On the surface, physician mortgage loans look great. No money down. No jumbo limits. No private mortgage insurance (PMI). Finally, it seems like a product exists to reward you for your time training to be a physician. After all, it’s been tough. You’ve watched many of your friends become homeowners for the past few years.

While they were posting their latest photo of a fun, DIY home renovation, you were stuck in the library studying pathology. While they hosted a summer barbeque in their backyard, you were sitting through an 8-hour board exam (and timing your breaks perfectly so you could scarf down a protein bar).

But, let’s be real. Lenders are in the business of making money and can’t just give you a free ride. So, how do physician home loans (a doctor loan) stack up against everything else available? Are they as good as they sound? Let’s find out.

At this point in the home-buying process, hopefully, you’ve already made a solid decision about how much to spend on your home based on your financial plan. So, the next step is deciding how to finance your home and whether a doctor mortgage loan is the best option.

Before we jump in, if you’d rather listen in on an overview of how the doctor loan works from mortgage lender Richard Ricci and physician financial planner Daniel Wrenne, check out this podcast from Finance For Physicians:

Or if you’d like to watch, check out this video from Daniel Wrenne summarizing the high points of this article:

To help you make an informed decision, we’ll cover:

- How Physician Mortgage Loans Work

- Where To Find Physician Mortgage Loans

- Alternatives and How They Compare

- Deciding On The Best Mortgage For Your Situation

About Physician Home Loans

First, let’s talk about why physician mortgage loans even exist. The reason is that doctors are extremely profitable customers for lenders. They take out big loans early in their careers and almost always pay them off. Lenders use these loans to lock in early-career doctors by lending them more money with fewer stipulations than their competitors. They make it even more appealing by marketing it as a “special program” just for physicians.

Keep in mind, though, that their ultimate goal is to get you in the door and sell you other products as your needs change. A medical student transitioning into residency with zero earnings history, no cash, and a boatload of student loans would normally never qualify for a mortgage if it wasn’t for physician mortgage loans. However, there’s no such thing as a free lunch. These loans are appealing at first, but in some cases end up being more expensive than the alternatives. That’s why it’s so important to compare doctor loans to other types of mortgage loans before making your decision.

What are the Benefits of a Physician Home Loan?

- Zero (or very low) down payment required (typically 0% or 5% down).

- No private mortgage insurance “PMI” (PMI is insurance you pay for to protect the lender).

- In some cases, physician home loan interest rates are lower than jumbo loan rates. As of 2022, “jumbo” loans are those larger than $647,200 in most areas, but higher in more expensive counties.

- Lending is based on a physician’s signed employment contract (instead of showing proof of prior earnings).

- Less critical of student loan debt. For example, many physician mortgage lenders will use your income-based student loan payment as the debt payment calculation when figuring out what you can afford as opposed to traditional lenders using standard amortization schedules, which typically show much higher payments (and reduce how much they will lend).

What About The Downsides Of Physician Loans?

- In some cases, doctor loan interest rates are higher than conventional loan rates (conventional loans typically require 20% or more down and are below jumbo loan rates).

- Making a very small or non-existent down payment means you’re starting with very little or no home equity. Housing markets don’t always go up, and in some cases have big downturns. This lack of equity increases your risk of going upside down (aka owing more than it’s worth) in a down market and therefore having very few options if you need to make a move.

- Simpler and easier financing can influence you to spend more on a home (think Apple iPhone financing).

For even more details and examples on the downsides, check out 5 Physician Mortgage Loan Downsides You’ve Not Considered.

Who Counts as a Qualified Borrower?

A “qualified borrower” is normally a medical resident, fellow, or attending physician with a signed contract for employment. Some lenders also include dentists, veterinarians, and sometimes other doctors and professionals.

Understanding who qualifies as a borrower is essential, especially in the context of specialized financial products like physician mortgage loans. Generally, medical professionals such as residents, fellows, and attending physicians with signed employment contracts are considered qualified borrowers. Additionally, this category is often extended to include dentists and veterinarians, and in some cases, it may encompass other healthcare professionals and doctors in various fields.

