Medical school loans have become a big deal! 37 million Americans collectively owe over 1 TRILLION dollars – and yet nobody seems to fully understand them.

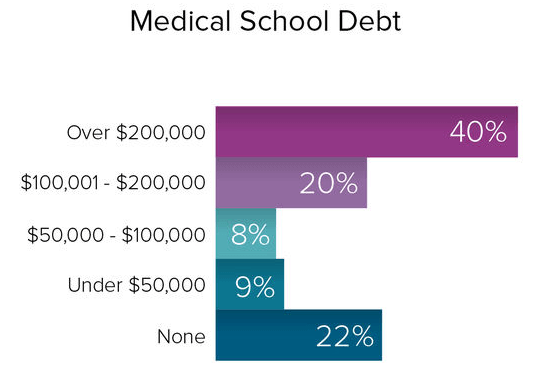

As you can see below from the Medscape 2016 Residents Salary & Debt Report, the average medical school grad comes out owing amounts that look more like mortgage balances than medical school loans.

Every year new repayment plans and forgiveness options pop up and further complicate the already complex loan programs. This guide is intended to answer questions and help provide a little clarity.

In case you’re looking for a specific topic, the Table of Contents below should get you to the right spot. If you’re just trying to get a better understanding of your loans, hopefully this guide will help answer most of the questions you have.

Where Do You Stand?

Clarifying where you stand can be broken down into four components…

1) Student Loan Details

2) Financial Circumstances

3) Professional Circumstances

4) Personal Circumstances

Medical School Loan Details

Do some homework and identify exactly where you stand with ALL of your medical school loans. Don’t skip over details or you may miss an important factor!

Federal Medical School Loans

Log into the Federal Student Loan Database and pull your NSLDS text file. This report will provide the detailed information you’ll need on all your federal student loans. If a loan doesn’t show in this report, it’s a private loan.

Private Medical School Loans

Pull your credit report to verify private loans.

It’s a good idea to create a spreadsheet to keep inventory of all this information.

Financial Circumstances

It’s essential to clarify exactly where you stand financially in order to make good decisions with your loans. Here are some questions to ask yourself:

- Do you have an appropriate emergency fund in place?

- Do you have credit card debts or other consumer debts?

- Do you have appropriate insurances in place (disability, life, health, etc)?

- Do you have an updated listing of all your assets and liabilities (debts)?

- What does your income look like each month? How about your expenses? Do you have money left over each -month?

- How much are you contributing to various retirement plans? Are you contributing to an HSA?

- What is your plan for the medical school loans?

- Do you expect any big financial changes in the next few years that could change your general financial situation?

Professional Circumstances

- Will you work for a not-for-profit, government, or other PSLF qualified employer?

- Is your medical residency and/or fellowship employer a PSLF qualified employer?

- Is your current or future employer providing loan repayment assistance?

- Are you unemployed, disabled or a veteran?

- Did you withdraw from school prior to completion?

- How will your income change in the future?

- What is your spouse’s income and how will it change in the future?

Personal Circumstances

- Are you married or you have children?

- How will this change in the future?

- Are there any unique circumstances where family may be involved with your medical school loans?

By gathering all of this information and answering these questions, you will be well positioned to make educated decisions regarding your medical school loans.

Medical School Loan Interest

Don’t let the complexity freak you out – understanding the basics of how student loan interest works will allow you to take on your debt like a champ. Complacency, on the other hand, will increase your chances of throwing dollars away.

Federal Student Loan Interest Rates

Federal student loan interest rates are set by the government and in most cases, do NOT take into consideration your individual situation. Every borrower receives the same deal. It makes no difference whether you are a millionaire or flat out broke. Some needs or profession based federal loans are the exception as they consider only a small set of facts for qualification and typically offer a rate break over normal federal loans.

If the government is not subsidizing the program (aka picking up some of the tab), the available interest rate should be higher than the best market rates available, but lower than the worst.

Private Student Loan Interest Rates

Private student loans originate from non-government lenders and work differently than Federal loans. The interest rates are set by the lender based on your specific situation and the products they have available. If you have fantastic credit, no debt and high income, you should receive the lender’s best interest rate option.

The interest rates on private loans are all over the place. We have seen loans with interest rates from as low as 2% all the way up to more than 20%!

Variable vs. Fixed Rates

Federal and private medical school loans can be fixed or variable. Federal loans that were originated before 2006 were variable rate only. From 2006 until now, the rates on new federal student loans are fixed.

Sometimes it’s difficult to determine whether your rates are fixed or variable, especially since rates have been relatively consistent.

Fixed Rates

Fixed rates are pretty simple. The interest rates are fixed for the life of the loan and are independent of the repayment method and economic conditions. At origination, the fixed rate is normally higher than the comparative variable rate loan. However, if (or when) market rates increase, it does not affect the fixed rate loan’s interest rate.

Variable Rates

Variable rates are a little more complex. The interest rate can go up and down and is typically tied to some sort of market rate (like the prime rate). Economic conditions go up and down, which will cause your rate to go up and down with it. Many loans have a cap on interest rates which tell you the maximum rate you would ever pay.

Subsidized vs Unsubsidized

The government picks up the interest tab on any subsidized loans while you are in school or deferment and sometimes during grace but never during forbearance.

With unsubsidized loans, you are responsible for the interest that accrues during all periods. All private loans are unsubsidized.

Under Income Based Repayment “IBR”, Pay As You Earn “PAYE”, and Revised Pay As You Earn “RePAYE”, if you have a subsidized loan, the government forgives 100% of unpaid monthly interest for the first three years of repayment. Therefore, your outstanding balance will not increase during this time. Also under RePAYE, if you don’t qualify for the 100% subsidy mentioned above, and your monthly payment isn’t large enough to cover the monthly interest, the government will forgive 50% of the unpaid interest.

Interest Capitalization

Most loans require that your monthly payment, at minimum, cover any interest accrued. This is not true with student loans. In many cases, your payment will only be a fraction of the interest. You need to know what happens to this unpaid interest in varying circumstances! Either it does not capitalize and builds up in a side account that doesn’t accrue interest, or it capitalizes and gets added to the principal balance. When capitalization occurs, you begin paying interest on your interest. As a result, large unpaid interest balances begin to build up.

