So, Brexit was big news! Everyone thought it would crush investments. And it did for a couple days. But investments fully recovered a few weeks later. So much for the stock market crash.

But you probably missed the other big Brexit news (big in my book)… Mortgage rates dropped again, and they haven’t recovered yet. If you have a mortgage, pay attention. Now is a great time to consider refinance. Thank you, Brexit! So let’s talk mortgage refinance. I’ll cover the following:

- When To Avoid Refinance

- Finding Refinance Quotes

- All-in Loan Costs

- Running The Numbers

- Comparing Options

- Good Debt vs. Bad Debt

When To Avoid Refinance

Some of you may already be good to go. If you’re not sure, here’s how to verify. Look up current refinance rates online. Zillow provides updated rates on various types of mortgages here.

Determine your scheduled pay off date. For example, if you took out a 30-year mortgage one year ago and make the minimum payments, it’s simple – you have 29 years left. Or, if you overpay your mortgage, run an amortization calculator to determine how long your payoff will take.

Then, compare your interest rate to the current rates being offered for similar types of mortgages (15 year/15 year, 30 year/30 year, etc). If your current rate is equal to or lower than marketed rates, refinance is likely not for you. Typically, advertised rates are the best possible outcome.

There are some exceptions to this rule. For example, if your rate is competitive but you pay PMI (mortgage insurance) AND you have 20% or more equity, you may still benefit from refinance. Or maybe you have a 30 year mortgage but have zero intention of staying in the home for more than a couple years, the 5-year ARM rates could be a much better comparison when considering refinance.

Finding Refinance Quotes

If your rate check shows that there’s potential for improvement, the next step is looking at actual proposals.

Tip: If you don’t know your credit score, run it yourself before starting this process. Lenders want to know your score so their quotes are accurate. If you initiate the process without knowing your score, they’ll encourage you to let them run it. However, if you allow 3 lenders to run your credit, it’ll pull your credit score down a bit. Instead, check your credit yourself (which doesn’t ding your credit) and share your score with the proposed lenders. This should be enough info for them to run a good quote. Eventually they’ll have to run your credit, however, it’s best if you can delay this until you’ve confidently locked into the best refinance option. Here are a few free resources to check your credit: Quizzle, Credit Karma & Annual Credit Report.

You’ll want to identify 2-3 quality lenders that are likely to provide competitive mortgage offers. If you work with a financial planner, they should be able to help facilitate this process. Reach out to each lender and request a proposal for refinance. The proposal should include information on estimated closing costs, interest rate, monthly payment and other details.

When reaching out to lenders, expect pressure to get the process started with them. After all, their job is to close these deals. It’s better to avoid this early on. Definitely don’t sign anything, let them run your credit or spend too much time with any one lender until you’ve decided on the best option. It’s not worth wasting everyone’s time. Instead, shoot ‘em straight. Tell them up front that you’re talking with multiple lenders and aren’t sure which one you’ll choose. Most people will respect this and not want to waste time either.

Now, we all have several buddies selling mortgages – I’m sure a few names have already come to mind. You might be thinking – “why not throw them a bone… it’s a win-win right?” Well, maybe. But it could also cost you thousands if you end up going with the wrong lender. If you’re set on working with a buddy, though, I suggest at least trying this strategy. Go to several referred lenders first and get their offers. Bring the offers to your buddy. Then it’s just a matter of comparing options – it makes it an objective decision. If they can provide a better deal, great! If not, it shouldn’t be a big deal.

The goal should be to have at least three solid mortgage refinance proposals to compare. This will increase the chances of you getting a solid deal. We review these all the time for clients. The spread in offers is normally thousands to tens of thousands of dollars. Trust me, it’s absolutely worth comparing multiple lenders!

All-in Loan Costs

There are several important types of pure costs you’ll pay with mortgages. Here are the loan costs we’ll cover:

- Interest Expense

- Private Mortgage Insurance (PMI)

- Closing Costs

Interest expense is the cost you pay to borrow money from a lender. If you’re looking to get an estimate of expected interest on your mortgage, take the amount owed and multiply it by the interest rate. Then divide that number by twelve to find how much of your current monthly payment is interest.

If a portion of your monthly payment is going toward paying down the debt (principal), this interest number will go down each month because your total amount owed will be less. An amortization schedule shows future principal and interest payments to give you an idea of how this will all shake out.

PMI is the annoying monthly fee commonly required when you don’t have at least 20% equity in your home. If PMI is in play with your potential refinance, it must also be considered as a pure cost. The terms and conditions will vary with different lenders, so make sure to ask specifically what’s required to drop PMI. This will help you project costs going forward.

