So you’re pre-qualified for the million dollar home, but should you buy it? I’m sure you’re not looking to become the next house poor physician, right? Yet, many physicians find themselves in this unfortunate position. Why? The most common reason is lack of awareness. Many physicians aren’t aware of what it looks like to be a house poor physician. They aren’t aware of how buying a home will affect their overall financial picture. And they aren’t aware of the major conflicts of interest that all real estate agents and mortgage salespeople have. If you’re feeling like this might be you, we’ve got you covered!

So what is a house poor physician? You’re house poor when your home expenses eat up all of your disposable income. You can afford the home, but just barely. Don’t expect to have the money to do other important things such as saving, giving, or traveling. If you’re not extremely frugal with your lifestyle, you may not even have enough to maintain the home. According to Investopedia, “house poor” is a situation that describes a person who spends a large portion of his or her total income on homeownership, including mortgage payments, property taxes, maintenance and utilities.

Physicians that are house poor are often surprised at how frugal they must be. They often feel like they’re not really making any money and there is barely enough to get by. Good luck furnishing the home or doing home improvements. That’s not going to fit into the budget.

If that doesn’t sound so bad to you, consider the fact that this scenario allows for absolutely zero margin. If something goes wrong or lifestyle creeps up, you can quickly get into big financial trouble. Having no margin equates to major job dependency and few options for dealing job risks like burnout or unexpected career changes. For more on why margin is so important, check out this Finance For Physicians podcast episode.

Lending Standards

Today, mortgage lenders are happy to lend money as long as your Debt to Income “DTI” ratio stays below about 40-45%. Your DTI ratio is your total required debt payments divided by your gross (pre-tax) income. This debt total includes all debts such as student loans, auto loans, credit cards and mortgages.

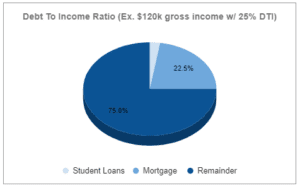

Here’s an example of a 25% debt to income ratio (at $120k gross income):

In this example with $120k gross income, $3k/yr goes to student loans and $27k/yr goes toward the mortgage. If you’re curious what $27k/yr buys you, as I’m writing this (~5% 30 yr fixed rates) it would be in the ballpark of $350k (this assumes 100% down and will vary sometimes considerably based on interest rates, property tax rates, insurance premiums, and your situation). This leaves $90k/yr for everything else in life. Is this a house poor physician? No. And that’s a great start. I’m sure you’re wondering if this is the right target for you or if maybe you can go higher. We’ll get to that in a second. But before we go there, let’s look at an example of what house poor looks like.

Becoming A House Poor Physician

With DTI ratio, the only considerations are income and debt payments. That should tell you something right there. It fails to consider other things like other home costs, home improvement, savings, giving, taxes, travel, and other spending. If you take out a mortgage that gets you to the max DTI, you’re going to be house poor. That’s why the lenders set this limit. House poor doesn’t mean you can’t afford the home. It means you can just barely by the skin of your teeth afford it.

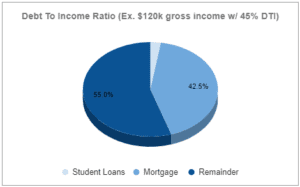

Let’s use the same $120k income example and assume this person is wanting to upgrade to a nicer home. Let’s call them Bobby and Sue. Bobby and Sue are in training and close to finishing up. They’ve just had their first child and they’re feeling the pressure to upgrade homes. They realize it’s going to be a stretch to afford the home they want, however they’re also not as worried about pushing it because they only have a couple years left of training. They end up taking out the max possible mortgage for their situation. Here is how this compares:

Everything in this scenario is the same as the first, except the mortgage increases to 42.5% (for a total 45% DTI when you add in the student loans). How much home does this get you using the same assumptions as above? Around $650K (same thing as above… this will depend heavily on interest rates, insurance, taxes and your situation).

I’m sure some of you are thinking you’re already used to living on the cheap. How bad can it be? Consider that living on the cheap in training when you’re single and renting a home is completely different than living on the cheap when you own a home and have a family. Homes are needy and more expensive that people think. Families are expensive too. I’m sure you have competing interests that are extremely important that you might be overlooking. Before you pull the trigger on this, consider how much it’s truly going to cost you all-in. Also think about where it’s going to come from. When you’re upgrading your home and you’re income stays constant, the money must come from somewhere. You need to know ahead of time how you’re going to make it work.

