This article from the Finance Buff explains a great way to save hundreds on Roth IRA contributions.

But I wanted to expand upon this idea and highlight an even bigger way to save using a similar strategy. Thanks to changes in tax law, the “deduct and convert” strategy has become much more beneficial. Before you read on, if you’re pre-retirement age, you must reside in Illinois or Kentucky for it to work well. For all Kentucky and Illinois residents, pay close attention!

The Original Strategy

This strategy exists thanks to Kentucky and Illinois favorable IRA rules. Both states allow state income tax deductions on IRA distributions (including Roth conversions) up to state specific limits. They also allow state income tax deductions on qualified Traditional IRA contributions.

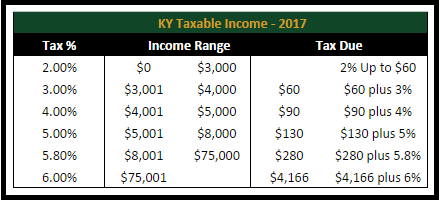

The strategy involves contributing to a traditional IRA, taking the tax deduction (assuming you qualify), and then converting it to a Roth IRA. Kentucky has a progressive state income tax which ranges from 2% to 6%. Most people are paying closer to the top.

For example, in Kentucky if you contribute to an IRA and qualify for the deduction, you’re able to deduct the contribution for state income taxes. So no state income tax going in. You’re also able to convert Traditional IRA’s to Roth (aka Roth conversion) at any age and avoid Kentucky income tax on the converted amount. So no state income tax on a conversion to a Roth IRA.

By taking the extra step, you avoid state income tax on the Roth IRA contribution. For someone in the top KY tax bracket, this strategy effectively saves them 6% on the contribution amount when compared to contributing directly to a Roth IRA. For a $5,500 contribution, that’s $330 in tax savings. With two IRA’s maxed out at $11,000, the max household benefit would be $660.

Although $660 is better than a poke in the eye, it may not be worth the hassle to many taxpayers. And most don’t even qualify in the first place because they don’t live in Kentucky or Illinois and/or cannot deduct IRA’s. We’re talking about a small benefit for a small group.

However, since the article was written, new laws now allow 401k’s to offer in-plan Roth conversion. This effectively opens up the strategy to 401k participants and raises the stakes with much higher contribution limits!

Mega-Deduct And Convert

Greg and Jane live in Kentucky and plan to maximize Roth 401k’s in 2017 ($18,000 each) for a total household contribution $36,000. Instead, they contribute $36,000 to traditional pre-tax 401k’s and in the same tax year convert $36,000 to a Roth 401k. The Traditional 401k contribution is pre-federal and state income tax. The Roth conversion causes additional federal income tax but avoids state income tax. Basically, the federal income tax offsets and ends up the same as if they had contributed directly to Roth. However, they save 6% in state income tax by taking the extra step thanks to the favorable Kentucky IRA tax laws. This saves them $2,160 of state income tax. Now we’re talking about a pretty serious benefit.

The net effect for Kentuckians is a 6% boost on Roth 401k contributions (3% for Illinois). This works especially well for those already planning to contribute to Roth 401k. However in reality, most people aren’t 100% certain that the Roth is better than simply going with the traditional 401k. There are several additional factors to consider as detailed in this article by Michael Kitces on making the Roth vs Traditional decisions. Also, there is also the fact that state income taxes are potentially deductible if you itemize deductions. If this is the case, the effect of this benefit will be reduced based on the tax savings of the deduction.

There’s also the step transaction doctrine to consider. This IRS catch-all rule says you cannot take multiple steps to circumvent the rules. This might be viewed as a violation under audit. Therefore, because of this and because in reality most people aren’t sure if the Roth is actually best (even with potential for up to 6% boost), an even better strategy would be to go ahead and contribute to the traditional 401k. Wait and see how the year shakes out. And decide on the Roth Conversion at the end of the year. Doing this actually gives you a much better idea of what your marginal tax bracket will be which factors heavily into the decision. This allows you to make the decision based on the maximum amount of information. It also lessens the chance of it being considered a violation of the step transaction doctrine.

As with any potentially taxable transaction, you should ultimately consult your tax advisor before moving forward.