Doctor mortgage loans tend to get positioned as a no-lose product that you’d be crazy to pass on; all the benefits of traditional mortgages but without the big down payment and at no extra cost. Add in the special provisions designed specifically for doctors and you’ve got the swiss army knife of mortgage loans. Sound too good to be true?

Maybe. You have always wanted to own a home and it seems a doctor mortgage loan can make that dream a reality now. Odds are this is your first mortgage decision ever. Your busy schedule doesn’t leave you with much time to analyze the decision and most of your friends are going with the doctor mortgage loan so it can’t be that bad, right?

Hopefully, I’ve caught you before you’ve pulled the trigger. My hope is to share the downsides of the doctor mortgage loan that are often overlooked so that you can make an informed and confident decision. Doctor loans aren’t always bad. In fact, in many cases the product works well. But they also come with some baggage that you’ve probably not thought about. Here is our list of five of the biggest supposed benefits of the physician mortgage loan that are actually major downsides. These are all things everyone should understand before signing up for a physician mortgage loan: (for a more comprehensive view, make sure and check out our complete guide to physician mortgage loans)

1) Easy Doctor Mortgage Loan Approval

With doctor home loans, you can qualify for the home you love even before starting residency. They’re designed to make it so easy to buy. But is it too easy? Think about buying a car. Everyone knows that car dealers sell the monthly payment. Why? Because they want the decision to be as easy as possible for you to make. It’s much easier, psychologically, to make a decision to buy a car for $299/mo than it is to make a decision to buy a car for $35,000. Apple also figured this out a while back when they started selling iPhones via monthly payment plans with no interest. It’s a great way to sell a $700 phone to people that would never pay $700 for a phone.

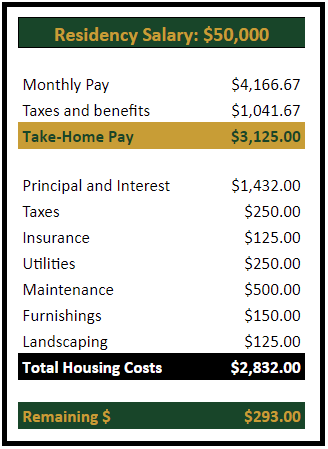

Home loans for physicians are the same way except they sell the monthly principal and interest payment. You can buy a $300K home for $1,432/mo (monthly principal and interest payment for a 30-year mortgage at a 4% fixed interest rate). $1,432/mo sounds doable. Maybe you’re already used to a $1,400/mo rent payment. Why not buy a home instead and start building equity, while also having a good tax deduction? But that’s not the full story. You have to consider all of the other expenses that come with owning a home: insurance, taxes, maintenance and repairs, utilities, landscaping, furnishings and association fees. Here is a breakdown of the all-in costs based on the $300K home example – assuming it’s a resident making a $50K/yr salary (FYI these numbers are long-term averages of the types of numbers we see with real clients owning homes).

So you’re left with $293 per month. That is barely enough to pay the mortgage, eat ramen noodles and ride your bike to work. There’s no room for transportation, entertainment or travel, and no chance of saving, buying insurance, or paying anything on student loans. This is what being house-poor looks like.

It’s important to understand how easy it is to get into this spot. Lenders will gladly qualify you for a doctor mortgage loan up to the level where your total debt payments approach 45% of your pre-tax income. If we look at the above example, the total debt obligation is $1,807 (includes home insurance and taxes). Divide this by the gross monthly salary ($1,807/$4,166.67) and you’ve got a DTI ratio of 43.37%. It may seem like this number is fine because you’re coming in under their “limits”. But you should realize their limits calculate the limit you can afford and still eat (barely). For most people, symptoms of being house poor show up when debt to income exceeds 35%. When you get up to 40-45%, it gets bad. It’s so easy to get into this spot if you’re not careful.

2) Zero Down Payment

I know it sounds appealing on the surface, but owning a home with zero equity (no down payment) is dangerous. In fact, if you put zero down, you’re actually starting out underwater (underwater = loan balance is higher than the home value) because you indirectly pay considerable transaction costs when you buy or sell a home. But maybe you’ve heard the pitch that housing prices in your area always go up and your home will be a great investment. People are quick to forget the recent past. Check out this historical chart showing the average sales price of US homes sold (notice how they go up AND down):

As you can see from this chart, not that long ago in 2008 and 2009, housing prices across the country dropped considerably in value. Specific regions dropped even more than the overall US. For example, California, Nevada and Florida saw the biggest declines in excess of 40%. And then certain cities saw even bigger drops. Las Vegas was one of the cities hit particularly hard. These quotes from the Las Vegas Review-Journal show how bad it was: “Existing homes lost more value than new ones. Of the roughly 3,000 existing homes bought in the peak month, the median loss was almost $190,000, or 65 percent. Of the almost 1,900 new homes bought in the peak month, the median loss was more like $182,000, or almost 60 percent.”