Capitalization Example

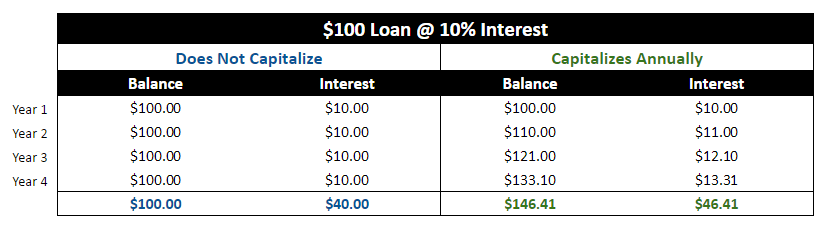

This can be confusing, so let’s look at an example:

In your first year of medical school you borrow $100 at a 10% interest rate. The interest does not capitalize while you are in school. After one year, you have made no payments. Therefore your principal balance is still $100 and your interest for the year is $10. In this example, because interest does not capitalize, interest does not get added back to your principal balance and instead is considered uncapitalized interest (which doesn’t actually accrue interest). After 4 years you enter repayment and your outstanding balance is still $100. Plus you have $40 of interest (4 yrs x $10 interest). At this point you’re paying 10% on the $100 and 0% on the $40 interest, therefore your effective interest rate has actually dropped to around 7.14% ($10 interest divided by $140 interest and principal balance).

Alternatively, many loans capitalize interest daily, monthly or annually. Let’s use the annual capitalization example to make the math simple:

You borrow $100 from a private student loan lender at a 10% interest rate. After one year, you build up $10 in interest and it’s added to the original balance of $100 (aka capitalized) which means you now owe $110. At the end of year two, your interest is $11 (10% of $110). This is capitalized again and you owe $121. Year three interest is $12.10 and at the end of the year you owe $133.10. Year four interest is $13.31 and at the end of the year you owe $146.41. The $6.41 difference is the cost of having interest capitalized annually vs. at the end of four years. It’s interest charged on the interest. Also, at his point your effective interest rate is still 10% (compared to 7.14% in the first example).

Federal Loans Capitalization

Generally, federal loans “capitalize” when at least one of the following triggers occur:

- Repayment begins

- Deferment ends

- Forbearance ends

- Upon default

- Change of repayment plan

- Loan consolidation

Capitalization During Income Based Repayment

Under IBR, if you leave the repayment plan OR you no longer qualify to make payments based on income, the outstanding interest will be capitalized.

The same is true with PAYE, except there is an interest capitalization cap if you no longer qualify to make payments based on income. The maximum interest that will be capitalized if this occurs is 10% of the initial loan balance at the time you entered PAYE.

Private Student Loans Capitalization

Similar to Federal student loans, many private student loans offer delayed capitalization on unpaid interest in certain situations. However, there are many variations and you should never assume your private loan works this way. Private student loans are all are over the place – as we mentioned before, there is really no rule of thumb. You must understand how your specific loan works to make the best decisions.

Loan Fees

Some federal and private medical school loans charge loan fees above and beyond interest. The most common fee is the origination fee charged when you take the loan out. It’s best to include any fees and interest when considering the entire lifetime cost of your student loan.

Consolidation Loan Interest Rates

Federal Direct Consolidation loans are designed to payoff multiple underlying federal loans and consolidate them into one new loan. The interest rate is set by taking the weighted average of your underlying rates and rounding up to the nearest 1/8th percent. Keep in mind, student loan consolidation is NOT a way to get lower interest rates. However it can be beneficial if you have older variable rate federal loans that you’d like to change to fixed rate.

Medical School Loan Consolidation

What Is Student Loan Consolidation?

Consolidation allows you to combine all your existing qualified federal loans into one new federal loan. The current vehicle available for doing this is the direct consolidation loan. There are pros and cons that you must understand before moving forward with this type change. Use caution – once you consolidate, you cannot undo the transaction.

There are also options for consolidating (or refinancing) your existing private and federal student loans into a new private loan, however, most of these lenders set your new rates and terms based on your financial situation – not based on the underlying loans.

Direct Consolidation Eligible Loans

The following is a partial list of federal student loans eligible for consolidation:

- Direct Subsidized Loans

- Direct Unsubsidized Loans

- Subsidized Federal Stafford Loans

- Unsubsidized Federal Stafford Loans

- Direct PLUS Loans

- FFEL PLUS Loans

- Supplemental Loans For Students “SLS”

- Federal Perkins Loans

- Federal Nursing Loans

- Health Education Assistance Loans

- Some existing consolidation loans

Private student loans are not eligible.

How Do You Qualify?

You are eligible to consolidate once you complete, drop out or drop below half-time enrollment in school.

In order to qualify for direct consolidation, you must have at least one Direct or FFEL student loan that is in grace or repayment. For example, you would not be able to refinance a Perkins Loan by itself – it would have to be paired with an FFEL or Direct loan.

Direct Consolidation Student Loan Basics

The new direct consolidation loan interest rate is fixed for the life of the loan. It’s calculated by taking the weighted average of all the underlying loans and rounding up to the nearest one-eighth of one percent.

The direct consolidation loan offers multiple repayment options as follows:

IBR

PAYE

ICR

Standard

Graduated

Extended

You are not required to consolidate all of your loans. Often, it makes the most sense to only consolidate specific loans as long as at least one of them is a Direct or FFEL loan. You cannot consolidate an existing direct consolidation loan unless you include at least one additional eligible loan in the consolidation.

You are able to preserve your underlying subsidized loan benefits (except with Perkins Loans). If you do have eligible subsidized loans, you will actually end up with two direct consolidation loans – one for the subsidized and one for the unsubsidized.

Perkins Loan Consolidation

By consolidating your Perkins loans into a new Direct Consolidation Loan, you lose several important benefits:

- Loss of subsidized interest-free periods during school, grace or deferment

- Loss of Perkins loan cancellation programs (different than public service loan forgiveness)

- Loan Forgiveness and Direct Consolidation

By moving forward with a new direct consolidation loan, you reset your clock for qualifying for income based repayment and public service loan forgiveness – “PSLF”. Any payments made prior to a direct loan consolidation will not count toward satisfying these forgiveness requirements. This is very important to consider before consolidating.

Interest Capitalization

Direct loan consolidation will trigger interest to capitalize (or be added to the loan principal) on the underlying loans in certain situations. For example, by leaving certain income based programs, interest will automatically capitalize. See part 2 of our series for more info.

Once the loans are consolidated, interest that accrues and is not fully paid by your monthly payments will capitalize at the end of deferment or forbearance.

Summary Of Pros & Cons

Pros:

- No origination or prepayment fees

- Can change variable loan rates to fixed (pre-2006 loans)

- Simplify loans by centralizing

- Access to PSLF with FFEL & Perkins loans

- Access to certain income based repayment plans that were otherwise unavailable (ex. RePAYE)

- Gives you the ability to forfiet grace period

- Offers more payment flexibility in some cases

Cons

- Resets the PSLF qualifying payments clock

- May trigger underlying loans to capitalize

- It’s never a lower interest rate and in some cases may be slightly higher

- Lose special benefits associated with underlying loans (Like the Perkins loans)

Again, be cautious about moving forward with direct loan consolidation – particularly if you have more recent fixed rate loans that already offer many of the perks that come with the direct consolidation loan. There are cases where it’s an obvious benefit, but others where it actually hurts you.