Which Banks and Lenders Offer Physician Mortgage Loans?

As you’ll see below, there are a lot of lenders offering loans for physicians. We’ve spent lots of time compiling this list for you. On it, you’ll see everything from huge national lenders that work everywhere in the US to tiny local banks offering physician home loans in one specific city. Keep in mind, we don’t have experience with many of these lenders. Proceed with caution and do your homework. If we’ve had good experience working with a particular individual, we will mention them however don’t consider this a list of recommendations. This is simply a list of lenders that offer physician loans to get you started.

- Amplify Credit Union – Texas

- Arbor Financial Credit Union – Western Michigan

- Arvest Bank – Arkansas, Kansas, Missouri and Oklahoma

- Bank of America – National

- BMO Harris Bank – National (We’ve worked with Doug Crouse and he is great!)

- Cadence Bank – Southeastern US

- Citizens Bank – National

- City National Bank – West Virginia

- Clear Mountain Bank – North-central West Virginia and Western Maryland

- Extraco Bank – Texas

- Fidelity Bank – Kansas

- Fifth Third Bank – Eastern US

- First Bank – North Carolina, South Carolina

- First Citizens Community Bank – Pennsylvania, New York, Delaware

- First Federal Lakewood – Ohio

- First Financial Bank – Texas

- First Horizon Bank – Southeastern US

- First Liberty Bank – Oklahoma

- First Merchants Bank – Indiana, Illinois, Michigan, Ohio

- First National Bank of Omaha – Iowa, Nebraska

- First National Bank of Pennsylvania – Pennsylvania

- First United Bank – Texas & Oklahoma

- Fulton Bank – Virginia, Pennsylvania, Maryland, New Jersey

- German American Bank – Kentucky & Indiana

- Greater Nevada Mortgage – Nevada and California

- Guaranty Bank & Trust – Texas

- Heritage Bank – Minnesota, Iowa, South Dakota

- Huntington Bank – National

- INB – Central Illinois

- Key Bank – National

- Lake Michigan Credit Union – Michigan & Florida

- Laurel Road – National

- Level One Bank – Michigan, Illinois, Ohio

- Liberty Financial – Mississippi. Tennessee, Kentucky, Alabama

- Mercantile Bank – Illinois, Missouri

- Midwest Bank Centre – Missouri

- Northpoint Bank – National

- Northwest Bank – Indiana, Western New York, Ohio, Pennsylvania

- Old National Bank – Indiana

- Orion Federal Credit Union – Tennessee & Arkansas

- Orrstown Bank – Pennsylvania and Maryland

- Peoples Bank – Washington

- PNC Bank – National

- Premier Bank – Ohio, Pennsylvania, Michigan, Indiana

- Regions Bank – National

- Republic Bank – Kentucky

- Salal Credit Union – Washington

- South State Bank – North Carolina, South Carolina, Georgia, Florida

- Southern Bank – North Carolina and Virginia

- TD Bank – Northeastern US

- Truist – National (We’ve worked with Richard Ricci and he is great!)

- Trustmark National Bank – Mississippi

- UMB – Missouri

- Union Bank & Trust – Nebraska & Kansas

- US Bank – National

- Warsaw Federal – Kentucky & Ohio

- WesBanco – West Virginia, Kentucky, Ohio

Please note that we do not have a financial relationship with any of these lenders. The good news about this is if you’re a physician, you don’t have to worry about the major conflicts of interest that often exist with these type lists. Also, if you’re a lender, you don’t have to pay us to list you. If you’re a lender that’s not listed and would like to be added to our list, please email admin@wrennefinancial.com with your bank name, URL (website address) to webpage breaking down your physician mortgage product and list of locations served. Don’t bother to ask us to mention you individually unless you’ve worked with one of our planning clients and they were very happy with their experience. If this is true, let us know who that was and we will confirm.

Should You Use a Physician Loan for an Investment Property?

