opportunities.

2. Run the numbers. Look at your personal situation and calculate the cost of PSLF. Compare that to the cost of paying off the loan as quickly as possible, or to whatever plan you have currently. Make sure you know how many payments you’ve already made that count toward forgiveness. You can submit employer verifications for prior employment periods to your loan servicer and they’ll tell you how many eligible payments you have so far.

3. If you have questions (we know this can get complicated), or want more hands-on service, check out our planning partner, Wrenne Financial Planning.

If you find that after running the numbers and employing the above strategies, PSLF still ends up having little value, your best option is to consider a private refinance. Federal loan interest rates are going to be higher in most cases than private. But be careful not to do this until you’ve made absolutely sure that PSLF is of no value.

Hopefully this was helpful in making sure you’re not leaving money on the table when you don’t have to. It all comes down to educating yourself so you can make the most informed decision.

As always, feel free to reach out to us with any questions, and check out the coordinating podcast episode on this topic.