Closing costs consist of four types of costs:

1) Loan Costs

2) Prepaid Interest

3) Initial Escrow

4) Lender Credits/Debits

Loan costs are the pure transactional costs required to close the deal. They consist of things like appraisal fees, credit checks, and application fees.

Prepaid interest covers the interest expense due on the debt from the time you close to the time you make your first payment. You know how they always say by refinancing, you get to skip a payment or two? Well, that’s only halfway true. You get to skip the principal payment but not the interest – sneaky right?

Initial escrow is the amount you must pay to beef up your new escrow account. Escrow accounts pay your insurance premiums and property taxes each year. This should not be considered in the refinance decision. It’s a cost that should be the same whether you refinance or not.

Lender credits and debits give you the option to either buy lower rates (lender debits) or get credit for higher rates (lender credits). Here’s an example – we’ll use the same $250,000 refinance scenario (no PMI) to show you how lender credits/debits vary. Lender XYZ is offering you three options as follows:

1) 3.25% Interest Rate, $1,500 Lender Credit

2) 3.125% Interest Rate, $0 Lender Credit

3) 3% Interest Rate, $1,500 Lender Fee (Debit)

Running The Numbers

Before I get into the numbers I wanted to clarify something: it’s not all about lowering your monthly payment! This is particularly true if you’re extending the time it’ll take to pay off the loan. The mortgage industry loves to sell the whole “payment reduction” idea. Check out Realtor.com’s refinance calculator. If you took out a 30-year mortgage for $300k in Jan 2008 at 4.5% (and you owe $251,024 as of this writing), and you’re considering refinancing into a new 30-year mortgage at 3.5% with $3,000 closing costs, you might think that’s going to be a home run. Run the realtor.com calculator and their bolded result shows monthly savings of $393. That’s pretty sweet, right?

Not so fast. If you look closer, you’ll also see lifetime savings shows -$16,560. Basically, the refinance loan with a 1% lower rate will actually end up costing you over $16K more than the old loan its lifetime. The problem is that you’re adding 8+ years to your term. That’s 8 more years of paying interest. Here’s a quick fix: at worst, keep your new monthly payment equal to your old payment so you’re not losing any ground.

So start by running the numbers on your current loan. Figure out how much interest will be paid in the short and long term assuming you leave it as-is. You can normally pull up your custom amortization schedule using your lender’s online access (note that this doesn’t take into consideration any additional payments toward principal made in the future).

Tip: Hang onto your mortgage amortization schedule if you don’t end up refinancing. If you do refinance, hang onto the new amortization schedule. It can come in handy if you consider refinancing again. Also it makes tracking your net worth much easier which we discussed in this earlier post.

Let’s stick with the $250K mortgage example at 4%. The loan has exactly 27 years remaining. If you run the amortization schedule (see below visual), you’ll find the following:

- Next month’s interest – $833.33

- Next 1 year cumulative interest – $9,904.41

- Next 3 years cumulative interest – $29,062.61

- Over 27 years, it’ll be $159,218.63 (ouch!)

If PMI is in play, add it to the interest expenses for as long as you’re required to pay it. The combined interest and PMI will be your total loan costs.

Next you’ll want to dig into the refinance quotes. There are three components to consider:

1) Transaction Costs – Total closing costs minus prepaid interest and initial escrow

2) Time Costs – Total time you’ll spend multiplied by the value of your time per hour (if you don’t know the value of your time per hour, use your salary divided by 2000)

3) Ongoing Costs – Total interest (from amortization), PMI and prepaid interest

Tip: Don’t limit yourself to choosing between the 30 year or 15 year mortgage. Most lenders allow you to request custom repayment periods (like 24 years) so that you can keep your principal and interest payments similar to before and gain ground on your mortgage. Ongoing costs depend upon how you structure the new loan. If you keep payments the same, it also provides a solid apples to apples comparison to consider.

Comparing Options

When you’re comparing refinance offers to your current mortgage, you’ll want to look at the total loan costs for each option. Compare each loan’s costs and determine how you’ll fare over various periods of time. If transaction costs are involved, you’ll want to figure how long it will take to recover those costs and be better off (breakeven analysis).

When you compare the three options above to the existing mortgage, it becomes obvious you’ll actually be better off refinancing in all three scenarios. But then which option is the best? Some might say Option 2 because it has the lowest interest rate. Or maybe Option 3 because there aren’t any closing costs. But the best answer really depends on your time horizon.

If you’re expecting to live in the home for less than 91 months, Option 3 provides the lowest costs. But then in the 91st month, Option 1 takes the lead. Although Option 2 would eventually be a better deal than the current mortgage (after 51 months), it would never be the best deal.