Medical School Loan Repayment Plans

The good news here is that you have a ton of options. You should be able to find a repayment plan that fits your needs. The bad news is… you have tons of options. Often, complexity is paralyzing. Please avoid this as it will cost you – keep reading so that you can make educated decisions!

For starters, you can change repayment plans at any time as long as your underlying loans are eligible for the desired repayment plan. There is a super handy repayment estimator online which allows you to run the numbers on your loans.

It’s important to know exactly what types of loans you have FIRST before analyzing your options.

Student Loan Status

Before we get into the repayment options, it’s important to clarify how loan repayment status works. Your federal medical school loans will always be categorized under one of the following repayment status, depending on your situation and how you are repaying them (or not repaying them). We will reference these more in future posts as they are extremely important for student loan planning, but for now it’s important to define each.

In-School – It is what it says. Interest treatment is similar to the deferment status detailed below.

Deferment – Repayment of the principal and interest of your loan is temporarily delayed. No payments are required. Interest will accrue on your federal loans; however, if they are subsidized, the federal government picks up the tab. Interest will capitalize at the completion of deferment.

Grace – Offers a set period of time when you graduate, leave school, or drop below half-time enrollment before you must begin repayment of your loan. Interest will typically accrue during your grace period. Grace is not available on all loans. (Example – PLUS loans have no grace period)

Forbearance – Available in some situations when you don’t qualify for deferment and you cannot make scheduled loan payments. Your monthly payment is reduced or eliminated depending on the circumstances. You qualify for forbearance in 12 month increments of time. Interest will accrue on your subsidized and unsubsidized loans during this period. Interest also capitalizes at the completion of each forbearance period. Use caution with Forbearance. We see many medical residents defaulting to it, however, it’s rarely your best option.

Repayment – The period of time when you are actively making payments under one of the qualified repayment options which we will cover below.

Delinquent – This period begins the first day after you miss a payment and continues until all outstanding payments are caught back up and your loan becomes current. Delinquencies of at least 90 days are reported to the credit bureaus and likely will negatively affect your credit rating.

Default – After a long enough period of delinquency, your loans eventually default. You want to avoid this as there are many negatives associated with it. Most notably, interest capitalizes and your credit takes a hit.

Standard Repayment

Available for the following loans:

- Direct Subsidized and Unsubsidized Loans

- Direct PLUS Loans

- Direct Consolidation Loans

- Unsubsidized and Subsidized Federal Stafford Loans

- FFEL PLUS Loans

- FFEL Consolidation Loans

Monthly payments are fixed (minimum $50/mo) and are made for up to 10 years for all loan types except Direct Consolidation and FFEL Consolidation Loans. If you have a FFEL or Direct Consolidation Loan, your monthly payments are fixed (minimum of $50/mo) and are made for 10 and 30 years depending on your total education loan indebtedness.

Graduated Repayment

The Graduated Repayment plan is very similar to the Standard Repayment plan (same eligible loans, same repayment periods, same exception with consolidation loans).

The main difference is that payments are not fixed – they start out low and increase every two years. The payments will never be less that the amount of interest accrued between payments and will never be more than three times your lowest payment.

Extended Repayment

The Extended Repayment option is available on the same loans as the Standard & Graduated Repayment plans. Although Direct Loans are eligible, there are some additional requirements specific to Extended Repayment you should be aware of.

With the Extended Repayment, you can set up monthly payments that are fixed OR graduated. The monthly payments, which are generally lower than Standard or Graduated payments, can be made for up to 25 years.

Income-Driven Repayment Options

Income Based Repayment “IBR”

Available for the following loans:

- Direct Subsidized and Unsubsidized Loans

- Direct PLUS Loans made to graduate or professional students

- Direct Consolidation Loans that did not pay any parent PLUS loans

- Unsubsidized and Subsidized Federal Stafford Loans

- FFEL PLUS loans made to graduate or professionals studies

- FFEL Consolidation Loans that did not repay any parent PLUS loans

- Federal Perkins Loans (only if you consolidated)

Payment amounts are based on a percentage of your discretionary income, but are never more than the 10-year Standard Repayment plan amount. The percentage depends on when you became a new borrower. If it was before July 1, 2014, it’s 15% of discretionary income. If it was on or after July 1, 2014, it’s 10% of discretionary income.

The repayment period also depends on when you became a new borrower. If it was before July 1, 2014, the repayment period is 25 years. If it was on or after July 1, 2014, the repayment period is 20 years.

Pay As You Earn “PAYE”

Available for the following loans:

- Direct Subsidized and Unsubsidized Loans

- Direct PLUS Loans made to graduate or professional students

- Direct Consolidation Loans that did not pay any parent PLUS loans

- Unsubsidized and Subsidized Federal Stafford Loans (only if you consolidated)

- FFEL PLUS loans made to graduate or professionals studies (only if you consolidated)

- FFEL Consolidation Loans that did not repay any parent PLUS loans (only if you consolidated)

- Federal Perkins Loans (only if you consolidated)

Payment amounts are 10% of discretionary income but never more than the 10-year Standard Repayment Plan amount. The repayment period is 20 years. To qualify, you must be a new borrower as of October 1, 2007, and must have received disbursement of a Direct Loan on or after October 1, 2011.

Revised Pay As You Earn “RePAYE”

Available for the following loans:

- Direct Subsidized and Unsubsidized Loans

- Direct PLUS Loans made to graduate or professional students

- Direct Consolidation Loans that did not pay any parent PLUS loans

- Unsubsidized and Subsidized Federal Stafford Loans (only if you consolidated)

- FFEL PLUS loans made to graduate or professionals studies (only if you consolidated)

- FFEL Consolidation Loans that did not repay any parent PLUS loans (only if you consolidated)

- Federal Perkins Loans (only if you consolidated)

Payment amounts are 10% of discretionary income and are not capped. The repayment period is 20 years for undergraduate loans and 25 years is the loans were for graduate studies. Also under the new repayment plan RePAYE, when your monthly payment is less than the total interest accrued, the government “subsidizes” 50% or 100% of any unpaid interest payments. This benefit is in play on all types of RePAYE eligible loans (subsidized and unsubsidized loans).

