Do you feel like you’ve lost control of spending? Maybe you make good money. But as you earn more, you just seem to spend more. You don’t feel like you’ve really changed anything, but old luxuries become new necessities. This is what we call “lifestyle creep” and it’s extremely common in our society.

The best way to combat lifestyle creep is to improve spending awareness, however, most budgeting systems are incredibly tedious and time consuming. People get hung up on small things, like how much you spend on cable, and totally miss the big picture. Often times, people burn out before making any progress. They conclude that there isn’t anything they can really cut right now, so what’s the point of going through the pain of budgeting. If this is all resonating with you, I have a great system to share that will help you gain better spending awareness with very little time commitment. It’s actually the system I’ve used personally for several years now. So I can totally vouch for it.

Before I share how it works, let’s talk about a few situations where it won’t work. This system will not work if you don’t pay your entire credit card balance each month. It might also be a pain if you have a bunch of different checking accounts or lots of transfers. For this to work best, you must simplify accounts – ideally 100% of all income and expenses run through one account.

Also – a quick note on using credit cards and paying them off each month. This system can work well for people, however, there is a time-lag on when you make purchases and when you actually see the expense show up. For some people, including myself, this isn’t a problem. But many others would rather have more real-time spending numbers. If this is you, here are two solutions: 1) stop using credit cards and strictly use the one checking account debit card and/or cash for everything (this can also work well for people that need/want to cut expenses) or 2) you could pay off your credit balances immediately.

But let’s get into the actual system. The key is that you carve out a 10-15 minutes every month to pull some numbers together. Pick a date of the month that you’d like to schedule your financial review. I do the first of the month because it’s easy and it lines up with the months. It’s not so much the date itself that matters, but rather being consistent with that certain date of the month. When you’re getting started, schedule reminders for that date to get you in the habit.

Here is how your review should go…

Step 1 (current month starting balance) – Log into your checking account which you run all transactions through. Ideally, as mentioned above, this is just one account but if you have more than one, you must add the total balance of all of them. Write down the current balance (closing balance as of the end of the prior date). For example if I’m doing my review on the 1st of the month, I’m writing down the balance as of the close of the prior month.

You can skip steps 2 and 3 for the first month since they require having a prior month starting balance to work. Or you could add the prior month starting balance in step 1 when you do it the first month.

Step 2 (prior month total inflows) – Look at your transaction history for the prior month. Sticking with the 1st of the month review example, you would look at all transactions in the prior calendar month. Total up all the inflows that came into the account for the prior month. And write down that number.

Step 3 (prior month total outflows) – Back into outflows for the prior month and write down this number. You can calculate this number by using some simple math. First, take the current month step 1 balance and subtract the prior months’ starting balance. This equals your prior month surplus. Then take your prior month total inflows (step 2) and subtract your prior month surplus. This equals your prior month total outflows. Here is the equation: Prior month total inflows – (Current month starting balance – prior month starting balance) = prior month total outflows.

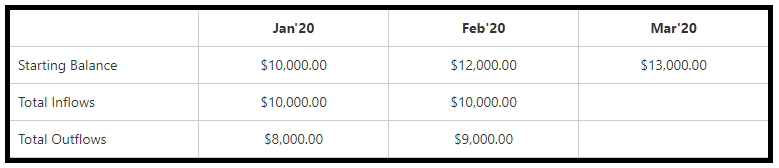

All you’re doing is writing down three numbers for every month. For the visual people, here is what this might look after a few months:

For those using excel, here is the formula for step 3 (would go in total outflows for prior month): =prior month total inflows-(current month starting balance-prior month starting balance)

That’s it. Just three numbers every month.

If you’re a tinkerer like me, you’ll be tempted to make this more complicated that is necessary. Maybe you’re already thinking it would be great to add in fixed expenses and categorize income and extract out investments. Those can all be great things to add in eventually. However, I would encourage that you resist that temptation and focus on getting in the habit of just having three numbers every month that you track. Starting balance, Money in, and money out. That’s going to give you way more awareness than most people. And it’s simple enough that you’re not going to burn out.

After a few months of completing these steps, you will begin to feel greater spending awareness. Over time, you’ll start to notice trends. You’ll be alerted to spending increases much sooner than before. The required monthly effort is well worth the long term payoff.

You might be wondering – what is a good target? That’s totally depending on what you’re trying to accomplish. In general, I would say a good target is achieving a good saving, spending and giving balance. Ideally those align well with what you consider most important.

For us, our goal is to lock-in our current lifestyle and save or give all the excess. As income increases, the goal is to be more intentional with this new income. But in reality, this can be challenging. To help combat this, we have incorporated into our system a target level of monthly outflows. How did we get a target? We started by coming up with a total estimated monthly budget. Let’s say our total budgeted monthly expenses are $7,000. I know from experience that target budgets are almost always under actual budgets. So to avoid constant disappointments, we built in a 10% margin. So that brings the total up to $7,700/mo. This becomes our target that we track against total outflows. As long as our total outflows are averaging $7,700/mo or less, I’m not going to get into the weeds. We’re on track and life is good. However, in our experience, every six months or so, we start seeing some lifestyle creep. And so when we start exceeding our target, we dig into the numbers a bit and figure out what’s actually happening. And come up with a plan to keep things better in check.

If you’re struggling with making this type system work well for you, we can help. Feel free to schedule a consultation to see if we might be a good fit to help you.