When considering a physician loan for an investment property, it’s important to understand how these loans differ from conventional financing. Physician loans often provide unique advantages like lower down payments and exemptions from private mortgage insurance, which can be attractive for doctors investing in property. However, these loans may come with higher interest rates compared to traditional loans, influencing the long-term cost of your investment. Physicians must weigh these factors against their investment goals and financial stability.

Moreover, physician loans are typically designed with the unique financial situations of doctors in mind, particularly those early in their careers with significant debt. While these loans can offer more lenient debt-to-income ratios, using them for investment properties requires careful financial planning. It’s essential to consider your overall financial situation, including potential rental income, maintenance costs of the property, physician student loan forgiveness, and your long-term investment strategy before proceeding.

Mortgage Expenses:

So now that I’ve explained why doctor mortgages are different and why they appeal to many young physicians, it’s time to take a look at mortgage expenses. Many people focus on the monthly payments when considering buying a home, but several costs make up your total mortgage expenses:

- Interest – The cost of interest is based on the interest rate, loan balance, and loan repayment term

- Closing costs – A one-time, out-of-pocket expense paid at closing, wrapped into the loan balance, or wrapped into the loan in the form of a higher interest rate

- PMI – The monthly fee typically paid until reaching 20% equity

The first thing you need to know about doctor loans is that many lenders are willing to lower their fees, especially when they know it’s competitive. Our clients often get offered discounts once the lenders realize they’re talking to multiple lenders. If you want to get the best deal, make sure it’s clear to the lender that you’re talking with multiple competitors and it’s not a sure shot for them.

Closing costs and interest rates are kind of like a teeter totter: reducing closing costs on a mortgage increases the interest rate — Or if you want the lowest rate possible, you’ll have to pay for it in the form of higher closing costs. Lenders call this buying points. Here is more on how mortgage points work:

There are cases when it makes sense to buy points (lower rate in exchange for more closing costs) and cases when it makes sense to do the opposite (higher rate in exchange for credits). In general, the longer you plan to keep the mortgage, the more it makes sense to buy points. On the other hand, if you’re only going to keep it for a few years or maybe plan to pay it off very aggressively, it may make sense to ask for a higher rate (and lower closing costs). Here are a few fantastic calculators from the Mortgage Professor on calculating the breakeven on buying points.

As for PMI, you either have it or you don’t. It’s typically going to cost between 0.3% to 1.5% of the original loan amount per year. A surefire way to avoid PMI is to put 20% down. Some loans, however, like the physician home loan, do allow you to avoid PMI even though you don’t have 20% equity.

Another way to avoid PMI is to get two mortgages – one that finances 80% of the deal and the second that covers the remaining debt (up to 20%). But keep in mind that all of these PMI avoidance tactics come with additional costs.

If you’re curious to see how all of these expenses add up in your situation, we’ve got the perfect tool for you. It’ll show you how various scenarios translate into monthly payments, and it also includes estimates for all of the hidden expenses – like home maintenance and utilities. You can see how this all adds up over the lifetime of the loan.

Click here to get the worksheet!

Monthly Costs of a Physician Mortgage

Understanding the monthly costs of a physician mortgage is crucial in planning your finances. These costs typically include the principal and interest payments, property taxes, homeowner’s insurance, and in some cases, homeowners association fees. Physician loans might offer lower initial payments, but it’s important to consider how interest rates and the structure of the loan affect these monthly costs over time. Keeping track of these expenses helps in making informed decisions about your home loan.

Physicians should also be aware of the potential for changes in interest rates, especially if they opt for an adjustable-rate mortgage. While initial rates may be lower, changes in the market can significantly alter monthly payments in the future. Using a physician mortgage loan calculator can be an effective tool to estimate monthly payments and understand how different scenarios might impact your finances.

Use a Physician Mortgage Loan Calculator To Estimate Your Total Mortgage Payment

A physician mortgage loan calculator is an invaluable tool for doctors looking to understand the financial implications of a home loan. By inputting details like the loan amount, term, and interest rates, physicians can get a clear picture of their monthly payments. This tool helps in budgeting and planning for other financial goals, ensuring that taking on a mortgage is a sustainable decision for you and your family.