Income Contingent Repayment “ICR”

Available for the following loans:

- Direct Subsidized and Unsubsidized Loans

- Direct PLUS Loans made to graduate or professional students

- Direct PLUS Loans made to parents (only if you consolidated)

- Direct Consolidation Loans that did not pay any parent PLUS loans

- Direct Consolidation Loans that repaid PLUS loans made to parents

- Unsubsidized and Subsidized Federal Stafford Loans (only if you consolidated)

- FFEL PLUS loans made to graduate or professionals studies (only if you consolidated)

- FFEL PLUS loans made to parents (only if you consolidated)

- FFEL Consolidation Loans that did not repay any parent PLUS loans (only if you consolidated)

- FFEL Consolidation Loans that repaid PLUS loans made to parents (only if you consolidated)

- Federal Perkins Loans (only if you consolidated)

Payment amounts are the lesser of either 20% of your discretionary income OR what you would pay under a 12 year fixed payment plan, adjusted according to your income. The repayment period is 25 years. The ICR Repayment strategy is very rarely used.

“Only if you consolidated” means that if you consolidated the loan type into a Direct Consolidation Loan you are eligible.

“Discretionary Income” for IBR & PAYE is the difference between your income and 150 percent of the poverty guideline for your family size and state of residence.

Income-Driven Loan Forgiveness Options

If your loans are not fully repaid at the completion of the repayment period under any income driven repayment plan, the remaining balance will be forgiven. This repayment period includes periods of economic hardship deferment and periods of repayment under other plans. The amount that is forgiven will be taxed at ordinary income in the year in which it is forgiven.

There is also a special forgiveness program called Public Service Loan Forgiveness “PSLF” for those working in not-for-profit and making payments under any of the income-driven repayment plans. In certain circumstances, PSLF can provide forgiveness in 10 years instead of the 20 or 25 year forgiveness available under the Income-Driven forgiveness options. Any balance forgiven under PSLF will not be subject to income tax.

Income-Driven Application, Qualifications & Payments

You must submit an application and provide either your Adjusted Gross Income “AGI” or alternative documentation of income such as a pay stub. If you have no income, you can state this on the application and it should suffice.

You can use AGI to qualify for your income-driven payment if BOTH of the following apply…

1) you have filed a tax return in the past two years

2) the income on the most recent federal tax return is not significantly different than your current income

Payments are based on your income and family size. This information must be updated each year so that your payments can be adjusted if necessary. The maximum payment for IBR and PAYE is the 10-year Standard Repayment plan equivalent payment. Under ICR and RePAYE, your payment is always based on your income no matter how high it goes.

Income-Sensitive Repayment

This repayment option is available for the following loans:

- Unsubsidized and Subsidized Federal Stafford Loans

- FFEL PLUS Loans

- FFEL Consolidation Loans

Income-sensitive repayment allows you to qualify for decreased monthly payments based on income, as compared to standard repayment, but is limited to a 10 year repayment term.

If your payments are reduced in the early years, remaining payments are increased to compensate. You must pay at least your monthly interest and it’s required that you reapply each year. It’s basically a 10 year repayment plan that allows for graduated payments based on income but because the term is set at 10 years, those reduced payments must be made up on the back end with higher payments.

This repayment plan will be more costly than the standard 10 year repayment plan. This option is rarely the best choice. Always check out the Income Driven and Graduated repayment plans before considering this option.

Choosing Your Repayment Plan

There are many factors to consider when choosing your student loan repayment plan. What specific loans do you have and what options are available for those loans? Do you plan to keep the loans in their current form or will you refinance or consolidate them? Do you plan to qualify for one of the forgiveness programs? What will be your income and financial situation? What’s your goal for loan repayment?

These are all critical questions that you must answer if you want to make the best possible decision.

See below interactive flowchart. It gives graduating medical students and residents an idea of options to consider when choosing student loan repayment.

Medical School Loan Forgiveness

Public Service Loan Forgiveness “PSLF”

The PSLF program is available for certain Direct Loan borrowers (including Consolidated Direct Loans) employed by not-for-profit or government organizations. To qualify for forgiveness of the remaining balance on your Direct Loans, you must have made 120 qualifying payments under a qualifying repayment plan while working full-time for a qualified employer. PSLF is a bear of a topic, so it has it’s own section below where you will find more details.

Income-Driven Repayment Forgiveness

If you are repaying loans using one of the income-driven repayment plans (IBR, PAYE, or ICR), loan forgiveness may be available on any remaining balance(s) at the end of the repayment period (if you make it that far). Essentially, for this forgiveness option to be of any benefit, you must have a loan balance at the end of full repayment period (20 or 25 years depending on your loans). Keep in mind this is totally different than PSLF. Most notably, it does NOT require “qualified employment” and the qualifying period is the full duration of the respective income-driven repayment plan.

How could you still owe money at the end of full repayment? Because it’s INCOME based. Results will depend on several factors, such as your income over the repayment period and the size of your total debt. Higher income and resulting higher payments will lower the likelihood of forgiveness. There is a point where your payments are high enough to pay off the entire loan on or before the full repayment period. This eliminates any benefit associated with income-driven forgiveness.

The forgiveness option is typically something to consider when your total student debt value exceeds total income. However, there are many factors to consider over a long period of time. Ultimately, it will depend on your specific circumstances. Also, under current tax law, the amount forgiven is taxable whereas the PSLF is tax free.

Total and Permanent Disability or Death

Borrowers of Direct, FFEL and Perkins loans who become totally and permanently disabled or die during repayment may be eligible for loan discharge. If you would like more information on qualifying for discharge, you should check out the outline from The Federal Student Aid Office.

Teacher Loan Forgiveness (5 year forgiveness)

Full-time teachers that work five consecutive years for a designated employer serving students from low-income families may be eligible for up to $5,000 (or up to $17,500 for certain special education, math and science teachers) of loan forgiveness at the completion of the fifth year. This program is available for certain Direct and Stafford Loan borrowers.

Perkins Loan Forgiveness Options

Several additional forgiveness options are available specifically for Perkins Loan borrowers. Here are several of the cancellation conditions that may exist for borrowers that are unique to Perkins Loans:

- Service in the US armed forces in a hostile fire or imminent danger area

- Full-time firefighters

- Full-time law enforcement or corrections officer

- Full-time nurse or medical technician

- VISTA or Peace Corps volunteer

- Certain librarians

- Full-time attorney employed in a federal public or community defender organization

- Certain full-time employees of public or nonprofit child or family agencies working in low-income communities

- Various other education and social service related jobs

Other Loan Forgiveness Programs

There are many other loan forgiveness and repayment options available. Here are a few to consider:

- The US Military offers several loan forgiveness programs that vary by the specific military branch and occupation.

