With Tuesday’s election looming, investors around the globe are growing concerned about what the results may mean for their portfolios. I’m here to tell you not to worry about it.

I could present to you decades of conflicting data, which could lead you to any number of arbitrary conclusions, but the fact remains: there are far too many complicating factors that determine the movements of the stock market. Trying to identify the effect of one of these factors is a losing proposition. If the pre-election movements are any indicator, you can expect a dip with a Trump win, and perhaps a bump with a Clinton win. But who is to say that these movements are not already priced in? And who is to say that these movements will hold beyond the immediate aftermath of the election? The truth is, this election is muddled with uncertainty — perhaps far more than any election preceding it.

With seemingly endless controversy surrounding both candidates, anybody purporting to know what will happen next is fooling themselves. Accordingly, here are the steps we are taking to ensure we are better off come Wednesday morning, regardless of the outcome.

1) Remaining calm: The biggest threat to your portfolio isn’t holding through a downturn, it’s selling ahead of an upturn. The mainstream media will undoubtedly capitalize on the fears of the electorate. Whether Republican or Democrat, everybody will be convinced that an election loss will spell the end of society as we know it. Don’t fall for it. The “safe” play is not in cash – it is in consistency and persistence. Ignore the noise, and stick to the same strategy you’ve employed for the duration of your investing life.

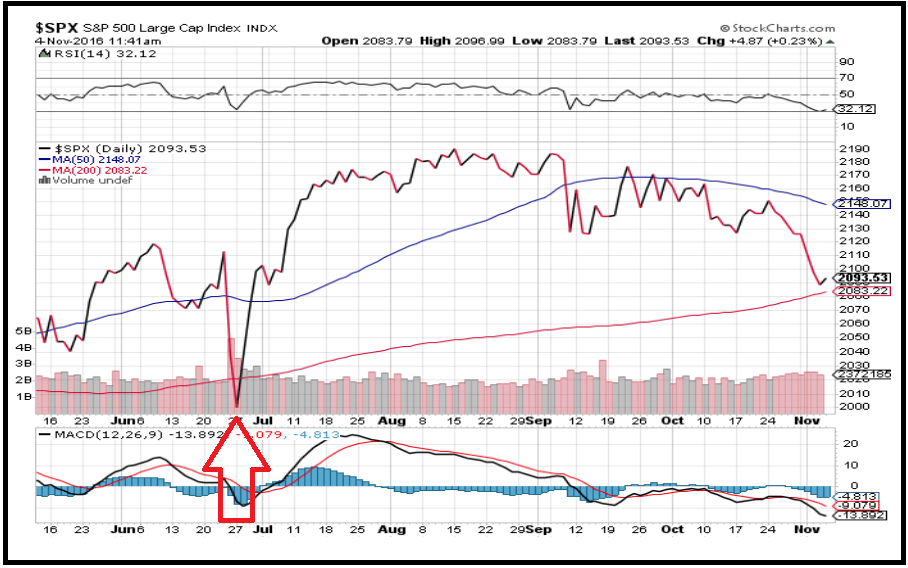

2) Looking for an entrance: Perhaps the most relevant, recent comparison to the uncertainty we are facing with this election, is the United Kingdom Referendum on participation with the European Union that we witnessed this summer. The market response from “Brexit” was not a positive one for equity investors… or was it? The following chart shows the sharp drop the S&P took in the days after the vote. Not surprisingly, it was temporary, with the market recovering quickly. Savvy investors took advantage of the dip and have been rewarded. Should we see similar results next week, we will be ready.

3) Staying Vigilant: Perhaps the worst part of election season, earnings season or generally any season that brings about market movements are the political and financial Nostradamus’ who saw it coming. Please understand, these people have essentially spent the last 12 months proclaiming 2+3=7, and it just so happened to work in their favor. Neither the election, nor the stock market are an exact science. It is critical we remember this moving forward, as there will undoubtedly remain the gurus and the know-it-alls spewing noise in attempt to throw us off course.

Keep these three principles in mind, and you are sure to have investment success moving forward. Also, regardless of political values or beliefs, make sure your voice is heard by voting this election. The future of our great nation is riding on the outcome.