Additionally, using a loan calculator allows physicians to explore various scenarios and compare different loan options. It can illustrate how changes in down payments or interest rates impact your monthly mortgage payment, helping you choose a loan that best fits your financial situation. With a clear understanding of these variables, you can make an informed decision about your home financing.

What Are The Different Types of Doctor Mortgage Loans

There are several different types of loans for doctors.

There are the fixed rate options. These loans have a fixed interest rate for the life of the loan which is typically structured to be 15 or 30 years.

And then there are the ARM options which include a fixed interest rate as well, but only a partial period of the loan term. Check this out if you want to dig more into the differences between an ARM and a fixed-rate mortgage. The most common fixed rate periods are 5 years, 7 years, 10 years, and 15 years and the loan payoff period is typically structured to be 30 years. For example, if you have a 7-year ARM with a 30-year payment schedule, that means the interest rate is fixed for 7 years and variable for the remaining 23 years.

If you’re considering an ARM, be very cautious if there is a chance you plan to be in the home beyond the term period. It would be good to run the numbers on the worst case (high rate) scenario. Remember that nobody really knows what the future holds. All we know for certain is the history and the present. If you’re curious what past historical 30-year mortgage rates have been, see below chart from FRED:

Are Physician Home Loans A Good Idea?

Just because you have special access to a product doesn’t automatically mean it’s the best option. There are plenty of solid alternatives to consider, some of which also require very low or no down payment. This decision comes down to your unique situation. For example, if you have no money to put down on your home, the doctor’s mortgage loan is potentially a solid option (could be your only option). But proceed with caution. If you truly have no money to put down, you have to be extra careful when making a big purchase like this.

Maybe you do have just enough money to put down on the home, but that’s it. In this case, the doctor’s mortgage loan can also make sense, but it depends on what your alternatives are. Maybe you have some nice tax-sheltered retirement plans that you plan to fund or maybe you’re planning to pay off your student loans. If those alternatives are in play, it might make sense to consider the doctor loan so you’re able to use limited funds fully.

On the other hand, if you have plenty of funds and you’re already maximizing all the tax shelters and you’ve paid off student loans (or are going for PSLF), then maybe the doctor mortgage is not the best option. However, there are always exceptions. Maybe you’re moving across the country to start a new job, and the other traditional lenders require an earnings history from your new job (that you haven’t started!). Or what if you have a home for sale in the old location with plenty of equity to use for a down payment on the new home? But maybe you’re not going to sell it before closing on the new home. There are many situations like these and many others I’m not mentioning that can come up. Often, this will make the doctor loan options appealing even though you have the funds to make a large down payment.

We’ll talk more about this below, but the long and short is the physician mortgage loan is great because it opens up more options and flexibility. The hard part is deciding the route you ultimately take.

Example Rates and Costs For Doctor Mortgage Loans (and Other Low Down Payment Alternatives)

Let’s assume you’re a doctor considering a $500,000 home. You have fantastic credit but very little cash for a down payment. What are your options for 0% or very low down payment mortgage? We’ve already discussed the doctor mortgage loans options which we will include below. There are also several other low down payment options which we will throw in that can sometimes make sense. Here are the most popular options with some example rates. Keep in mind, these are not actual rates and are examples only:

- Fixed Rate Physician Mortgage Loans: 30 yr fixed rate – 4.75%

- ARM Physician Mortgage Loans: 7/1 ARM (could also be 5/1 or 10/1) – 3.75%

- Conventional with PMI (could also be a Jumbo): 30 yr fixed – 4.25% plus PMI

- The VA Mortgage (must be military):30 yr fixed rate – 4.25%

- The FHA Loan with 3.5% Down: 30 yr fixed rate – 4.25%

Which Type Of Low Down Payment Mortgage Option Should You Choose?

If you’re in the military and especially if you’re disabled, the VA Mortgage is likely your best option.

Fixed Rate loans for doctors have the highest interest rate, but they’re locked in. The ARM has a better rate than the 30-year doctor mortgage, but the rate becomes variable after ARM period ends (this can become a massive cost in a rising interest rate environment like we’re in now). The conventional loan offers the best rate on the primary mortgage, but it requires paying PMI which is a pure additional cost.

