We regularly receive this question from clients: Between HSA’s, Traditional & Roth 401k’s and IRA’s – which is the best type of account to build wealth?

Answer: In most cases, the HSA is your best bet assuming you’ve already maximized employer 401k matching.

Often, the difference is dramatic. Don’t believe me? Read on…

The HSA Missed Opportunity

In this article, I am going to compare the HSA, the Traditional 401k, and the Roth 401k. This comparison ultimately comes down to taxes. Each of these is taxed differently. This can result in a massive variance in outcomes, especially when you consider the effects over long periods of time. There is of course investment return, however, all three of these choices typically come with a range of investment choices that will be similar – and in some cases identical.

HSA Clarification

Most people use HSA’s like a savings account for short term health care costs. They fund it at the level they expect to use in the short term and stop there. Maybe they add and subtract a few thousand per year, never really letting the balance grow. It is after all, a health SAVINGS account.

To clarify, the Health Savings Account “HSA” does not require that you use the balance every year. It doesn’t have to be a savings account. Most HSA’s have investment options just like your 401k. As a result, it’s totally fair game to use your HSA for long term wealth building instead of short term health care savings.

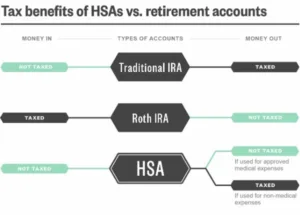

Summary of Tax Differences

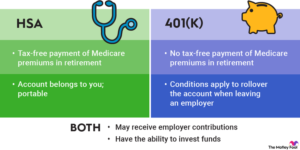

HSA contributions are pre-tax (like a traditional 401k) for everyone that’s eligible. And, in some cases, when you have a cafeteria plan through work, they are also pre-FICA tax (401k’s are not pre-FICA). The balance that builds in an HSA is not taxed as it grows. And HSA distributions used for qualified healthcare expenses are tax-free. After age 65, HSA distributions used for anything besides qualified healthcare expenses are taxed as ordinary income (similarly to an IRA).

Roth 401k and Roth IRA contributions are made with after-tax dollars. Growth is not taxed. Distributions are tax-free and avoid penalty if you take them after age 59.5 or qualify for one of several exemptions.

Traditional 401k or tax-deductible IRA contributions are tax-free going in. Growth is not taxed. Distributions are taxed at ordinary income and penalty-free if you take them after age 59.5 or qualify for one of several exemptions. You can click each of these to find more details from the IRS on the taxation of HSA’s, 401k’s, and IRA’s.

The People’s Choice

As you can see in the infographic, the research from the Employee Benefit Research Institute “ERBI” indicates people overwhelmingly favor IRA’s over HSA’s. Of the HSA accounts with contributions in 2013, 15 percent were maximized. Of the IRA and Roth IRA accounts with contributions in 2013, 41.8 percent were maximized. Although this was based upon 2013 data, my suspicion is that not much has changed. You might think that this would indicate that IRA’s provide more value to people that HSA’s… but actually, it’s the opposite. Are you one of the many people missing the HSA opportunity?

What Does The Math Say

I decided to run some numbers to see how the HSA would compare to the Roth IRA/401k and the Traditional IRA/401k. You can see the summary in the chart below. This shows the projected 40 year annual distributions for the various scenarios (more is better!). You can see more details on the assumptions I used at the bottom of this post.

As I suspected, the HSA kicks major butt! In one of the more likely scenarios, which you can see in bold italics below, the HSA results in over $3.6 million of total distributions (or over $4.1 million if you spend 100% on qualified health care). The Traditional 401k comes in just over $2.9 million. While the Roth 401k ends up just over $2.5 million.

Basically, most people should be maximizing HSA’s before Roth and Traditional IRA’s and 401k’s. Especially those with HSA’s offered through their employer’s cafeteria plan (pre-FICA). And those that expect to have considerable health care expenses at older ages. There are always exceptions, like maximizing employer matching within a 401k, and those noted in the chart above. But they are few and far between. Yet, people still overwhelmingly opt for the Roth or Traditional IRA over the HSA for wealth building.

My only guess is that people aren’t maximizing HSA’s because they still consider them to be a short term savings account that they must use for health care. They haven’t shifted their thought process to consider that HSA’s might also be a great wealth building tool. If you have any thoughts on why so many people are failing to take advantage of HSA’s, please comment below. Or, if you’re not clear on the advantage of the HSA or have a scenario you feel may be another exception we haven’t considered, please let us know!

My Assumptions For The Projection

Skip this part if you only care about the big picture.

I assumed that this was a young family that was eligible for an HSA, 401k and Roth 401k. And that if they used the HSA (or the 401k), they did not spend any of it during the contribution phase. I also assumed the rate of return on all the accounts was 8% during the contribution phase. The contribution period was 40 years and the distribution period was also 40 years (age 25 to 65 as contributions and age 66 to 106 as distributions).

I assumed the marginal income tax rate during the contribution period was 35% and FICA was 7.65%. This family does not go above the social security maximum contribution, therefore, pre-FICA marginal adjustments result in a 7.65% change. Also, I took the balance at the end of the contribution period and assumed it was annuitized for the next 40 years at a 5% rate of return. I considered 25%, 35% and 45% marginal income tax rates during the distribution phase. I looked at the following scenarios – all of which assume this family has exactly $6,750/yr gross income available to save…

Scenario 1 – HSA maximized and avoids FICA tax – $6,750/yr

Scenario 2 – HSA maximized but does not avoid FICA tax – $6,234/yr

Scenario 3 – Roth 401k used instead and contributions are $4,052/yr

Scenario 4 – Traditional 401k used instead and contributions are $6,234/yr