Can you guess the #1 cause of stress for Americans? You got it – money. According to the American Psychological Association “APA” 2014 Stress in America survey, 72% of adults report feeling stressed about money at least some of the time. So why are all these people stressing about money? Isn’t America one of the wealthiest countries in the world?

Society’s Solutions to Money Stress

- Save More – Trick yourself into saving; you’ll just spend the remainder. Just like taking the new diet pill allows you to skip the gym.

- Make More – More income will solve your problems – work harder! Similarly, taking steroids will make your muscles grow faster.

- Spend Less – Cut expenses, become extremely frugal, and hoard money. Like skipping meals helps you cut weight.

So what’s missing here? None of these solutions consider your values! As Einstein said, “Try not to become a man of success, but a man of value.”

Values and Actions

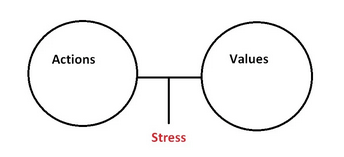

Money stress is an alignment issue – values are not aligned with actions.

Values = the things most important to you

Actions = how you spend your time and resources

Here are some symptoms to look out for to help identify if you are out of alignment:

- Retirement is very important and stresses you out because you don’t think you are saving enough. You also have the NFL Cable package.

- You have everything you need and save plenty for retirement & your children’s education, yet you still stress about money. Your solution is to drive harder to make more and it doesn’t ever work.

- That rent payment is killing you. You have two nice cars, cable TV, new clothes and the iPhone 6+.

- The potential for unexpected expenses stresses you out because you live paycheck to paycheck – job loss could cause you to lose your home. You are about to go on vacation with friends.

- Its frustrating that you cannot afford books for your children, however, you buy junk food at the gas station.

As it turns out, your money stress is probably not actually about money. It’s about your actions (how you handle your money) in relation to your values. So what can you do to improve?

TIME TO TAKE CONTROL!

1) Identify Your Values

Take some time (schedule it if you’re really busy) to do some planning. If married, always include your spouse. Take 30 minutes – no distractions allowed – and brainstorm what’s most important to you.

Here are several questions to get you started…

- * What’s most important to you? Why?

- * What motivates you?

- * What is your vision for your future?

- * How can you improve today?

- * What changes can help you become more like the person you want to be?

- * Fast forward five years from now – you are reviewing your progress over the five years past – what has to have happened financially, professionally and personally for you to be excited about your progress?

Your answers to these questions (and others you come up with) will help you begin to identify your values. Write them down and use them as motivation. Schedule 2x per year (literally put it on the calendar!) to review and adjust these.

2) Less is More

The average American’s personal finances are WAY too complicated. They have 2 checking accounts, 3 credit cards, 3 savings accounts and a money market account. Take it easy on yourself! There is a reason most people felt more in control of their money in college – it was incredibly simple. Time to clean out the closet!

Limit 100% of cash flow to one checking account (joint if you are married) and one savings account. You are not allowed to use any other accounts (including credit cards) – all income and expenses must flow through this one, single account. All the excuses (credit points, forced savings, auto debit, etc) are not worth the trade off that this simplicity will provide. Your spouse must be involved in this plan!

3) Take Action

Schedule time once per month to go through the process of taking inventory and identifying improvement opportunities (ideally at the beginning of each month) .

Most people lose motivation when they realize it’s a pain in the butt to keep up with.. but you won’t have to worry about this problem because you simplified your accounts – a fourth grader could keep up with 1 checking account. Plus, it take far less TIME to keep up with one account – and time is more valuable than money..a and credit card reward points.

Before you get started, no online account aggregators are allowed when using this system. We are looking for action and progress and the best route is to go old school. I’ll bet your grandmother has complete control over her money – and that’s because she balances a checkbook for her one checking account.

Monthly Meeting

In preparation for your monthly meeting, you can create an excel spreadsheet or paper journal to log your results each month. And, lucky for you, we already have cash flow management spreadsheets created for this exact purpose – no need to re-create the wheel if you don’t want to! You can access our spreadsheets here – just click “download now” at the top of the page (they’re free, of course).

This exercise works well because it’s incredibly simple. So simple that everyone can knock it out in 15-30 min per month once you get the hang of it. It also forces you to balance the budget or run your finances like a business. Involving a spouse adds excellent accountability. After completing this exercise for several months, you will begin to feel more in control of your money. This is absolutely the most important skill in regards to managing your personal finances. It’s a great solution to America’s chronic money stress issues.

So.. in summary.. if you’re really serious about improving, take action. Schedule time on your calendar now to go through your first financial review. And please share your experience – let us know how it’s going and if the system is working well for you!