Assuming you’re not in the military and can’t get a VA Mortgage, you should base this decision on how long you’ll own the home and how much you plan to pay on the mortgage. Let’s go over the best options based on these factors:

- 0-7 years – If you don’t foresee yourself living in the home for at least seven years, the ARM Physician Mortgage Loan is often your best option. But, really, if you plan on living in it for fewer than five years, you should be renting.

- 7+ Years (and average income and savings) – In this case, the Doctor Loan with 30-year fixed rate can be appealing (or 15 yr fixed if you have the cash flow). But this should be revisited when you have 20% equity, you drop below the jumbo limits or if rates drop in general. Once you fit the profile, you can often refinance into a new, non-physician loan that’s more competitive.

- 7+ Years (and ability to pay the loan off very quickly) – The Conventional with 0% down starts to look much better especially the faster you can get the home equity high enough to eliminate PMI (make sure to find out how all this works BEFORE signing on the dotted line – different lenders have different rules for how they allow you to drop PMI). On the other hand, if you really have this much cash flow, maybe you should be looking at a 15 yr mortgage instead.

Closing costs tend to complicate things quickly. To simplify the math, we didn’t include any closing costs. Keep this in mind when you’re comparing various mortgage options. Ask the lenders to provide a loan costs estimate (technically called a loan estimate) with as close to zero closing costs as possible – at least for starters. It’s much easier to compare mortgages structured similarly from a cost standpoint. If you’re not familiar with what a Loan Estimate is, here is a link to an explainer. Also, when you ask for this, don’t be surprised if you get a little push back from the lender. FYI lenders are required to provide this to you at closing but many don’t like sharing it before closing because they know it can change. Either way, I would strongly encourage reviewing this as early in the process as possible and using it to help you compare alternatives.

What About Credit Checks?

Most lenders will ask you to complete an “application” and authorize a credit check before they provide you with quotes. However, if you’re in the early stages, I would suggest NOT submitting an application and simply asking for a rate/cost breakdown. Tell them you have great credit (if you do) and let them know you want to wait to run it until you’ve decided which direction to go. They should be able to provide the loan estimate without a credit check, if you ask for it.

That being said, eventually you’re going to have to complete the credit check to qualify. This is a good step to take when you’re ready and know which direction you’re going. One big misconception about credit checks is that talking to multiple lenders will hurt your credit because they each pull it separately. However, there is a period of time where additional checks don’t affect your credit. Learn more on how this works from Quicken Loans.

Should You Put Cash Down?