Good Debt vs. Bad Debt

Many people believe mortgages fall under a category called “good debt.” The idea behind “good debt” is to always make the minimum payments because the interest rates are so low. Why make extra payments when you have other options that provide a better long-term bang for your buck or return on investment? If you look at long-term investment returns and compare them to your interest rate (net of taxes) on the mortgage, you’ll end up with more wealth investing. The math behind this is pretty straight-forward and something I agree with. However, there is always more to the story.

The first issue with this analysis is that it assumes when you opt for lower mortgage payments you ALWAYS invest the difference. In reality, most people don’t do that. At least not every single month. They end up spending some of it.

The second issue is that we’re comparing apples and oranges. Paying down your mortgage faster provides guaranteed ROI (in the form of interest avoidance) whereas investing is not at all guaranteed. You must take risks to provide better results. Also along those same lines, research says that your Average Joe investors consistently underperform the market by a large margin. People often fail to take this into consideration.

And finally, there are psychological benefits to owning your home free and clear that people don’t think about. Ask people who have paid off their mortgage how they feel about it. I’ve never heard one of these people talk about getting back into a mortgage so they can invest.

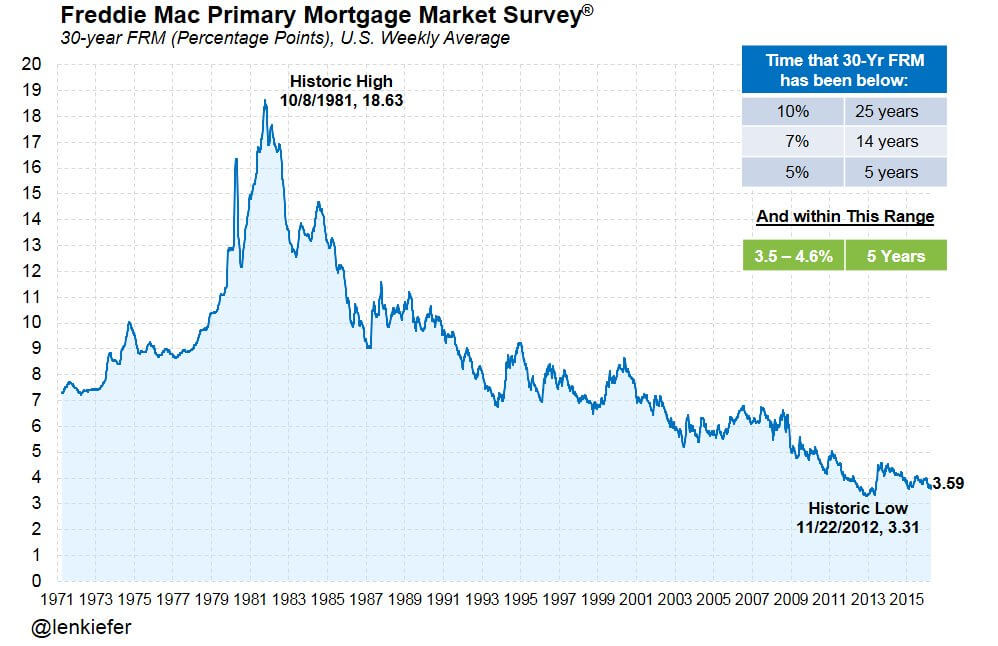

Over the past 20 years you can see all of this playing out. People started out 20 years ago with their 30-year mortgage. As rates dropped (see above historical visual of mortgage rates), people refinanced into new 30-year mortgages so they could lower their payments and get a better bang for their buck with other types of investments. But, in reality, they don’t invest and end up just spending the free cash flow.

After a few years, rates drop and they refinance again and pay all the new transaction costs again. They must have forgotten what happened the last time because somebody talks them into the exact same plan. They set up the 30-year with plans to invest the difference. And, like before, they end up spending the extra cash flow. Fast forward to today and they’re still in the early years of a 30 year mortgage. They’ve refinanced 5-7 times over the years. Who knows how much they’ve paid in transaction costs over the years. They haven’t made any forward progress on the debt, and they haven’t generated any additional wealth on the side as a result of having lower monthly payments.

Building wealth is hard enough as it is. Make it easier on yourself and quit overthinking these decisions. Set up your mortgage with the required payments that put you on track to pay it off as quickly as you’d like. When you refinance, don’t extend your payoff date. At worst, keep payments the same and shorten your term! Paying off your mortgage is a good thing. Ask someone you know that actually owns their home outright, and you’ll see what I mean.

Have questions or care to share your experience? Ask/share in the comments!