- Many states offer medical and other health professionals loan repayment assistance or scholarships. This website will help you to search these programs and find out more info.

- The National Health Service Corps offers loan repayment for qualified health care providers who choose to work in certain need areas. This website will provide more information on this program.

- The National Institute of Health provides loan repayment to certain qualified health professionals focused on research careers. This site will provide more info.

- Many employers offer loan repayment programs. Some are very rigid programs whereas others can be negotiated and directly relate to your specific compensation package.

Public Service Loan Forgiveness “PSLF”

As we touched on in the section above, this program is for certain Direct Loan borrowers employed by not-for-profit or government organizations. In order to receive forgiveness, the borrower must make 120 qualifying payments (under a qualifying repayment plan), while working for a qualified employer (full-time).

If you meet all of the qualifications for PSLF and your income-based monthly payment is less than the 10-year standard repayment, you will have some amount forgiven at the end of 10 years. The amount of total forgiveness depends on your income (lower = more forgiveness) and total debt (higher = more forgiveness).

Alternatively, if your income-based repayment is equal to or greater than the 10-year standard repayment amount for the entire 10-year qualifying period, you will not realize any loan forgiveness under PSLF.

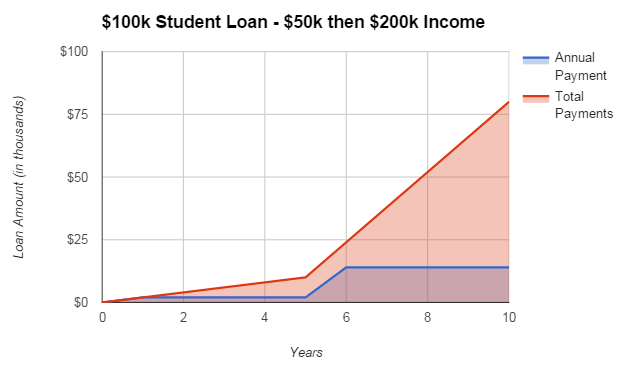

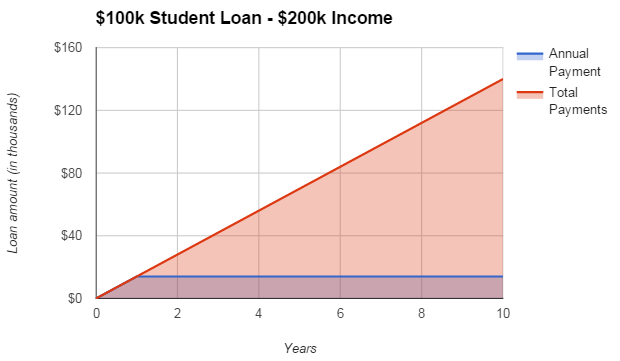

The classic example shown in the graph below is the medical resident working in an academic not-for-profit hospital that plans to continue working at a not-for-profit hospital in practice. This example shows a hypothetical borrower who is eligible for PSLF and has income that allows for income-based payments far below the 10-year standard payments. This low income period lasts for 5 years. In year 6 their income jumps up and, as a result, they must then begin to pay the maximum payment under PSLF (10-year standard payments) for the remaining 5 years.

Although this borrower ends up with a very high income, they still realize plenty of value because half of the PSLF qualifying years are at a very low income level (as a ratio of the total debt). This person ends up paying back only 80% of what they originally borrowed over the 10 years! The forgiveness occurs at a point when their income is 2x greater than the original loan balance. And under current tax law the forgiveness under PSLF is tax free.

To put the value of this into perspective, let’s consider another example illustrated below. This person is PSLF qualified based on their employment, however, their income and total debt requires that they must pay the 10-year standard payments over the entire duration of the 10-year repayment period.

Although they are technically PSLF qualified, by paying at the 10 year repayment rate for 10 straight years they end up paying off the entire loan themselves. There is nothing left to forgive. In the example below, the borrower ends up paying back 140% of the original loan balance. This is more consistent with a normal loan repayment.

Keep in mind, these examples are hypothetical, rough estimations of varying scenarios and will not be reflective of your exact situation. You must calculate the numbers based on your specific circumstances in order to get an accurate projection. These scenarios will vary considerably for each borrower’s situation.

Qualifying for PSLF

Pay attention if you have medical school loans (or other types of student loans) and work for a not-for-profit or government employer! The PSLF program is a heck of a deal for certain qualified borrowers. You would be surprised how many people actually qualify and are unknowingly missing out on the opportunity. Others realize they qualify for PSLF but aren’t maximizing the benefit. Today we will dig into how PSLF works and help you avoid missing opportunity.

The PSLF program allows certain borrowers loan forgiveness after making 120 qualified payments. In short, it’s a big deal (if you qualify).

It’s all about the qualifiers:

- Employment

- Loan Type

- Payments

Qualifying Employment

You must work full-time for one of the following employers to qualify:

- Government organizations at any level

- Not-for-profit 501(c)(3) organizations

- Other not-for-profit organizations providing qualifying public services

- AmeriCorps or Peace Corps

Keep in mind that most academic hospitals and institutions are not-for-profit and would therefore be considered a PSLF qualified employer.

What exactly does “full-time” mean?

For PSLF, you are typically considered full-time if you meet your employer’s definition of full-time or work at least 30 hours per week, whichever is greater.

Qualifying Loans

A qualifying loan for PSLF is any loan you receive under the Direct Loan Program including Direct Consolidation Loans.

What about FFEL and Perkins Loans?

Student Loans from the FFEL and Perkins programs do not qualify for PSLF, but they may become eligible if you consolidate them into a Direct Consolidation Loan.

It’s important to note that Direct Loan Consolidation will restart the PSLF clock on your 120 payments. For example, if you are consolidating a Direct Loan and a Perkins Loan and have paid PSLF qualifying payments on the underlying Direct Loan, those will be lost if you consolidate.

Qualifying Payments

A PSLF “qualifying payment” is a full, on-time, monthly payment made after October 1, 2007 under a qualified repayment plan while employed full time by a qualified employer. Keep in mind, you cannot make qualifying payments while in deferment, grace, forbearance or default. Your 120 qualifying monthly payments do not need to be consecutive.

What is a qualifying repayment plan?

Qualified repayment plans include all of the income-driven repayment plans (IBR, PAYE, ICR) and 10 Year Standard Repayment (required when your income reaches a certain level under income-driven repayment plans).

If you are in repayment and make all 120 PSLF qualifying payments under the 10-year standard repayment plan, you will have no remaining balance left to forgive. Alternatively, if under the same scenario your income allows income-driven payments be lower than 10-year standard payments, you will begin to see benefits from PSLF.