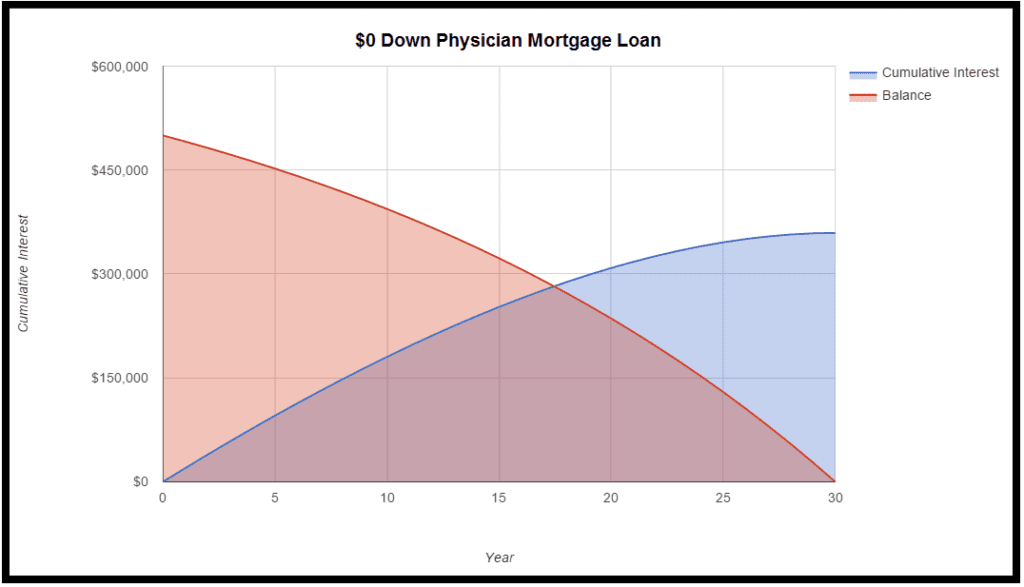

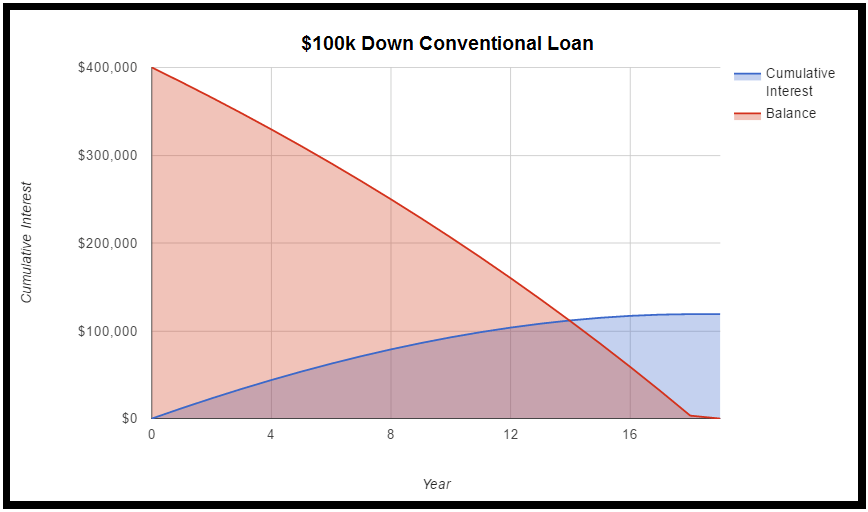

Let’s look at an example to explore this question further. What if you have some cash to put down or are considering waiting until you have the cash? In that case, you’ll be comparing the physician mortgage with the conventional 20% down mortgage. Once again, we’ll assume both are structured to wrap closing costs into the loan to make the math simpler. To give you a clear comparison, let’s structure the 20% down conventional loan to have the exact same payments as the doctor loan. The only difference is the down payment and the interest rate.

Option #1 – $100K down payment conventional loan

- $400,000 balance

- 18.1183 year fixed rate at 3%

- $2,387.08 per month principal and interest

Option #2 – $0 down payment doctor mortgage loan

- $500,000 balance

- 30 yr fixed rate at 4%

- $2,387.08 per month principal and interest

Looking at those numbers, you’re probably thinking you’d take the $0 down option. Maybe you don’t have that much cash available or maybe you think there are smarter ways to use that $100,000. You could use it to pay off loans or start investing. And 4% is still a really good rate. But how does it really compare to the 20% down option?

The total lifetime interest costs:

- Option 1 – $118,998

- Option 2 – $359,348

As you can see on the charts above, putting $100,000 down will end up saving you over $240k in interest. Plus (and this is a huge plus), you’ll get your mortgage paid off almost 12 years sooner.

Additionally, don’t forget that having equity in your home will provide greater security and flexibility, especially if something unexpected happens. With the 100% financed physician home loan, you should expect to start out underwater. If something doesn’t work out and you’re forced to sell quickly, you should be prepared to write a potentially large check for up to 10% of the purchase price just to get out of the home.

On the flip side, if you do come up with the $100,000, you could finance 100% using the doctor mortgage loan and invest the cash. If you run those numbers, the end result will look much better. But not only does this require an aggressive investment, it also requires greater leverage on your home, which further adds to the risk. It will also require many years of disciplined investing and assumes you never spend any of it. That’s not impossible, of course, but it’s much easier said than done.

At the end of the day, if you have the cash for a down payment, getting the conventional mortgage and paying it off faster results in much lower lending costs. But there are many more factors you should consider that will depend on your situation and preferences. On the other hand, if you don’t have the cash for a down payment, the doctor home loan is likely a great option. Still, it’s not always automatically best solution.

