In 2014, there were approximately 123 million households in the US. This means that for every one household, the government collected over $49,000 in total taxes. I don’t know about you, but that’s WAY more than I expected. As a naturally curious person, I wanted to know more.

Did you know that in 2014, income taxes accounted for only 34% of total US government tax collections ($2.1 trillion $6.1 trillion)? Where did the remaining 66% ($4 trillion) come from?

This especially alarming for physicians if you consider that 97.2% of all income taxes are paid by the top half of income earners. Odds are your household is paying much more than an evenly distributed $49,000 share of taxes. So, how can you find out how much tax you’re really paying?

The Truth Behind Taxes

Initially, my plan was to figure out exactly how much I had contributed to the government’s tax collection. I started my research by reading on the internet and digging into my own tax records. Income taxes were simple. The issue began as I attempted to quantify my share of all the other non-income taxes. How do I quantify how much more I paid for goods and services as a result of companies passing through taxes? After some wheel spinning, I realized it would be nearly impossible to figure out my exact contribution. Lack of transparency is primarily to blame. It’s nearly impossible for me, a financial planner who’s familiar with taxes, to figure out how much total tax I paid. Sad!

So what are these hidden taxes I speak of? Unfortunately, the list is long. I’ll focus on 5 of the most alarming hidden taxes.

1. Corporate Income Taxes

The US government has, for many years, taxed corporations. In 2014, our government collected over $1.1 Trillion in corporate income tax. But what’s the purpose of a corporation? They exist to provide people with products and services, jobs, and profits. And additional corporate taxes will always result in one of the following occurring:

1) Increased customer prices

2) Reduced stockholder payments

3) Reduced employee compensation and capital investment

All three of these options result in Americans indirectly footing the corporate tax bill.

It gets even more complicated when you start drilling down into the details. How can you tell exactly how the taxes are passed through? Maybe it’s always passed through to owners and you’ll never see any of it. But maybe it’s not. And that’s crux of the issue. Nobody really knows.

What if every company in America was a pass-through business? Pass-through business income is taxed on the business owner’s individual tax return. Pass-through businesses currently employ more than 50 percent of the private sector workforce. If every business became a pass-through, it would eliminate corporate income tax and force companies to pass-through everything to owners, employees or customers (which they already do, but it’s opaque).

2. Employer Payroll and Wage Taxes

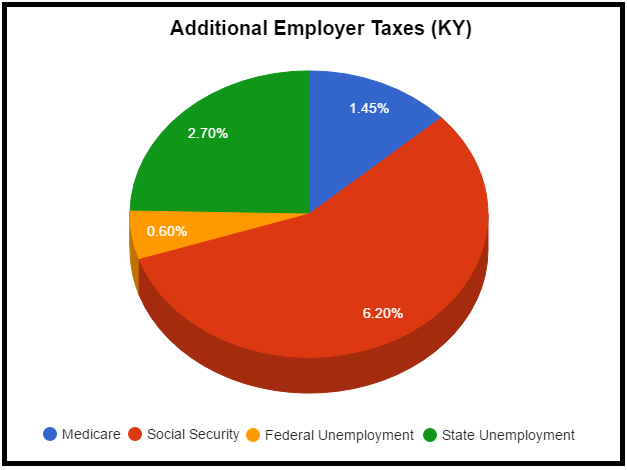

Employers must pay the following taxes for employees… none of which never show up their pay stub.

1) Medicare

2) Social Security

3) Federal Unemployment

4) State Unemployment

For example, an employer in Kentucky will pay the following rates for each:

– Medicare – 1.45%

– Social Security – 6.2%

– Federal Unemployment – 0.6% (normal net tax)

– State Unemployment – 2.7% (standard new employee rate)

This totals 10.95% in wage taxes. So let’s assume you own a small practice and are considering hiring a new physician. If the maximum salary you can afford is $200,000, you’ll only be able to offer them a salary of $180,261. The remaining $19,739 must be budgeted for wage taxes. Similarly to corporate income taxes, businesses simply pass taxes back down to the people involved. It might fall on the shoulders of the new hire, the owners or the patients. But either way, somebody pays it.

What if an employer was required to withhold these taxes from employee wages just like federal income taxes or employee social security? Or even better, what if it was all wrapped into income taxes as one simple line item? It would not affect employee take home wages. It would increase transparency and simplify tax reporting. People would likely be shocked at how much they really pay and demand answers from politicians about why taxes are so high. Who could argue with this outcome (besides politicians)?

3. Insurance Premium Taxes

Insurance premium taxes are like an insurance company’s version of corporate income taxes. Except, unlike corporate income taxes, insurance premium taxes are charged as a percentage of total premiums collected. Insurance premium taxes are often, but not always, fully disclosed to the customer. For example, if you buy an annuity in Nevada, it’ll cost 3.5% more as a result of the state’s premium tax. Nevada allows insurers to pass this cost through to customers (formally) and therefore it’ll show up on illustrations as a line item expense.

Here are several of the findings from the 2014 NCLS Task Force on State and Local Taxation:

- All states (except Oregon and DC) charge insurance companies taxes on instate premiums collected.

- Local governments also charge premium taxes in five states.

- Premium taxes are intended to be imposed in lieu of corporate income taxes.

- Premium tax rates range from 0.5% to 4.35% and average slightly below 2%.

When it’s disclosed, the insurance premium tax is less hidden than corporate income tax. At least people can find out what they pay. When it’s not disclosed, it’s basically just like corporate income taxes. Either way, it’s always passed down to the people in one form or another.

4. Fuel Taxes

When you fill up your car with fuel, you might think the price of gas is what the pump tells you it is. Say it’s $2.00 per gallon for gasoline and $2.25 for diesel. What most people don’t know is that 68.7 cents per gallon of gasoline and 89.5 cents per gallon of diesel goes toward state and federal gas taxes.

Let’s say you’re a resident physician working in Pennsylvania. Your family and girlfriend live in North Carolina so you’re constantly on the road when you’re not working. In an average month, you think you’re spending $500 on gasoline. But, in reality, you’re spending $328.25 on gasoline and $171.75 on hidden taxes. That’s a major tax hit – especially for lower income earners. You can see how much these taxes are in your state using this resource from API.

5. Sin Taxes

Alaska charges hidden taxes of $2.00 per pack of cigarettes, $12.80 per gallon of liquor, $2.50 per gallon of wine, and $1.07 per gallon of beer. The publicized idea behind these taxes is to discourage consumption of harmful products. Which do you think a lifetime Marlboro smoker hates more – taxes or Marlboro? Obviously taxes! If discouraging behavior is the intent, why not disclose taxes?

What if collecting more taxes was the intent? That would make more sense. Let’s add a hidden tax to something people are addicted to, market it as taxing bad companies, and watch the money roll in. As it stands now, the government loses money when people quit using such products. That seems like a pretty major conflict if you ask me.

Tax Transparency

For the record, this is not at all a political statement. I’m not against taxes. It’s a necessary part of running a country. What I am against is the lack of transparency. I believe US taxpayers should have a right to understand how much tax they pay. This creates a more informed population and increases our government’s accountability.

Were you aware that income taxes were less than 50% of tax collections? Do you know of any legitimate arguments against increasing transparency in our tax system? What can we do to improve transparency in our tax system?