It’s important to understand that the ultimate benefit depends on the variance between the 10-year repayment and your actual qualifying payments (for all 120 payments). The bigger the variance, the larger your forgiveness will be. Therefore, if you are going for PSLF and want to maximize your benefit, you want to seek the lowest payment possible on every payment you make.

A great starting point if you’re considering PSLF would be the Federal Student Aid “FSA” repayment calculator and the PSLF overview page.

Verifying Employment & Tracking Progress

Make sure to qualify your employment annually or whenever you change jobs! Employment verification is not required until you apply for forgiveness, however, it’s far better to keep up with it over time so you don’t run the risk of not being able to verify it when it really counts. Employment verification allows the following to occur:

- Confirm with FSA your employer is or is not PSLF qualified.

- If your employer is PSLF qualified, any of your federal student loans not held at FedLoans are transferred to FedLoan Servicing. This will allow all your PSLF eligible loans to be serviced in one place.

- If your employer is PSLF qualified, FSA will review your payments and determine your progress toward PSLF qualification.

- FSA will notify you of their findings

Once you complete your 120th qualifying monthly payment, you must submit the PSLF application. Keep in mind, you must be working for a qualified organization at the time you submit the application and when your remaining balance is forgiven.

Maximizing PSLF

The amount you ultimately pay for each income driven payment directly affects your ultimate benefit from PSLF (lower payments = larger forgiveness). In most cases, your payments are set based on your loan situation, Adjusted Gross Income (AGI) and tax filing status.

It’s important to note that you have some level of control over your AGI and filing status. It is possible to lower your AGI based on actions you take over the course of the year.

Examples of the most common AGI reducing actions are pre-tax retirement contributions, HSA contributions, and qualified moving expenses. For example, if you contribute to a deductible IRA instead of a Roth IRA, you allow your AGI to be lower which, in turn, lowers your income-based payment. This ultimately provides for greater forgiveness.

A similar scenario occurs with your tax filing status. If you are married and both you and your spouse earn an income, odds are you file taxes jointly. So here’s the scoop… you typically owe more taxes as a couple when you choose to file separately. At the same time, your income-driven payments are reduced as a result of the lower AGI with separate filing. If you want to maximize PSLF, it’s very important to run the married filing separately numbers for BOTH your tax return AND your income-driven payments.

If the amount you save in income-driven payments over the coming 12 months by filing separately over jointly is greater than the tax cost of filing separately, you will benefit by filing your taxes as married filing separately. The larger the variance, the greater the benefit.

This calculation is not simple, however, it can have major impacts on your ultimate PSLF benefit. If you and your spouse both work and one or both of you have federal student loans that are PSLF qualified, make sure your tax advisor runs the analysis every year before filing your taxes!

Stay on Top of Income-driven Repayment

You also have some control over when you file for income-driven payments. Ideally, you file at the most efficient time based on your circumstances. Keep in mind your income-driven payments are based off of prior year returns or other income verification provided by you. It’s important to be aware of your deadlines and options relating to providing income verification.

Unsure About Qualifying for PSLF?

If you haven’t ironed out your exact career path but are currently employed by a PSLF qualified employer, it’s often best to position yourself for PSLF by using one of the income-directed repayment plans.

For example, most medical residents fall into the above scenario. They are working as a resident at a not-for-profit hospital but are unsure if their future employer will be PSLF qualified. On top of that, the medical resident often has limited available cash flow to make payments. Unfortunately, a large portion of this crew is defaulting to forbearance and, in most cases, this is a bad move. It’s worth paying the minimal income-driven payment to position yourself for PSLF and defer interest capitalization.

The Government and PSLF

Many people are worried the government will do away with PSLF midway through their qualifying repayment and, as a result, they will lose forgiveness benefits. They feel it’s risky to count on something that could be taken away at any time, and that if PSLF doesn’t come through, they will be faced with a much bigger problem than they started with. If this is a concern you have, you should read this article from Jan Miller.

Medical School Loan Refinance

If you aren’t going for student loan forgiveness, your next consideration should be student loan refinance. Many people today pay thousands more in student loan interest than is necessary.

Until recently, there wasn’t much to do about it. But, fortunately, in the past few years, several legitimate lenders have started offering much better deals on your medical school loans. Before you sign on the dotted line, though, there are a few potential downsides to consider as well. Private lending is like the Wild Wild West compared to federal medical school loans.

What Is A Student Loan Refinance?

Student loan refinance is where you pay off one or more old federal or private student loans with a completely new private loan. This differs from consolidation because you receive entirely new terms that have nothing to do with the underlying loan(s). You typically qualify for refinance based on your financial situation, so you must be considered low risk to the lender in order to receive a good offer.

Keep in mind you do not have to refinance all of your student loans. It’s easy to pick and choose which loans you want refinanced. The most common reason for refinancing is to lower your interest rate.

Should You Refinance Your Medical School Loans?

Before you waste any time looking into student loan refinance, take an honest minute to reflect on your finances. If you’re a wreck financially, odds are that private lenders will decline your application. Even if you could find a lender, you probably shouldn’t refinance any federal loans when your finances are weak.

Do you own long term disability and life insurance? Take this into consideration, as many private loans come with weaker protection for disability and/or death than federal loans.

Next, analyze your potential new loans. Find the lenders that are likely the best fit. Learn about a potential lender’s financial standards, loan options and terms. And read the promissory note – this document will outline the terms and conditions.

Run through various worst case scenarios and determine how the loans compare in each. Consider situations such as a job loss, early loan repayment, death, disability, or another major financial hardship. Federal student loans, for example, typically offer flexible options during financial hardship (forbearance, etc). Private lenders generally aren’t as generous with these types of benefits. If you were in a bad spot financially, could you keep up with the refinanced student loans payments?

Be especially cautious about forfeiting Public Service Loan Forgiveness (PSLF) eligibility with federal student loans. Once you refinance, this option is eliminated for good. If there is any chance that you may be eligible for loan forgiveness, you should avoid refinance. Also, if you’re spouse is going for PSLF, use caution. Refinancing federal loans into private can ramps up your spouse’s IDR payments.

Common Scenarios

Student loan refinance most commonly provides value when you have an existing student loan that can be refinanced into a new loan with the same terms, no closing costs, and a significantly lower interest rate. This refinance becomes an instant financial benefit.

Also, medical residents who plan to work in for-profit employment should put much consideration into refinancing their medical school loans. There are programs available from DRB and LinkCapital that allow medical residents to refinance and make very low payments while in training (similar to income-driven repayment). This isn’t always an easy decision even if you’re not going for PSLF. For example if your income is low and your balances are high, RePAYE can offer lower effective rates than Refinance. Also if you have lots of uncapitalized interest, your effective rate can actually be much lower than the stated rate.

