Creating wealth is easier said than done. Save before you spend. Pay in cash. Spend less than you earn. Pay your debts asap. While these are all good points, marking them off your financial goals list is not as easy as it seems on the surface. The challenge is in application and execution. There is no “get rich quick” tip – building wealth is a process.

In working with physicians over the years, we’ve had the opportunity to observe common practices and habits among them, and determine which tend to yield the most favorable results. Let’s take a look at some of our findings:

1. Have Control Over Their Money

They keep score. You’ll never know if you’re winning or losing if you aren’t keeping score. Do you know where your cash is going each month? Look at your cash flow like it’s your heart monitor – it will tell you whether or not your cash flow trends are healthy. Look at your cash at the beginning of the month and again at the end of the month. Where did everything in between go? Did you spend more than you thought? Or more than you should have?

If you’re not already tracking your cash flow, try using our system. The idea is to get an understanding of where your money goes each month. This video explains how the system works and how you can use it.

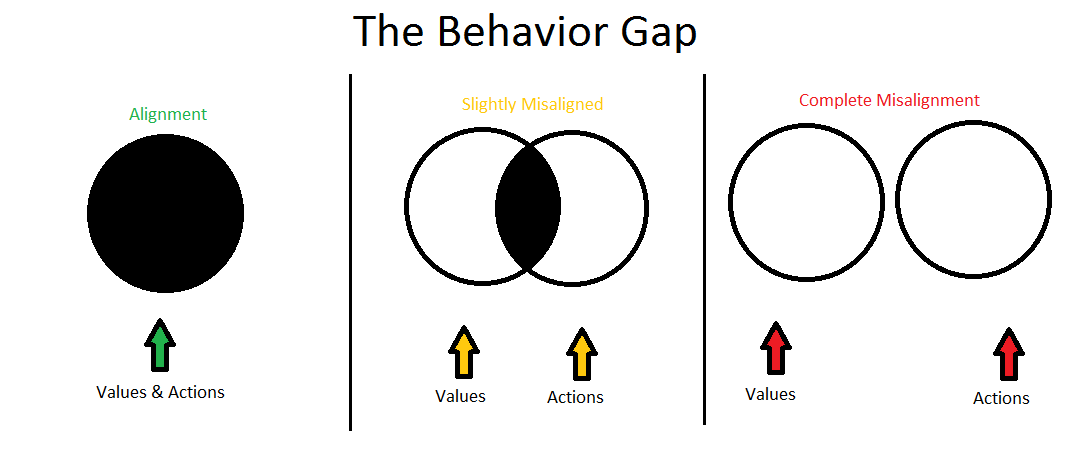

Their values and actions are in alignment, meaning they are clear on what they VALUE and their ACTIONS support those values. Do you VALUE being able to spend time with your family? What ACTIONS are you taking to allow for this? Use your cash flow as a tool to help you achieve your values through your actions. If your values and actions start to drift apart, like in the image below, acknowledge the problem and take time to adjust.

2. Proactive Risk Management

They regularly identify financial risks and address them with plans and action steps. Take a minute to identify your own – what exposures do you have to unfavorable circumstances? If you were to pass away unexpectedly, if you were to become disabled, if you were to be sued, if your house were to catch fire… how will that be handled? Do you have products/policies in place to insure against them, or have you accumulated enough assets to self-insure? If not, make this a priority.

They also understand that cash is risk management tool. What would happen if you lost your job tomorrow? Do you have an emergency fund you can access without penalty? If not, this also needs to be a priority.

3. Efficient Asset & Debt Management

The majority of us have some sort of debt. But the wealthy physician is constantly monitoring accounts and opportunities to make sure they have the most efficient interest rates and terms on loans. And when an inefficiency is identified, they refinance or adjust accordingly & quickly to better their position.

They have a debt pay down plan that includes a priority order. They attack debt piece by piece – starting with the most costly. Furthermore, they make sure to maximize loan forgiveness when possible and avoid loan forbearance in residency like the plague.

They have an efficient investment philosophy. They use passive funds with low expenses and maintain a proper asset allocation. They rebalance regularly, maintain discipline in down markets, and understand difference in risk/reward vs. gambling

4. Have a Process For Addressing Blindspots

Everyone has behavioral blindspots – the problem is when someone is not coachable to that fact. What can someone do to change this? Be open to feedback from others who can help identify potential trouble issues.

Here are some common examples….

- Spending problems

- Not considering the worst case scenario (it will all work out)

- Falling for “get rich quick” or “too good to be true” deals

- Buying into scams or pyramid schemes

- Buying the million dollar home during the 1st year in practice

- Working with bad advisors

- Poor money communication habits with a spouse or partner

- Failing to plan in general

5. Appreciate The Value of Time

The wealthy physician understands that time is more valuable than money. They know how much their time is worth per hour (both professionally and personally), and they are able and willing to outsource tasks to help them maximize the value of their time.

Further, they understand that building wealth takes time. It takes patience, diligence, and teamwork.

“Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.” – Einstein

6. Forget The Ego

55% of physicians claim to have never made an investment mistake according to the 2015 Medscape Physician Debt & Net Worth Survey. The wealthy physicians knows everybody makes mistakes, no matter how smart they are. Therefore, they interpret this Medscape statistic differently than most – they see it as 55% may have some ego issues and aren’t willing to admit to their mistakes.

The wealthy physician realizes that they don’t know everything. They identify and acknowledge their weaknesses and hire experts to assist in areas in which they are lacking.

7. Follow A Plan

Most importantly, the wealthy physician has a plan for accomplishing short term, mid term and long term goals – and they follow it. Their goals are reasonable, obtainable, and in alignment with their values. When a goal is achieved, they celebrate the victory – even the small victories. And when a goal is missed, they work to determine why and find a way to fix it going forward.

As you can see, even among physicians, there are no tricks or gimmicks. It’s all about forming constructive habits & behaviors, planning ahead, and being self-aware. It’s just as important to be aware of your weaknesses as it is your strengths. Focus on your strengths and enlist the help of other professionals to help with weaknesses. Develop a strong support system – your spouse, your family members, your advisors – and make sure everyone is on the same team and working toward the same goals.