What if You Already Have a Physician Loan?

If you already have a physician mortgage loan but you’re not paying attention to it, there’s a good chance you’re throwing away good money. You should review your options for refinance if any of the following occur:

- Interest rates drop

- You reach 20% equity

- You get below the jumbo limits

- Your plans change

Lately, interest rates have been trending higher. If this continues, it will make refinancing your mortgage much less appealing. However, the future is unknown and if/when rates begin dropping again, refinancing will be back in style. When you’re considering a refinance, be sure to check out a few different lenders.

If you’re unsure where you stand, check out these simple steps to help you decide if you should consider refinancing your physician mortgage loan.

When Should You Avoid Physician Loans?

Perhaps by now, you’re more excited than ever about buying a house, especially now that you know an option exists where you can get a home with $0 down and no PMI. However, in order to cover all my bases, I did want to point out that you should probably stay away from physician mortgage loans if any or all of these conditions apply:

- The ease of getting a home loan for physicians is tempting you to consider buying too much house.

- You have (or will have) at least 20% to put down on the home. In this situation, look at the conventional mortgage with 20%+ down.

- You’re in the military and you’re disabled. In this situation, look at a VA loan instead.

- You aren’t comfortable with the prospect of starting out 5-10% underwater on your home (in other words, you don’t want to write a big check to get out of it if your circumstances change).

The Bottom Line

From a risk standpoint, it’s typically best to wait until you have at least 20% to put down on the home before purchasing. That way, you’ll be less susceptible to downturns and you’ll also have access to the best mortgage rates. But more importantly, this decision (and really all of your big financial decisions) is about living a great life. I’m sure part of that is working to minimize risk. But there is a LOT more to it! Ultimately it comes down to your unique circumstances and preferences.

If you’ve gotten this far in our article, nice job! It’s great that you’re educating yourself on what’s out there in the world of doctor loans. As you dig into the topic, keep an eye out for conflicts of interest underpinning the material you’re reading.

The biggest conflict you often see is the majority of the doctor loan info on the internet today is written by authors that are the lenders themselves (they sell loans) or they’re written by third party authors that are paid to promote lenders. We do not accept advertising dollars from lenders (or anyone for that matter). We also are not in the business of selling loans. If we refer someone, it’s because we know they have a solid product or we’ve had good experiences working with them. This is important for you to know because these types of conflicts inevitably make it much more likely the writer will push you in one particular direction. If you’re already aware of this, you’re much less likely to get corralled into a hidden sales pitch.

Although we make an extra effort to reduce conflicts of interest, we’re not completely free of them. Our conflict of interest is that we’re financial planners in the business of providing one on one financial advice for physicians and physician families. Providing quality advice requires that we get to know our clients and help them develop a complete financial plan. This becomes the basis of big decisions like buying a home. We’d love to get to know you too, and talk about how we might be able to help. In the meantime, good luck on your journey purchasing a home!

Other Mortgage Resources

There are many online resources to help you learn more about doctor loans. Some examples include:

- The Mortgage Professor is a great site for digging into the numbers and options even more. They have many different great mortgage calculators and spreadsheets to help analyze mortgage options.

- White Coat Investor List of Physician Mortgage Lenders in the US: Check out Jim’s listing of many of the physician mortgage lenders in the US organized by state.

Also, if you’re feeling overwhelmed by all of these options, please reach out to us. We help clients navigate these types of decisions all the time. We’re happy to set up a free consultation to find out whether we’re a good fit.

Contact Us for Physician Mortgage Loan Information Today

At Wrenne Financial Planning LLC, we are committed to providing physicians with comprehensive and clear information about mortgage loans. Our expertise in physician-specific financial planning means we understand the unique challenges and opportunities that come with financing a home. Whether you’re a new doctor starting or an established physician looking to invest, we have the knowledge and resources to guide you. Reach out to us for help with anything from mortgage rates and home loans to physician long-term disability insurance and more! Contact us today!