Finally, anyone who will not receive a forgiveness benefit from a government program, has above market rates on their loans, and does not need the other federal loan protections, should definitely be looking into refinance.

The Refinance Process

So you’ve done all your homework and feel great about refinancing your student loans! What’s next?

The Typical Application Process

It’s important that you come into this process organized, otherwise it could take considerable time and effort to complete.

The Initial Phase

Typically you will fill out an online or paper application (financial, personal and professional info). The loan company will run a credit check. You should already know your credit info before they check – if you don’t, here are a few free resources: Annualcreditreport.com, Quizzle.com and Creditkarma.com

Some companies provide tentative offers once they see your initial information. Don’t count solely on this initial quote when making decisions, though, as it’s subject to change.

Additional Info Often Requested:

- Photo ID

- Copies of recent pay stubs

- Proof of graduation (official transcript, diploma, degree verification, certificate of completion, etc.)

- Loan statements indicating your 30 day payoff amount. It can be a BIG pain to get this information.

- Often, medical professionals must provide a license to practice and proof of malpractice insurance.

Approval

After reviewing your information, the lender provides a formal offer. If you accept the terms of the loan, the lender will send you a final disclosure and promissory note. You then sign and return that promissory note. Review these document before signing!!!

The new lender will then send checks to your current lender(s) to pay off your student loans.

The lender may also open a checking account if you request this (often comes with a .25% rate reduction). Your first payment is typically due in 30 days.

Refinance Companies

The student loan refinance market is heating up. New lenders seem to pop up every couple months – many with competitive products to consider. This is great for you, the consumer, however, it also requires that you be on your game and understand how lenders compare. This list should get you started.

Laurel Road ($300 welcome bonus link)

- Refinance available to working professionals with bachelor’s or graduate degrees (U.S. citizens and permanent residents)

- Refinance available for federal and private student loans

- Application process done online

- No maximums for student loan refinance

- No prepayment penalties or origination fees

- In the event of death, DRB will forgive all amounts owed under the loan

- In the event of permanent disability, DRB may forgive some or all amounts owed (see promissory note for specific definition of disability and terms)

- Special program available for medical residents and fellows: payments of $100/mo during residency, fellowship and your first six months in practice

- Interest does not capitalize until you begin making normal payments (6 months into practice)

CommonBond ($500 welcome bonus link)

- Available for federal, private, corporate-sponsored, and international student loans

- Application process online

- No maximum refinance

- No prepayment penalty, origination fee or application fee

Earnest ($300 welcome bonus link)

- Available for students who have graduated or will graduate in 6 months

- Offers federal and private student loan refinancing

- No maximum – 100% of outstanding loans can be refinanced

- Very flexible terms and interest rates available

- No prepayment penalty, origination fee, application fee, or late fees

- Online application with additional information required (Education history, personal info, employment history, and financial history)

- Hyper-personal underwriting – application process is very detailed and will consider your full financial picture allowing you to receive a more personalized offer.

- Earnest looks to lend money to borrowers who are in control of their finances and know how to manage them

- Flexibility offered by allowing the following: Borrower can switch between fixed and variable rates for no additional charge, structure loan terms based on available budget, allows for considerable payment flexibility without penalty

- Promises to never pass you off to a third-party servicer

First Republic

- Available for undergraduate and graduate students

- Must apply at a First Republic office location (California, Oregon, Florida, New York, Connecticut, and Massachusetts)

- Refinance both federal and private loans

- No origination fee, prepayment penalty or annual fees

- Eligibility requirements: must have FR Checking account with auto-pay, working professional for at least 24 months

- Interest prepayment rebate program – First Republic will rebate interest paid on the loan, up to 2% of the original balance, if the loan is paid in full within 48 months

There are also many others on the list that you might want to check out such as SoFi ($300 welcome bonus link), Splash Financial ($300 welcome bonus link), LendKey ($300 welcome bonus link), LinkCapital ($600 welcome bonus link) and many others.

Also there are several third party companies that help you sort through all the options such as LendEdu (check out their complete guide to refinancing student loans) and Credible ($1K welcome bonus link – they also have a discount with the AMA).

Keep in mind, with any refinance of federal loans into private loans, you will be giving up federal loan benefits such as Public Service Loan Forgiveness, income-driven repayment, disability discharge and forbearance options. You should fully understand exactly what you are giving up with your federal student loans before moving forward with this process. You should also consult with your tax advisor to understand the tax implications of this type of transaction.

We do not accept any compensation of any type from any of the lenders mentioned on this list.

Tax Considerations

If you are still not convinced that student loans have become extremely complicated, then this should seal the deal for you. In many cases, student loan planning will become very much intertwined with your tax planning. Unfortunately, just keeping up with student loans alone isn’t enough. In order to get the best deal, you must also regularly analyze various tax scenarios and keep up with applicable income tax laws.

You might think this trouble is not worth your time – but not so fast! It can easily result in thousands of dollars being saved each year. I suggest either making time to keep up with all of this yourself OR hiring an expert to help – like us :-).

But for now, we will go over the basics to help get you started.

Public Service Loan Forgiveness Maximization

Tax Deductions – PSLF Booster #1

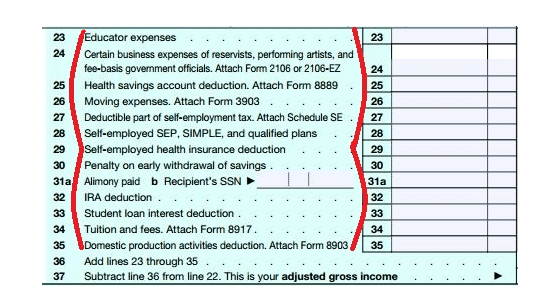

Certain types of tax deductions are like boosters for maximizing PSLF. When going for PSLF, the goal is to repay the least amount possible on each of your 120 qualifying payments. Your income-driven payments are normally established based on your Adjusted Gross Income or “AGI”. AGI is your gross income minus above the line deductions. The more above the line deductions you have, the lower your AGI. The lower your AGI, the lower your income-driven payments (assuming you qualify to use AGI). The lower your income-driven payments, the more future forgiveness you receive. Catching my drift?

See below screenshot of the 1040 IRS form listing above the line deductions (bracketed in red – lines 23 – 35).

You may recognize some of these deductions. Health savings account (HSA) contributions, for example, are great because contributions are pre-tax, the balance grows tax-free, and qualified withdrawals are tax free. A solid deal can turn into a home run when going for PSLF because of the reduced income-driven payments resulting from a lowered AGI. You receive the normal tax benefits AND you get the additional PSLF value resulting from your reduced AGI. Typically, each dollar of reduced AGI reduces your income-driven payments by 9-15% under PAYE and IBR.