This statistic from a 2011 Business Insider article paints the picture well: “As of the end of 2010, 23.1 percent of all U.S. homeowners with a mortgage owed more on their homes than their homes were worth.” Another article written around the same time from Reuters, “Home Price Drops Exceed Great Depression: Zillow” (a 26% drop since their peak in 2006).

The housing market can and will go down. If this happens when you happen to be in the first few years of a doctor mortgage loan, you’re going to be in major financial trouble. It’s better to go into this decision understanding this risk.

Let’s look at the recent housing crisis example and use the $300k home example from above. Maybe you’re a med school grad who is starting a 5 year residency in 2006. At the end of residency, if you’re the average U.S. homeowner, your home price has dropped 26% and is now worth $222k. Maybe you’ve paid the mortgage down to around $270k. In order to sell the house, you’re looking at writing a check for around 48K – and that’s before you pay any transaction costs (like realtor commissions or closing costs).

If you happened to be the unlucky resident around the same time that bought in Vegas, your $300K home is now worth around $120K. Selling now requires writing a check for $150K. Obviously, this creates a major problem for the resident transitioning into practice in a new location.

3) Exclude Student Loans During The Doctor Mortgage Loan Underwriting

Doctor home loans allow you to qualify for a home mortgage without consideration of your massive future student loan payments looming. This is great if your sole goal is to own a home during residency. However, if you’re not careful, it’ll cost you tens of thousands on your student loans.

The average mortgage lender will always look at your student loans and want to consider the eventual payment when approving your mortgage. So, it can be tough to qualify for anything if you owe $400K in student loans. However, mortgage lenders have figured out how this all works. They know about the grace period and forbearance for medical residents. They know if they can get you in the home before the loans kick in (grace period), and if you make an uninformed decision and buy too much home (like the example in #1), you can always forbear the loans until you go into practice. Therefore, taking the loans off the table is a no risk decision for them. However, it can hurt you.

Here is what the scenario looks like. You’re graduating from med school, and your first priority is buying a home. So you look at doctor mortgage loans. In talking with a lender, you learn the max amount they’ll loan you is way higher than your price range. Mentally, this makes you feel better about buying in the price range you had initially intended. So you move forward. In getting formally approved, the lender instructs you to not mess with your student loans (which are in grace period) until the deal closes. You don’t think much of it; everything goes smoothly and you’re now in the new home and starting residency. However, what you didn’t realize was that there is absolutely no chance you’ll be able to make any student loan payments during residency with your newly established living expenses (most of which is the home). So you’re forced to forbear on your student loans until you go into practice. What’s the damage? The average medical school grad is throwing away $5-20K by going through grace period (instead of skipping it). They’re throwing away another $50-100K by forbearing during all of residency. A better way to do this would be to figure out the best plan for your student loans before you go down the mortgage path. Always structure your mortgage around the student loan repayment plan (as opposed to the reverse).

4) Doctor Mortgage Loan With No PMI

With most mortgages, if you don’t have at least 20% equity (or put 20% down at purchase), you’re required to pay private mortgage insurance “PMI”. This is a pure cost that can easily be several hundred per month. However, the doctor mortgage allows you to avoid PMI even though you start out with 0% equity. But what lenders don’t tell you is it’s typically not really the lowest interest rate option available. Doctor mortgage loans are normally 0.25% to 0.50% higher than the lowest rate 20% down alternative loan. The problem is most of these alternatives require 20% down. However there are some less common 0% down alternatives to consider that can sometimes have a lower interest. For example, the VA loan (especially if you’re disabled). Make sure and check out all your alternatives before proceeding with the loan.

5) Tax Deductible Interest

Medical residents could really use a tax deduction. Why not buy a home instead of renting so that you can begin to take advantage of the tax deductibility of mortgage interest now? This is another classic doctor mortgage loan selling point. But what you don’t hear is most residents won’t actually get any tax benefit from the mortgage deduction. They can put it on their return but odds are high they end up taking the standard deduction which is no different than if they hadn’t bought the house. This is especially true now with the new tax laws. Starting in 2018, the new standard deduction is $12,000 for single filers and $24,000 for married filing jointly. That’s a big increase from 2017 and basically makes it much less likely that the typical resident will see any tax benefit from paying mortgage interest.

Understanding Conflicts of Interest

Keep in mind that lenders are in business to make money. Your financial interests will always be secondary to their desire to close the deal. This is not to say that they’re bad people – not at all. In fact, most lenders we work with are nice, knowledgeable, and professional people. They’re very helpful in navigating the home buying process. But, remember who they work for. As much as they may tell you otherwise, they don’t work for you. They are sales people working to close deals for the lenders. So before you go down this path, remember this. You have to keep your own interests in mind or have an advisor like us keep an eye out for you. Otherwise, you could end up unknowingly making one of these classic doctor mortgage loan mistakes.