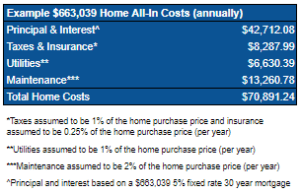

First thing to consider is all the other home costs. Nice homes cost a LOT to keep up. If you don’t believe me, talk to anyone that’s reasonably financial savvy that’s owned a home for a really long time. Either the live in a dump or they’ve had to spend a lot maintaining their home. Here are what those expenses might look like (keep in mind these are baseline expenses which include maintenance to keep the home in the current condition):

Some of you are thinking maintenance is way too high. If you don’t trust my word, experts suggest setting aside 2 – 4% of the value of the home just to keep it in good working order. And this is before any upgrades or expenses like security systems, lawn care, landscaping, or HOA fees. This is bare bones – get you in the house and keep it in the condition you bought it. Nothing more.

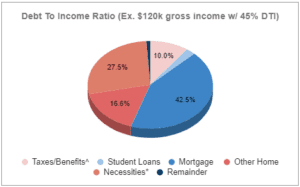

Let’s take a look at that $120k income scenario again and add in the all-in home costs above plus all the other baseline expenses like taxes, benefits, student loans, and baseline lifestyle necessities.

This leaves you a whopping $1,169 per year! That’s not much when you consider it’s all you have leftover for things like entertainment, dining out, travel, saving or giving. There is no margin for error either. In case you’re wondering where the necessities number came from, we used 150% of the poverty threshold for a family of 3 based on the 2021 US poverty guidelines for the contiguous states and DC. This is a house poor physician. And this is how lenders determine the maximum amount that they’ll loan you. It’s basically the most you could possibly handle and still be able to put food on the table (and that’s it).

The Not So Obvious House Poor Physician Example

There are different levels of house poor physicians. Let’s say a young physician is starting in practice at $250k/yr and is considering purchasing a $1mil home. They also have student loans and a car payment which totals $30k/yr. This would equate to a DTI of around 35%. You might think that’s fine and much better than the 45% max. However, when you carve out all the other baseline expenses, the leftover disposable income (before any extra expenses beyond owning the home + baseline necessities) is around $25k/yr. That’s not much considering it’s before any saving, investing, giving, travel and entertainment.

Maybe it’s not technically a house poor physician because there is some margin. But it’s not much, especially after all the hard work you put in getting to where you are today. I would consider this to be house poor if the house eats up so much of your cash flow that there is not enough leftover to really use money to live out your values. When the house gets in the way of you living a better life, that’s house poor. So how do you figure that out?

The Wrong Way To Determine Home Price

Most people ask the question, how much house can I afford at my income? This is the approach the lending and real estate industry use. This “debt first” approach is the wrong approach. The problem is it assumes that buying as much house as you can afford is the most important priority. But everybody has other priorities. And most people don’t rank their home as the top priority.

The Right Way To Determine Home Price

First, don’t take this lightly. It’s very difficult to un-do a home purchase. If that feels stressful to you, remember this is a temporary stressor. Think about the fact that spending too much on a home creates a permanent stressor. Also, consider that renting may not be so bad after all. Check out our post on renting vs. buying and when in doubt, make renting the default (not buying). Take a minute to logically think through your best course of action BEFORE you start checking out houses and getting emotionally attached.

Think about your values first. What’s most important to you now and in the future? Consider how you’d like to prioritize those values and related goals and how the house decision stacks up against everything else. Think about the tradeoffs of buying more home vs. less home and where that money is going to come from. If you’re not sure where to start, check out this finance for physicians podcast on 3 exercises to clarify your values.”

Once you’re clear on values, goals and priorities, it’s time to get organized. You should have a good idea of what you own (assets) and what you owe (debts) and where you’re money is going each month (cash flow). Begin to model in scenarios that incorporate those values and the potential home decision. This will allow you to “balance the budget” of the potential new home expenses while considering all the other priorities.

Life is great when you can learn to use your money as a tool to live out your values. The home decision is such an important one because it can really make or break your ability to live out those values. Ideally, this new home brings you in even more alignment with your values. However, you have to be intentional about it. Going in off the cuff or using rules of thumb doesn’t cut it. Take your time and remember what’s truly most important.

If you’re ready to start your journey buying a home and are considering a physician mortgage loan, make sure to check out our complete guide to physician mortgage loans.