For example, during lower income years such as those in medical residency, the Roth IRA would normally be your best bet. You would compare your current marginal tax rate to your expected future marginal tax rate to make this decision. If your tax rate is lower now that you expect it to be in retirement, the Roth IRA is the easy choice. However, if you are going for PSLF and therefore working to minimize your income-driven payments, your calculation of the Roth vs. the Traditional IRA decision must also include PSLF additional value. For some, this can totally swing the pendulum in favor of the Traditional IRA.

Married Filing Separately – PSLF Booster #2

Another easy way to potentially boost PSLF benefits for married, dual-income households is by analyzing the tax and student loan implications of filing separately vs. jointly. Filing separately often brings negative tax implications and positive PSLF benefits. The key is the NET benefit of this decision. For example: a couple might pay $1,000 in additional income taxes by filing separately, however, by doing this, they reduce income-driven payments by $6,000 in the following year. This reduced payment results in pure savings when going for PSLF. Therefore, their net benefit from filing separately is $5,000. You must perform this analysis every year before filing taxes to determine how it shakes out.

It’s surprisingly common to see that filing separately provides much more net value when considering both taxes and PSLF. You can play with the numbers using the Federal Student Aid’s repayment estimator – it allows you to input filing separately or filing jointly. At a minimum, it’s well worth your time or the cost of paying for help to run these numbers each year!

Managing Income-Driven Repayments – PSLF Booster #3

Lastly, you must be very proactive about managing your income-driven repayment planning to maximize PSLF.

Understanding how they verify income is KEY. You are required to verify income annually under income-driven repayment. However, you can also choose to re-certify income whenever you’d like (typically if your income decreases). Let’s say, for instance, that your income decreases one year by a considerable amount. Most people would wait until their annual request to re-certify income, but if you want to maximize PSLF, you should be proactively requesting that income be re-certified ASAP. In most cases, you can use AGI to verify income. Examples of exceptions would be if your income changed “significantly” from the prior year OR if you haven’t filed taxes for the prior two years. When you are unable to use AGI, you must verify current income another way.

Timing is also KEY as you can control (to some extent) when you apply for income-driven payments. Typically, for the medical professional, filing for repayment ASAP is a good strategy because your income stair-steps upward. For example, the medical school graduate may want to file for income-driven repayment before they officially start earning their residency income so they can claim no income (this strategy is becoming harder than it used to be). Waiting too long to file could force you into higher monthly payments if your income increases and/or you file a new tax return. Maybe you are getting married to someone with a much higher income in August – it’s probably a good idea to file for income-driven repayment in July before you are officially married.

Avoid forbearance and missed payments like the plague. Knocking out your 120 payments to qualify for PSLF asap is key. You can only qualify for 1 payment per month – if you miss a month you can never get it back. The lower your payment each month, the more impactful PSLF will ultimately be for you. People usually file for Forbearance during one of the best possible times for maximizing PSLF (when income is really low). Often, they don’t realize they can re-certify their new lower income or that payments would be lower under PAYE.

Let’s say someone is paying $400/mo during medical residency under IBR. They cannot handle the payments and choose forbearance for 6 months. Fast-forward 7 years and they are in practice finishing up the last year of PSLF qualification. Their income is much higher so they are paying the maximum payments at $3,000/mo. Because of their decision to forbear a total of $2,400 in payments, they now must pay an additional $18,000 in payments to qualify for PSLF.

To further make a point, let’s say instead that this person used a credit card to pay the IBR payments for those 6 months. (DON’T EVER DO THIS – I AM SIMPLY MAKING A POINT OF HOW IMPACTFUL THIS IS). This credit card charges 30% interest – this may be over the legal limit but I’ll assume it isn’t. This unpaid credit card balance with interest over the 7 year period ultimately ends up being $17,972 at the beginning of the 84th month.

Taxation of Loan Forgiveness

Under current tax law, the amount forgiven under Public Service Loan Forgiveness is NOT considered taxable income and the amount forgiven if you still have a remaining balance at the end of your income-driven repayment plan is considered taxable income.

Nothing in this post should be considered tax advice. For more information or specific recommendations, seek advice your tax advisor or check with the IRS.

Medical School Loan Resources

Here are some of the tools and resources we have compiled related to managing your student loans:

Student Loan Calculators

Federal Government Repayment Estimator: use this link when you are beginning repayment of your federal loans for the first time, or exploring your repayment options based on your income.

Student Loan Payment Calculator: wondering what to expect for your monthly student loan payments? Use this simple calculator to get an estimate.

Student Loan Term Comparison Calculator: this link will help you see how different terms of repayment affect your monthly payments and total interest paid over the life of the loan?

Student Loan Refinance Calculator: get an idea of how much interest you can save by refinancing student loans to a lower rate.

Student Loan Deferment Calculator: (https://studentloanhero.com/calculators/student-loan-deferment-calculator/) use this link to determine how much interest will accrue during a student loan deferment or forbearance period

Important Student Loan Paperwork & Documents

Public Service Loan Forgiveness Program: (https://studentaid.ed.gov/sa/sites/default/files/public-service-loan-forgiveness.pdf) Details on PSLF, which loans are eligible, how to become eligible, etc.

Public Service Loan Forgiveness (PSLF) Employment Certification Form: Fill this out annually to ensure you’re on the right track with qualifying for PSLF (here are some instructions)

Public Service Loan Forgiveness Q&A: Questions on PSLF? They might be answered here.

Public Service Loan Forgiveness Application: Once you’ve made your 120 qualifying payments, you will need to fill out a form to actually apply for forgiveness. The form is still being developed. It will be available prior to October 2017 when the first borrowers will become eligible for PSLF.

Income-Driven Repayment Plans Fact Sheet: Details on IBR, PAYE, etc.

Other Helpful Links

Here are a few free resources for obtaining your credit information:

Annualcreditreport.com

Quizzle.com

Creditkarma.com

WFP Media Links

In our webinar “How You Can Save Thousands on Student Loans”, you’ll learn how to avoid the most common student loan pitfalls that will cost you thousands, deciding between filing taxes jointly vs. separately to maximize PSLF, and how to reduce your income-driven payments.

Our Student Loan Services

If you are interested in seeking the help of an expert, check out our student loan advising services.

We regularly revise this guide to keep it up-to-date and provide you with the most accurate information available, so be sure to check back periodically for any revisions or updates! Please comment with any observations, questions or comments you have – we’d love to hear from our readers & help in any way we can.