Building wealth is simple: make more than you spend and invest the difference.

There are two ways to increase your savings rate: spend less or make more. There are also two ways to earn more income: work more hours or earn more per hour. Many of you already spend enough time working, so let’s start by talking about how you might go about increasing your hourly rate.

What’s Your Hourly Rate?

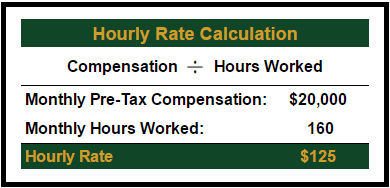

No matter how you’re compensated, everybody has an hourly rate. Knowing this rate can help you make better financial and professional decisions. Take your total pre-tax compensation (income before anything is taken out) and divide it by the number of hours you typically work. The resulting dollar value is your hourly rate for the period. Here’s a quick example:

Negotiate More Income Per Hour

Build your case before asking for a pay increase. Start by learning about the market pay rates. Find out how much your colleagues are paid. Check salary studies for your area and specialty. Learn the going rate for locums in your area.

Once you’ve built a compelling case, meet with the decision maker and confidently share what you’ve found. And make the ask. If they say no, ask them what you can do for the practice to make it happen.

Also, be cautious with new job responsibilities. Your employer may agree to your request in exchange for you taking on more job responsibility. That’s not what you were asking for initially, so take some time before saying yes.

This doesn’t have to be purely tied to your primary job. Maybe you’re an emergency room physician who works extra shifts from time to time, and in your market research you determine your employer pays locums far more per hour than your typical overtime shift rate. Knowing this, you now have the opportunity to begin asking for a higher rate on overtime shifts – especially those that are last minute.

Change Your Hours

Look at the hours you’re working. Identify what your hourly rate is for the different hours/tasks you’re performing. Work on cutting the low rate work and increasing the high rate work. For example, you might give up your management role that pays a lesser amount, and instead moonlight more for a higher rate.

Or maybe you can negotiate for less contracted shifts and agree to working more overtime shifts, since you now know those pay rates can be higher.

Outsource Jobs And Work More

Take some time to make a list of all the unpaid work you do, and estimate the time you spend on each task. Next, find out how much it would cost someone else to perform these services. What is the opportunity cost of doing this work yourself vs. working more in your profession and outsourcing the unpaid work?

Consider, for example, yard work – many of us are faced with this time-consuming chore. Let’s say you take 5 hours each month to mow, trim & fertilize your yard – plus the cost of equipment (let’s say $50). On the other hand, your hourly rate as a physician is $200. Doing this yourself essentially costs you $1,050 per month ($200 per hour x 5 hours + $50).

On the other hand, your research shows you can hire the best lawn care company in the area for $300 per month. This saves you $750 per month when you compare it to the opportunity cost of your potential earnings. On top of that, they do a better job than you. And you enjoy your work more than mowing. It’s really a win-win situation.

Then the final (and most important) step is to make sure you actually save the increased cash flow. Set up an automatic savings program so you don’t get used to having the extra money in your bank account. And as always, we would love to hear how our tips worked for you, and how your hourly rate negotiations worked! Please share your experiences!